Answered step by step

Verified Expert Solution

Question

1 Approved Answer

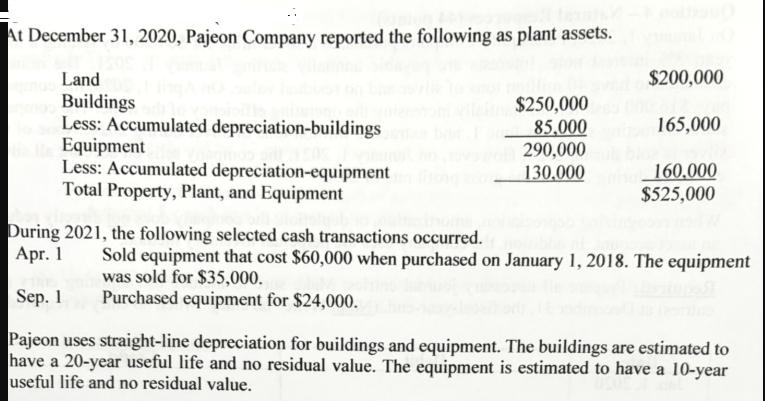

At December 31, 2020, Pajeon Company reported the following as plant assets. Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total Property, Plant,

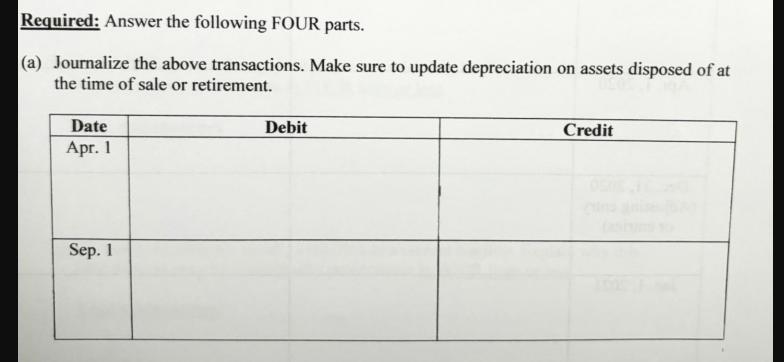

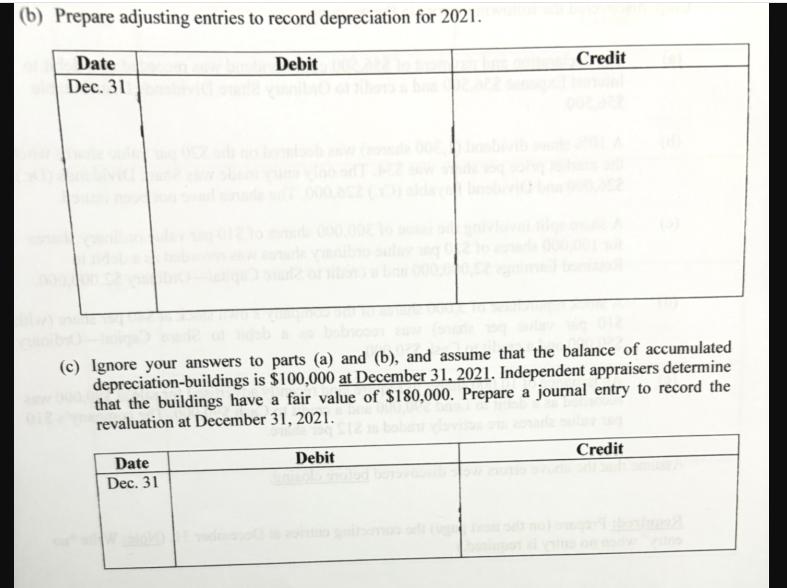

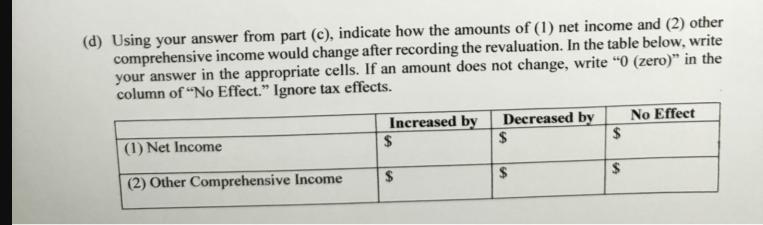

At December 31, 2020, Pajeon Company reported the following as plant assets. Land Buildings Less: Accumulated depreciation-buildings Equipment Less: Accumulated depreciation-equipment Total Property, Plant, and Equipment $250,00000 85,000 290,000 130,000 $200,000 165,000 160,000 $525,000 During 2021, the following selected cash transactions occurred. Apr. 1 Sep. 1 Pajeon uses straight-line depreciation for buildings and equipment. The buildings are estimated to have a 20-year useful life and no residual value. The equipment is estimated to have a 10-year useful life and no residual value. Sold equipment that cost $60,000 when purchased on January 1, 2018. The equipment was sold for $35,000. Purchased equipment for $24,000. Required: Answer the following FOUR parts. (a) Journalize the above transactions. Make sure to update depreciation on assets disposed of at the time of sale or retirement. Date Apr. 1 Sep. 1 Debit Credit (b) Prepare adjusting entries to record depreciation for 2021. Date Dec. 31 Debit Date Dec. 31 (c) Ignore your answers to parts (a) and (b), and assume that the balance of accumulated depreciation-buildings is $100,000 at December 31, 2021. Independent appraisers determine that the buildings have a fair value of $180,000. Prepare a journal entry to record the revaluation at December 31, 2021. Credit Debit Credit (d) Using your answer from part (c), indicate how the amounts of (1) net income and (2) other comprehensive income would change after recording the revaluation. In the table below, write your answer in the appropriate cells. If an amount does not change, write "0 (zero)" in the column of "No Effect." Ignore tax effects. (1) Net Income (2) Other Comprehensive Income Increased by $ $ Decreased by $ $ No Effect $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer b Date Account Titles and Explanation Debit Credit Dec 31 Depreciation expense Building 12500 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started