At age 25, someone sets up an IRA (individual retirement account) with an APR of 5%. At the end of each month he deposits

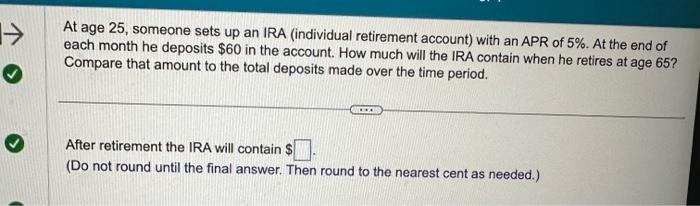

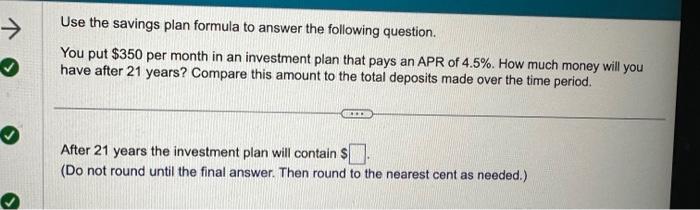

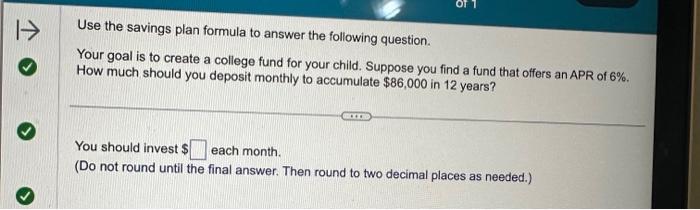

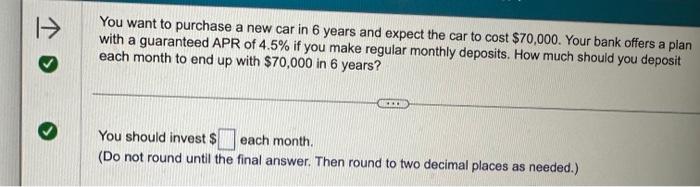

At age 25, someone sets up an IRA (individual retirement account) with an APR of 5%. At the end of each month he deposits $60 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $. (Do not round until the final answer. Then round to the nearest cent as needed.) Use the savings plan formula to answer the following question. You put $350 per month in an investment plan that pays an APR of 4.5%. How much money will have after 21 years? Compare this amount to the total deposits made over the time period. you **** After 21 years the investment plan will contain $ (Do not round until the final answer. Then round to the nearest cent as needed.) 1-> Use the savings plan formula to answer the following question. Your goal is to create a college fund for your child. Suppose you find a fund that offers an APR of 6%. How much should you deposit monthly to accumulate $86,000 in 12 years? You should invest $ each month. (Do not round until the final answer. Then round to two decimal places as needed.) FI You want to purchase a new car in 6 years and expect the car to cost $70,000. Your bank offers a plan with a guaranteed APR of 4.5% if you make regular monthly deposits. How much should you deposit each month to end up with $70,000 in 6 years? ... You should invest $ each month. (Do not round until the final answer. Then round to two decimal places as needed.) At age 25, someone sets up an IRA (individual retirement account) with an APR of 5%. At the end of each month he deposits $60 in the account. How much will the IRA contain when he retires at age 65? Compare that amount to the total deposits made over the time period. After retirement the IRA will contain $. (Do not round until the final answer. Then round to the nearest cent as needed.) Use the savings plan formula to answer the following question. You put $350 per month in an investment plan that pays an APR of 4.5%. How much money will have after 21 years? Compare this amount to the total deposits made over the time period. you **** After 21 years the investment plan will contain $ (Do not round until the final answer. Then round to the nearest cent as needed.) 1-> Use the savings plan formula to answer the following question. Your goal is to create a college fund for your child. Suppose you find a fund that offers an APR of 6%. How much should you deposit monthly to accumulate $86,000 in 12 years? You should invest $ each month. (Do not round until the final answer. Then round to two decimal places as needed.) FI You want to purchase a new car in 6 years and expect the car to cost $70,000. Your bank offers a plan with a guaranteed APR of 4.5% if you make regular monthly deposits. How much should you deposit each month to end up with $70,000 in 6 years? ... You should invest $ each month. (Do not round until the final answer. Then round to two decimal places as needed.)

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer You save for 40 years so the value of the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started