Answered step by step

Verified Expert Solution

Question

1 Approved Answer

at age 50, Charles began receiving payments under a distribution method that provides for substantially equal payments over his life. he had no basis in

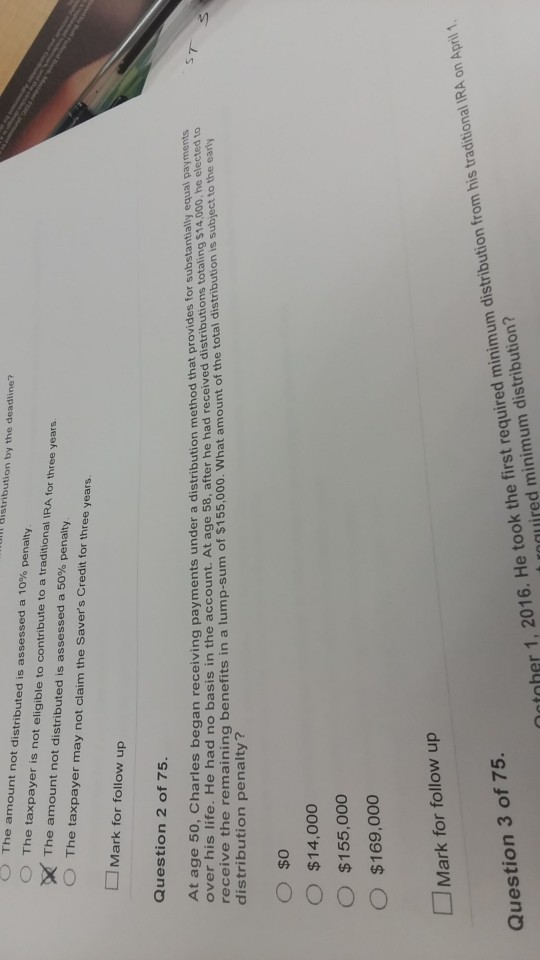

at age 50, Charles began receiving payments under a distribution method that provides for substantially equal payments over his life. he had no basis in the account. at age 58 after he ha received distributions totalling $14000 he elected to receive the remaining benefits in a lump sum of $155000. what amount of the total distribution is subject to the early distribution penalty?

help

0 The amount not distributed is assessed a 10% penalty O The taxpayer is not eligible to contribute to a traditional IRA for three years distribution by the deadline? The amount not distributed is assessed a 50% penalty O The taxpayer may not claim the Saver's Credit for three years Mark for follow up Question 2 of 75. At age 50, Charles began receiving payments under a distribution method that provides for substantially equal pay over his life. He had no basis in the account. At age 58, after he had received distributions receive the remaining benefits in a lump-sum of $155,000. What amount of the distribution penalty? g $14,00o, he elected to total distribution is subject to the e O so O $14,000 $155,000 O$169,000 Mark for follow up um distribution from his traditional IRA on April 1 netoher 1, 2016. He took the first required minimu uired minimum distribution? Question 3 of 75. er 1, 2016. He toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started