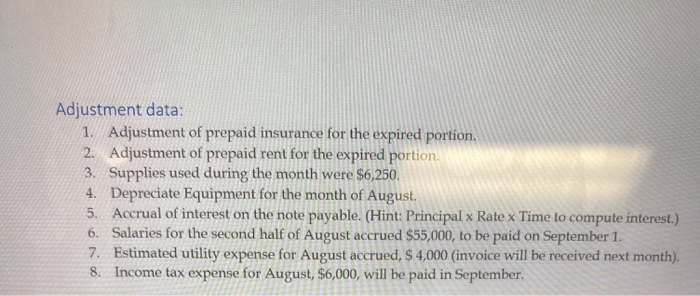

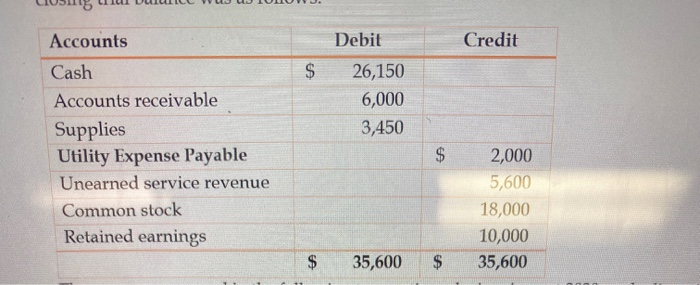

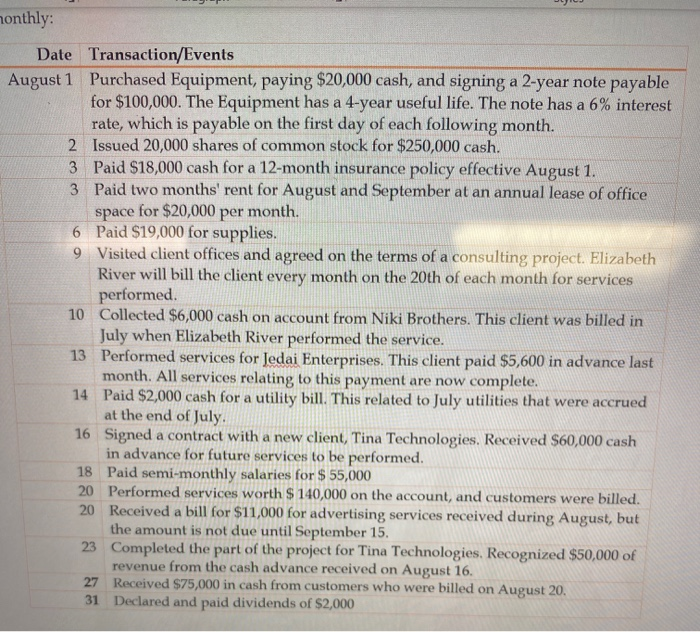

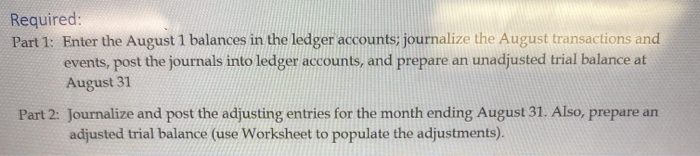

Adjustment data: 1. Adjustment of prepaid insurance for the expired portion. 2. Adjustment of prepaid rent for the expired portion 3. Supplies used during the month were $6,250. 4. Depreciate Equipment for the month of August. 5. Accrual of interest on the note payable. (Hint: Principal x Rate x Time to compute interest.) 6. Salaries for the second half of August accrued $55,000, to be paid on September 1. 7. Estimated utility expense for August accrued, $ 4,000 (invoice will be received next month). 8. Income tax expense for August, $6,000, will be paid in September. Debit Credit $ 26,150 6,000 3,450 Accounts Cash Accounts receivable Supplies Utility Expense Payable Unearned service revenue Common stock Retained earnings $ 2,000 5,600 18,000 10,000 35,600 $ 35,600 $ nonthly: Date Transaction/Events August 1 Purchased Equipment, paying $20,000 cash, and signing a 2-year note payable for $100,000. The Equipment has a 4-year useful life. The note has a 6% interest rate, which is payable on the first day of each following month. 2 Issued 20,000 shares of common stock for $250,000 cash. 3 Paid $18,000 cash for a 12-month insurance policy effective August 1. 3 Paid two months' rent for August and September at an annual lease of office space for $20,000 per month. 6 Paid $19,000 for supplies. 9 Visited client offices and agreed on the terms of a consulting project. Elizabeth River will bill the client every month on the 20th of each month for services performed 10 Collected $6,000 cash on account from Niki Brothers. This client was billed in July when Elizabeth River performed the service. 13 Performed services for Jedai Enterprises. This client paid $5,600 in advance last month. All services relating to this payment are now complete. 14 Paid $2,000 cash for a utility bill. This related to July utilities that were accrued at the end of July 16 Signed a contract with a new client, Tina Technologies. Received $60,000 cash in advance for future services to be performed. 18 Paid semi-monthly salaries for $ 55,000 20 Performed services worth $ 140,000 on the account, and customers were billed. 20 Received a bill for $11,000 for advertising services received during August, but the amount is not due until September 15. 23 Completed the part of the project for Tina Technologies. Recognized $50,000 of revenue from the cash advance received on August 16. 27 Received $75,000 in cash from customers who were billed on August 20, 31 Declared and paid dividends of $2,000 Required: Part 1: Enter the August 1 balances in the ledger accounts; journalize the August transactions and events, post the journals into ledger accounts, and prepare an unadjusted trial balance at August 31 Part 2: Journalize and post the adjusting entries for the month ending August 31. Also, prepare an adjusted trial balance (use Worksheet to populate the adjustments)