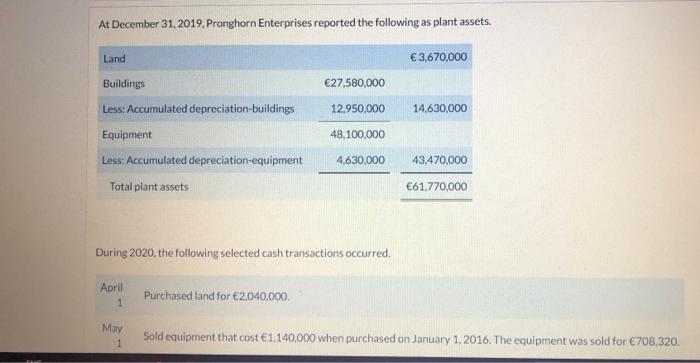

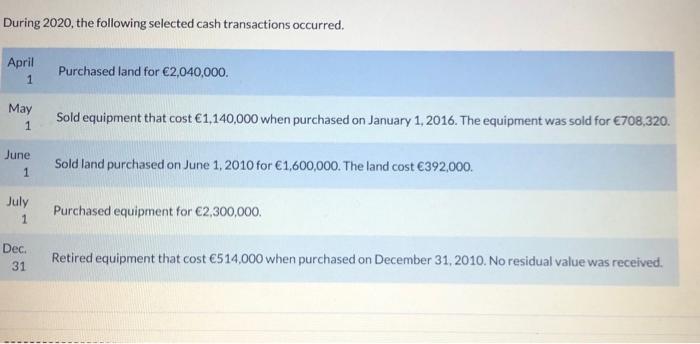

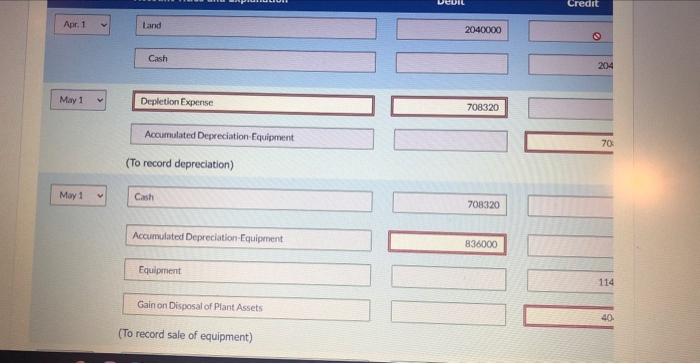

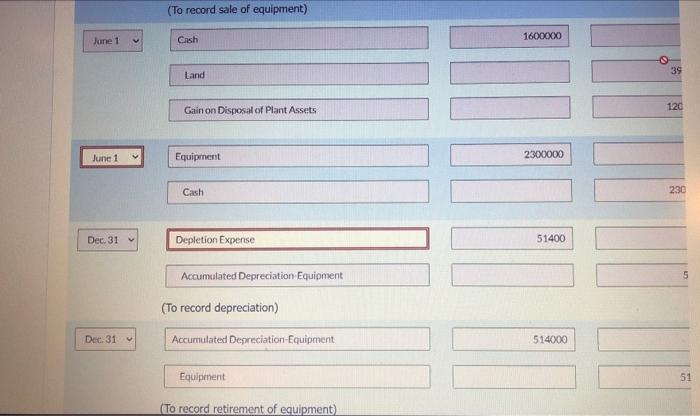

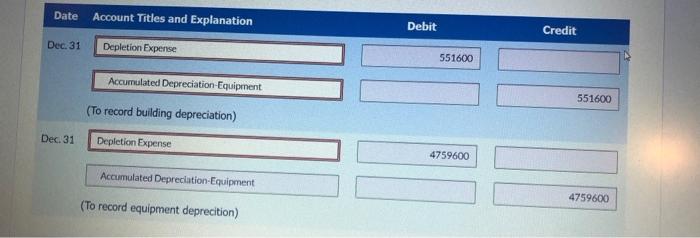

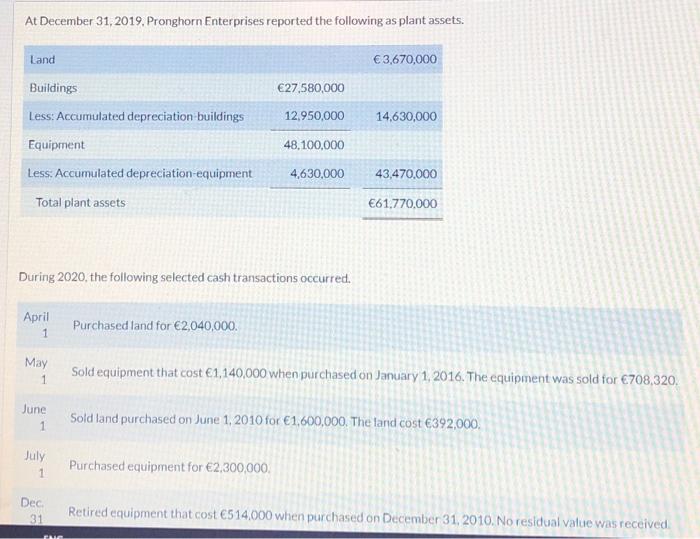

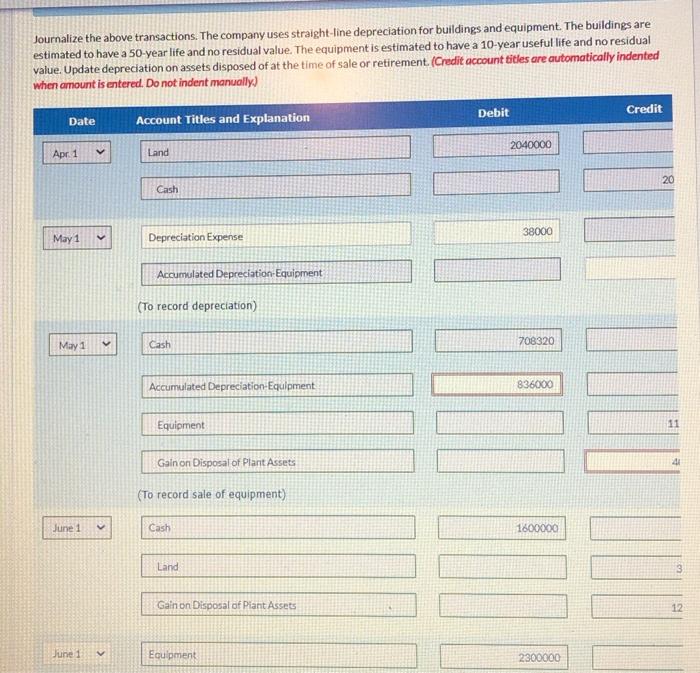

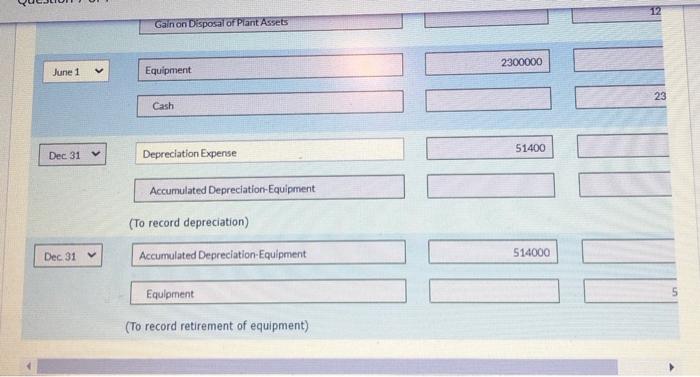

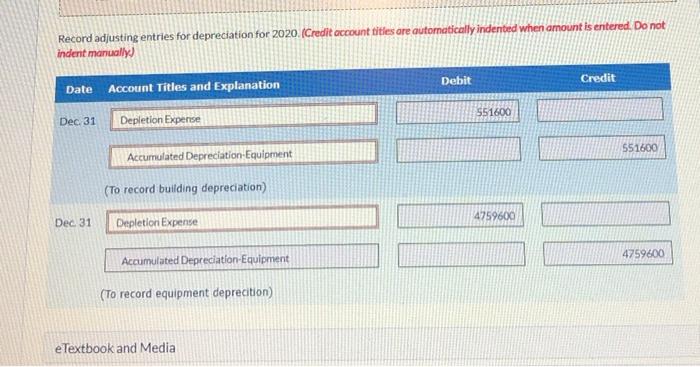

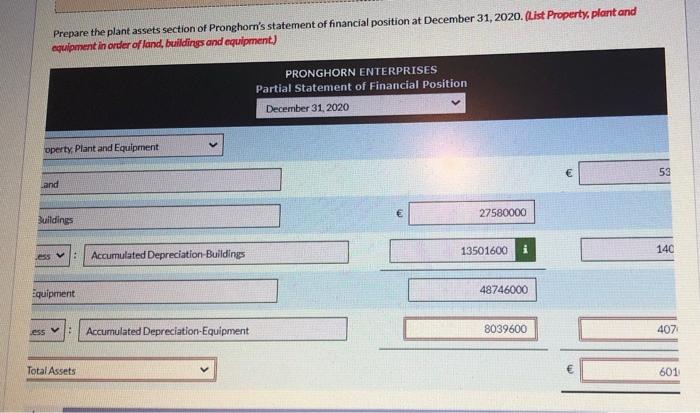

At December 31, 2019. Pronghorn Enterprises reported the following as plant assets. During 2020, the following selected cash transactions occurred. April Purchased land for 2,040,000. May 1 Sold equipment that cost 1,140,000 when purchased on January 1. 2016. The equipment was sold for 708,320. During 2020, the following selected cash transactions occurred. April Purchased land for 2,040,000 May Sold equipment that cost 1,140,000 when purchased on January 1, 2016. The equipment was sold for 708,320. June Sold land purchased on June 1,2010 for 1,600,000. The land cost 392,000. July Purchased equipment for 