Answered step by step

Verified Expert Solution

Question

1 Approved Answer

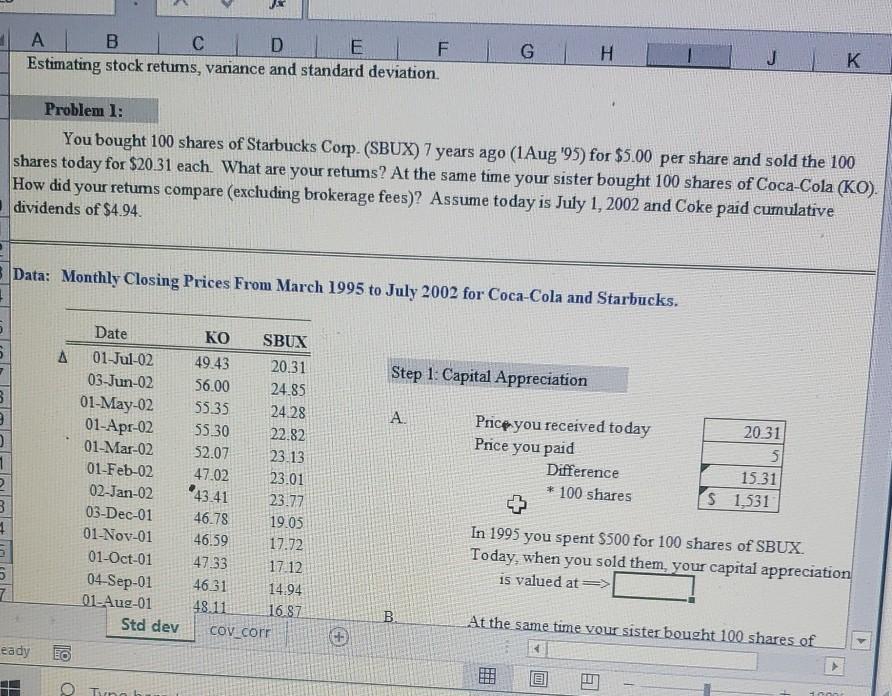

AT B C D E F Estimating stock retums, variance and standard deviation G H K Problem 1: You bought 100 shares of Starbucks Corp.

AT B C D E F Estimating stock retums, variance and standard deviation G H K Problem 1: You bought 100 shares of Starbucks Corp. (SBUX) 7 years ago (1Aug '95) for $5.00 per share and sold the 100 shares today for $20.31 each. What are your retums? At the same time your sister bought 100 shares of Coca-Cola (KO). How did your retums compare (excluding brokerage fees)? Assume today is July 1, 2002 and Coke paid cumulative dividends of $4.94. Data: Monthly Closing Prices From March 1995 to July 2002 for Coca-Cola and Starbucks. 5 5 A Step 1: Capital Appreciation 3 A Date KO SBUX 01-Jul-02 49.43 20.31 03-Jun-02 56.00 24.85 01-May-02 55.35 24.28 01-Apr-02 55.30 22.82 01-Mar-02 52.07 23.13 01-Feb-02 47.02 23.01 02-Jan-02 *43.41 23.77 03-Dec-01 46.78 19.05 01-Nov-01 46.59 17.72 01-Oct-01 47.33 17.12 04-Sep-01 46.31 14.94 01-Aug-01 48.11 16.87 Std dev Cov_corr Price you received today Price you paid Difference * 100 shares 1 2 3 4 20.31 5 15.31 S 1,531 In 1995 you spent $500 for 100 shares of SBUX. Today, when you sold them, your capital appreciation is valued at => 7 . B At the same time your sister bought 100 shares of eady BO F Tun AT B C D E F Estimating stock retums, variance and standard deviation G H K Problem 1: You bought 100 shares of Starbucks Corp. (SBUX) 7 years ago (1Aug '95) for $5.00 per share and sold the 100 shares today for $20.31 each. What are your retums? At the same time your sister bought 100 shares of Coca-Cola (KO). How did your retums compare (excluding brokerage fees)? Assume today is July 1, 2002 and Coke paid cumulative dividends of $4.94. Data: Monthly Closing Prices From March 1995 to July 2002 for Coca-Cola and Starbucks. 5 5 A Step 1: Capital Appreciation 3 A Date KO SBUX 01-Jul-02 49.43 20.31 03-Jun-02 56.00 24.85 01-May-02 55.35 24.28 01-Apr-02 55.30 22.82 01-Mar-02 52.07 23.13 01-Feb-02 47.02 23.01 02-Jan-02 *43.41 23.77 03-Dec-01 46.78 19.05 01-Nov-01 46.59 17.72 01-Oct-01 47.33 17.12 04-Sep-01 46.31 14.94 01-Aug-01 48.11 16.87 Std dev Cov_corr Price you received today Price you paid Difference * 100 shares 1 2 3 4 20.31 5 15.31 S 1,531 In 1995 you spent $500 for 100 shares of SBUX. Today, when you sold them, your capital appreciation is valued at => 7 . B At the same time your sister bought 100 shares of eady BO F Tun

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started