Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following balances were available at 31st November 2021 for Salah Ltd. Capital 95,000; Inventory 75,000; Trade Payables 55,000; Trade Receivables 20,000; Non- Current

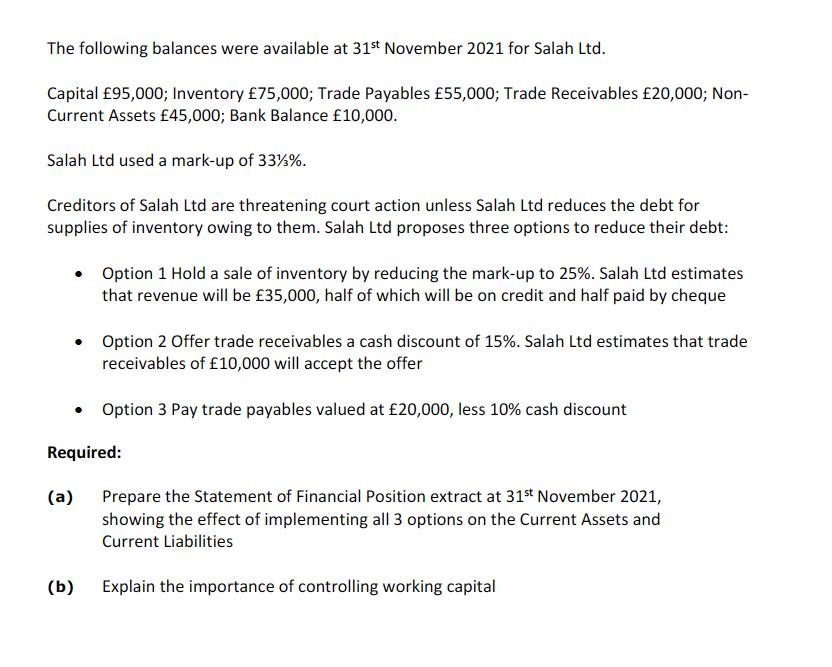

The following balances were available at 31st November 2021 for Salah Ltd. Capital 95,000; Inventory 75,000; Trade Payables 55,000; Trade Receivables 20,000; Non- Current Assets 45,000; Bank Balance 10,000. Salah Ltd used a mark-up of 33%%. Creditors of Salah Ltd are threatening court action unless Salah Ltd reduces the debt for supplies of inventory owing to them. Salah Ltd proposes three options to reduce their debt: Option 1 Hold a sale of inventory by reducing the mark-up to 25%. Salah Ltd estimates that revenue will be 35,000, half of which will be on credit and half paid by cheque Option 2 Offer trade receivables a cash discount of 15%. Salah Ltd estimates that trade receivables of 10,000 will accept the offer Option 3 Pay trade payables valued at 20,000, less 10% cash discount Required: (b) (a) Prepare the Statement of Financial Position extract at 31st November 2021, showing the effect of implementing all 3 options on the Current Assets and Current Liabilities Explain the importance of controlling working capital

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

step 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started