Question

SHOW COMPLETE SOLUTION ABCD Corporation had the cashflow from year 2001 to 2019 as shown in the figure (year-end basis). Furthermore, the list below shows

SHOW COMPLETE SOLUTION

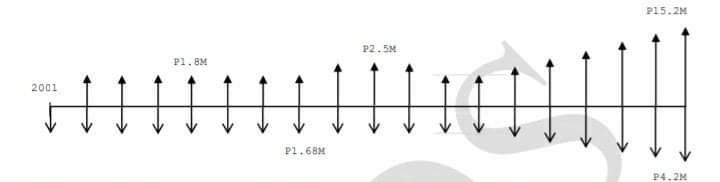

ABCD Corporation had the cashflow from year 2001 to 2019 as shown in the figure (year-end basis).

Furthermore, the list below shows the detailed fixed assets acquisition of the company. Acquisition year: 2001 Equipment : Walk behind compactor Initial cost : 155,000.00 Mobilization : 2,000.00/yr Electricity : 18,000.00/yr Service life : 7 years Salvage value : 10,000.00 Acquisition year: 2001 Equipment : 5.0 kW Diesel generator set Initial cost : 52,800.00 Mobilization : 1,500.00/yr Electricity : 20,000.00/yr Fuel : 14,000.00/yr Service life : 12 years Salvage value : 500.00 Acquisition year: 2013 Equipment : 7.5-ton capacity Dump truck Initial cost : 5.0M Miscellaneous : 85,000.00/yr Service life : 12 years Salvage value : 10% of initial cost Upon reaching service lives of the equipment indicated, the company immediately repurchase these fixed assets for replacement. If all the transactions made in the cashflow diagram were 3% compounded annually, costs of equipment do not vary during the given timebound, and the book depreciation used is straight-line method, determine the:

4. The amount needed to acquire dump truck on year 2018.

P15.2M P2.5M P1.8M 2001 HU P1.68M P4.2MStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started