62,300,000 Dec. 31 Retired equipment that cost 514,000 when purchased on December 31,2010 . No residual value was received. Cash Depletion Expense 708320 Accurmalated Depreciation-Equipment (To record depreciation) 708320 Accumulated Depreciation-Equipment 836000 Equipment Gain on Disposal of Plant Assets (To record sale of equipment) (To record sale of equipment) 1600000 Gain on Disposal of Plant Assets. Date Account Titles and Explanation Dec.31 Depletion Expense AccumulatedDepreciation-Equipment (To record building depreciation) Dec. 31 Depletion Expense 4759600 Accumulated Depreciation-Equipment (To record equipment deprecition) At December 31, 2019. Pronghorn Enterprises reported the following as plant assets. During 2020, the following selected cash transactions occurred. April 1 Purchased land for 2,040,000. May 1 Sold equipment that cost 1,140,000 when purchased on January 1,2016. The equipment was sold for 708,320. June 1 Sold land purchased on June 1,2010 for 1,600,000. The land cost 392,000. July Purchased equipment for 2,300,000. Dec Retired equipment that cost 514,000 when purchased on December 31, 2010. No residual value was received Journalize the above transactions. The company uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 50-year life and no residual value. The equipment is estimated to have a 10-year useful life and no residual value. Update depreciation on assets disposed of at the time of sale or retirement (Credit account titles are automatically indented Gain on Disposat of Plant Assets 12 June 1 Equipment 2300000 Cash Dec31v Depreciation Expense 51400 Accumulated Depreciation-Equipment (To record depreciation) Accumalated Depreciation-Equipment 514000 Equipment (To record retirement of equipment) Record adjusting entries for depreciation for 2020. (Credit account tities are automatically indented when amount is entered. Do not indent manually Prepare the plant assets section of Pronghorn's statement of financial position at December 31, 2020. (llist Property, plant and win omberaf land buildinss and equipment.)