Answered step by step

Verified Expert Solution

Question

1 Approved Answer

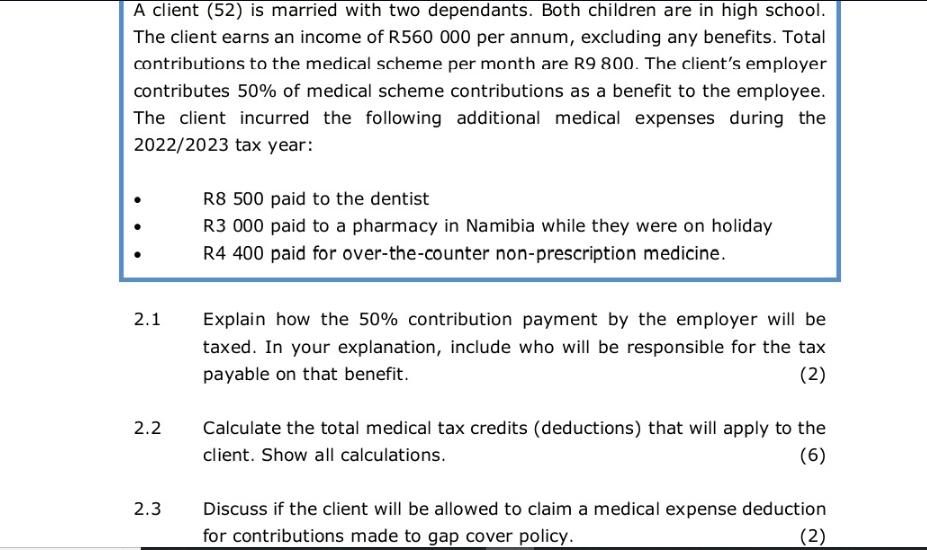

A client (52) is married with two dependants. Both children are in high school. The client earns an income of R560 000 per annum,

