Answered step by step

Verified Expert Solution

Question

1 Approved Answer

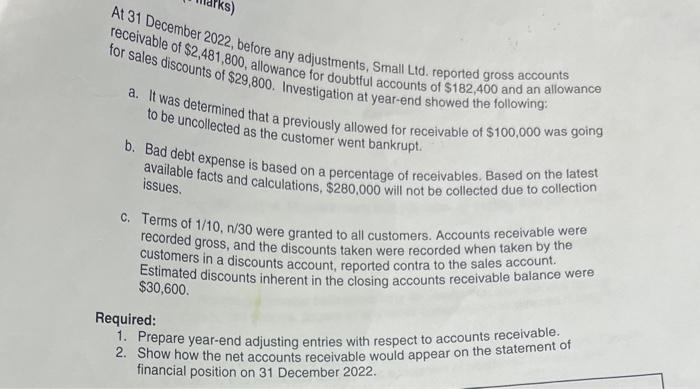

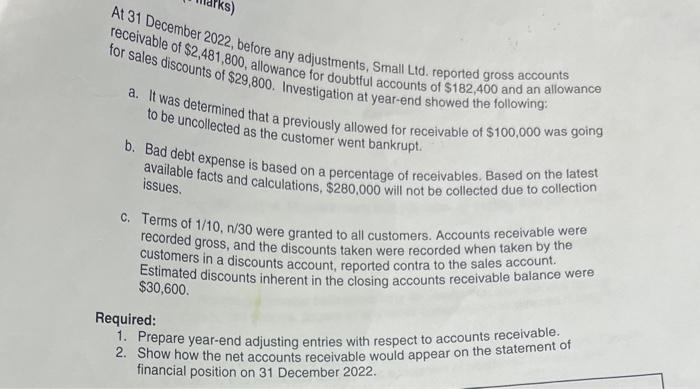

At 31 December 2022, before any adjustments, Small Lid. reported gross accounts receivable of $2,481,800, allowance for doubtful accounts of $182,400 and an allowance for

At 31 December 2022, before any adjustments, Small Lid. reported gross accounts receivable of $2,481,800, allowance for doubtful accounts of $182,400 and an allowance for sales disco a. It was determing a. It was determined that a previously allowed for receivable of $100,000 was going to be uncollected as the customer went bankrupt. b. Bad debt expense is based on a percentage of receivables. Based on the latest available facts and calculations, $280,000 will not be collected due to collection issues. c. Terms of 1/10,n/30 were granted to all customers. Accounts receivable were recorded gross, and the discounts taken were recorded when taken by the customers in a discounts account, reported contra to the sales account. Estimated discounts inherent in the closing accounts receivable balance were $30,600. Required: 1. Prepare year-end adjusting entries with respect to accounts receivable. 2. Show how the net accounts receivable would appear on the statement of financial position on 31 December 2022

At 31 December 2022, before any adjustments, Small Lid. reported gross accounts receivable of $2,481,800, allowance for doubtful accounts of $182,400 and an allowance for sales disco a. It was determing a. It was determined that a previously allowed for receivable of $100,000 was going to be uncollected as the customer went bankrupt. b. Bad debt expense is based on a percentage of receivables. Based on the latest available facts and calculations, $280,000 will not be collected due to collection issues. c. Terms of 1/10,n/30 were granted to all customers. Accounts receivable were recorded gross, and the discounts taken were recorded when taken by the customers in a discounts account, reported contra to the sales account. Estimated discounts inherent in the closing accounts receivable balance were $30,600. Required: 1. Prepare year-end adjusting entries with respect to accounts receivable. 2. Show how the net accounts receivable would appear on the statement of financial position on 31 December 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started