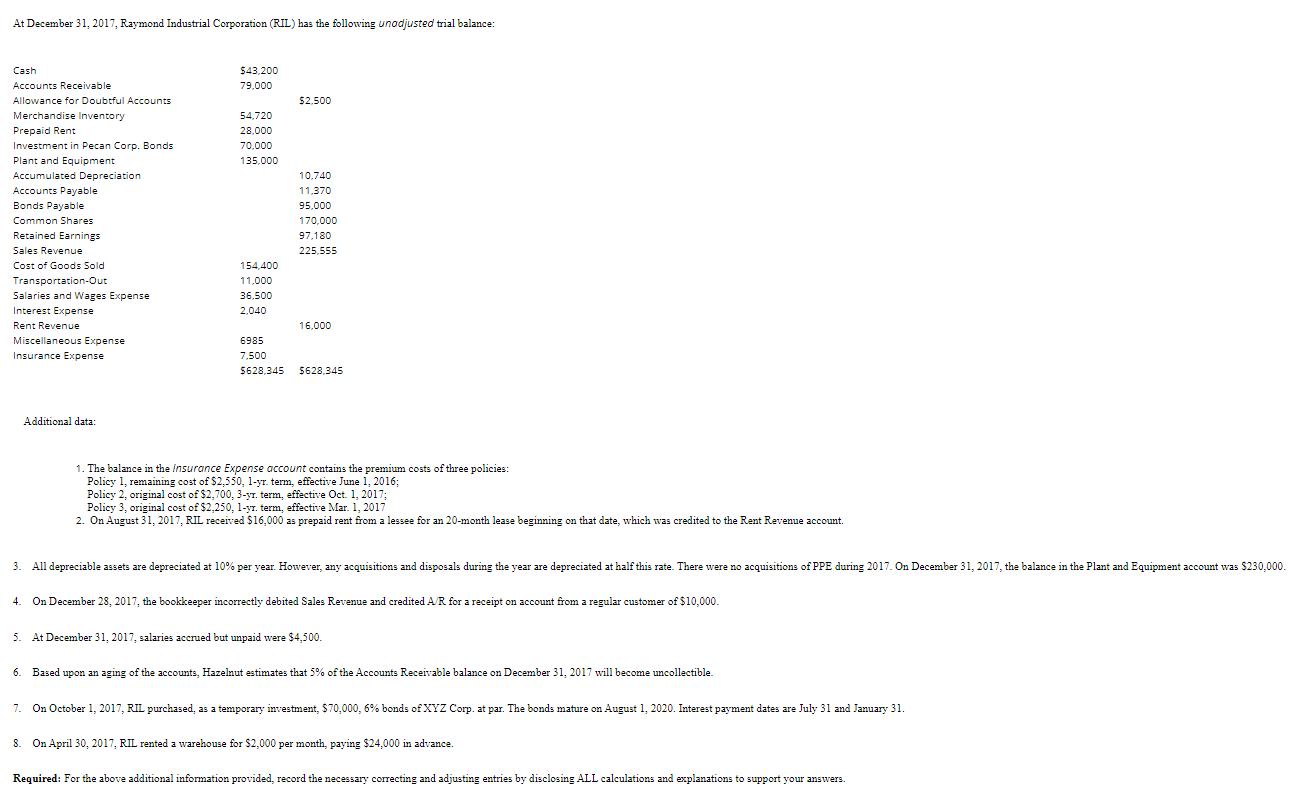

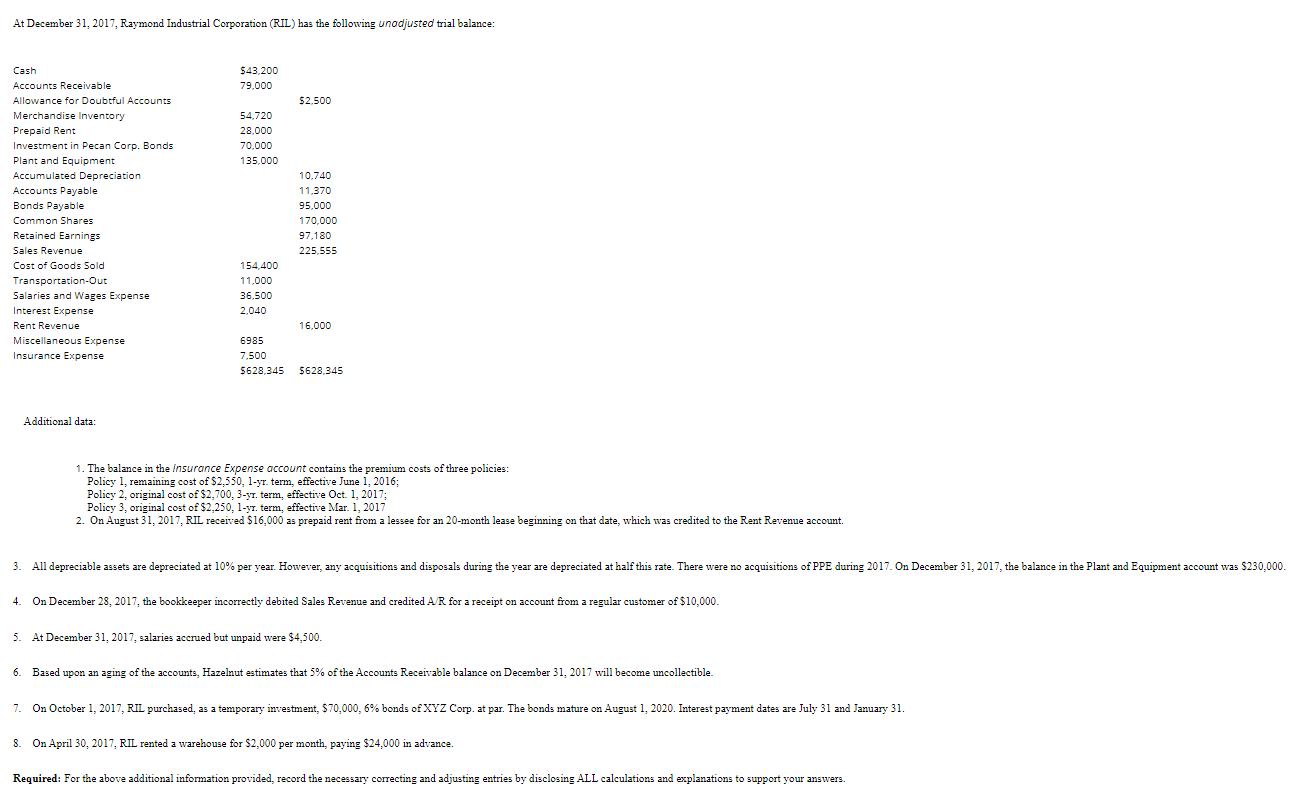

At December 31, 2017, Raymond Industrial Corporation (RIL) has the following unadjusted trial balance: $43,200 79.000 52.500 54.720 28.000 70,000 135,000 Cash Accounts Receivable Allowance for Doubtful Accounts Merchandise Inventory Prepaid Rent Investment in Pecan Corp. Bonds Plant and Equipment Accumulated Depreciation Accounts Payable Bonds Payable Common Shares Retained Earnings Sales Revenue Cost of Goods Sold Transportation-Out Salaries and Wages Expense Interest Expense Rent Revenue Miscellaneous Expense Insurance Expense 10.740 11.370 95,000 170,000 97.180 225.555 154,400 11,000 36.500 2.040 16.000 6985 7.500 5628,345 5628,345 Additional data: 1. The balance in the insurance Expense account contains the premium costs of three policies: Policy 1, remaining cost of $2,550, 1-yr. term, effective June 1, 2016; Policy 2, original cost of $2,700, 3-yr. term. effective Oct. 1. 2017; Policy 3, original cost of $2,250, 1-yr. term, effective Mar. 1, 2017 2. On August 31, 2017, RIL received $16,000 as prepaid rent from a lessee for an 20-month lease beginning on that date, which was credited to the Rent Revenue account. 3. All depreciable assets are depreciated at 10% per year. However, any acquisitions and disposals during the year are depreciated at half this rate. There were no acquisitions of PPE during 2017. On December 31, 2017, the balance in the Plant and Equipment account was $230,000. 4. On December 28, 2017, the bookkeeper incorrectly debited Sales Revenue and credited A/R for a receipt on account from a regular customer of $10,000 5. At December 31, 2017, salaries accrued but unpaid were $4,500. 6. Based upon an aging of the accounts, Hazelnut estimates that 5% of the Accounts Receivable balance on December 31, 2017 will become uncollectible. 7. On October 1, 2017, RIL purchased, as a temporary investment, $70,000, 6% bonds of XYZ Corp. at par. The bonds mature on August 1, 2020. Interest payment dates are July 31 and January 31. 8 8. On April 30, 2017, RIL rented a warehouse for $2,000 per month, paying $24,000 in advance. Required: For the above additional information provided, record the necessary correcting and adjusting entries by disclosing ALL calculations and explanations to support your answers