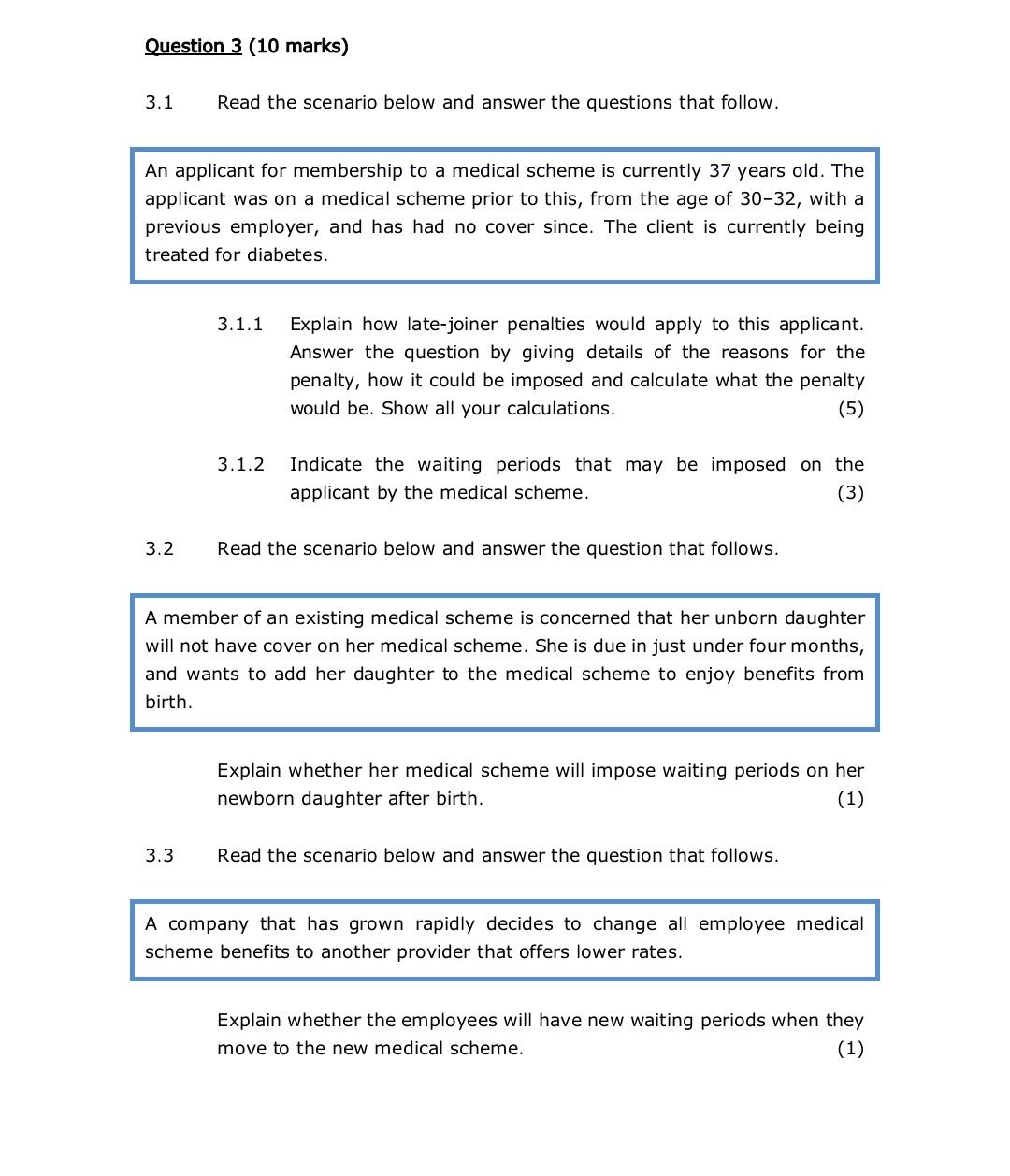

A client (52) is married with two dependants. Both children are in high school. The client earns an income of R560 000 per annum, excluding any benefits. Total contributions to the medical scheme per month are R9 800. The client's employer contributes 50% of medical scheme contributions as a benefit to the employee. The client incurred the following additional medical expenses during the 2022/2023 tax year: 2.1 2.2 2.3 R8 500 paid to the dentist R3 000 paid to a pharmacy in Namibia while they were on holiday R4 400 paid for over-the-counter non-prescription medicine. Explain how the 50% contribution payment by the employer will be taxed. In your explanation, include who will be responsible for the tax payable on that benefit. (2) Calculate the total medical tax credits (deductions) that will apply to the client. Show all calculations. (6) Discuss if the client will be allowed to claim a medical expense deduction for contributions made to gap cover policy. (2) Question 3 (10 marks) 3.1 Read the scenario below and answer the questions that follow. An applicant for membership to a medical scheme is currently 37 years old. The applicant was on a medical scheme prior to this, from the age of 30-32, with a previous employer, and has had no cover since. The client is currently being treated for diabetes. 3.2 3.1.1 3.3 3.1.2 Explain how late-joiner penalties would apply to this applicant. Answer the question by giving details of the reasons for the penalty, how it could be imposed and calculate what the penalty would be. Show all your calculations. (5) Indicate the waiting periods that may be imposed on the applicant by the medical scheme. (3) Read the scenario below and answer the question that follows. A member of an existing medical scheme is concerned that her unborn daughter will not have cover on her medical scheme. She is due in just under four months, and wants to add her daughter to the medical scheme to enjoy benefits from birth. Explain whether her medical scheme will impose waiting periods on her newborn daughter after birth. (1) Read the scenario below and answer the question that follows. A company that has grown rapidly decides to change all employee medical scheme benefits to another provider that offers lower rates. Explain whether the employees will have new waiting periods when they move to the new medical scheme. (1)

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

21 The 50 medical scheme contribution paid by the employer is considered a taxable benefit for the employee The value of the benefit 50 of R9800 per month R4900 will be added to the employees remunera...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started