Answered step by step

Verified Expert Solution

Question

1 Approved Answer

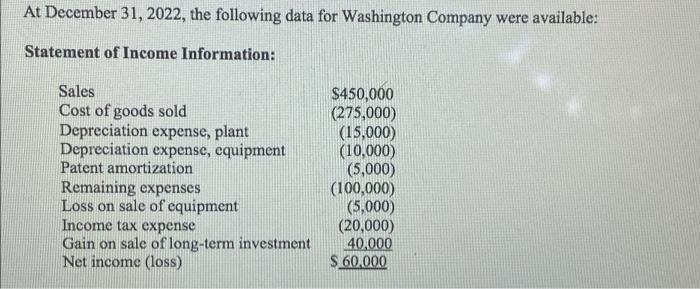

At December 31, 2022, the following data for Washington Company were available: Statement of Income Information: Sales $450,000 Cost of goods sold (275,000) (15,000)

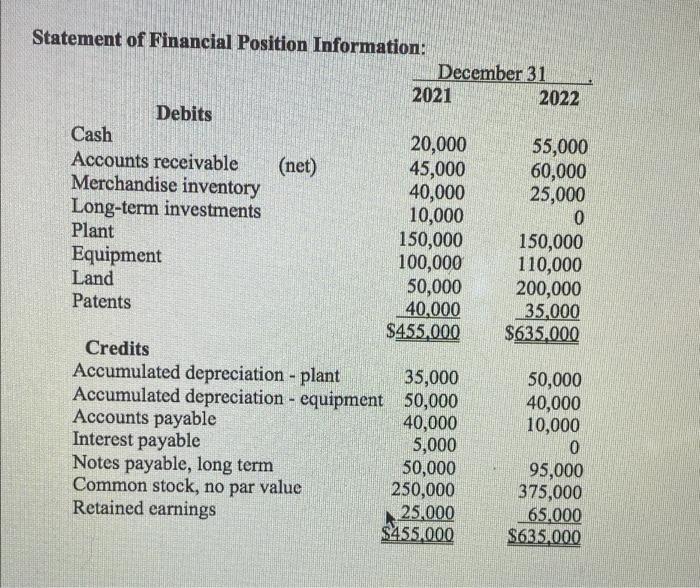

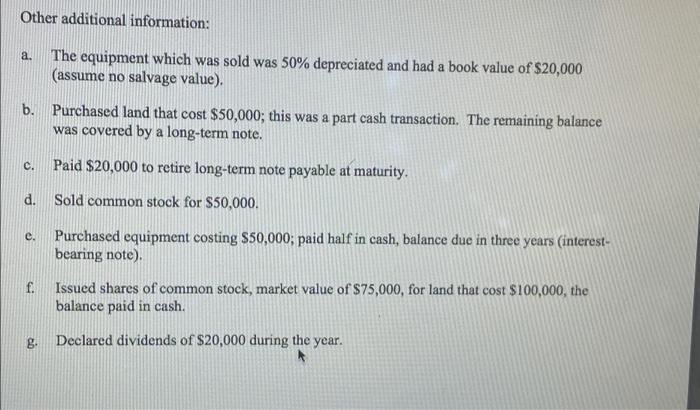

At December 31, 2022, the following data for Washington Company were available: Statement of Income Information: Sales $450,000 Cost of goods sold (275,000) (15,000) Depreciation expense, plant Depreciation expense, equipment (10,000) Patent amortization (5,000) Remaining expenses (100,000) Loss on sale of equipment (5,000) Income tax expense (20,000) Gain on sale of long-term investment 40,000 Net income (loss) $ 60,000 Statement of Financial Position Information: 2021 Debits Cash 20,000 Accounts receivable (net) 45,000 Merchandise inventory 40,000 Long-term investments 10,000 Plant 150,000 Equipment 100,000 Land 50,000 Patents 40,000 $455.000 Credits 35,000 Accumulated depreciation - plant Accumulated depreciation - equipment 50,000 40,000 Accounts payable Interest payable 5,000 Notes payable, long term 50,000 Common stock, no par value 250,000 Retained earnings 25,000 $455,000 December 31 2022 55,000 60,000 25,000 0 150,000 110,000 200,000 35,000 $635.000 50,000 40,000 10,000 0 95,000 375,000 65,000 $635.000 Other additional information: a. The equipment which was sold was 50% depreciated and had a book value of $20,000 (assume no salvage value). b. Purchased land that cost $50,000; this was a part cash transaction. The remaining balance was covered by a long-term note. C. Paid $20,000 to retire long-term note payable at maturity. d. Sold common stock for $50,000. e. Purchased equipment costing $50,000; paid half in cash, balance due in three years (interest- bearing note). f. Issued shares of common stock, market value of $75,000, for land that cost $100,000, the balance paid in cash. g. Declared dividends of $20,000 during the year. REQUIRED: 1. Prepare a Statement of Cash Flows in GOOD FORM using the direct method to prepare the operating activities section. 2. Prepare a reconciliation of net income to cash flows from operations (indirect method) 3. Prepare a schedule of significant non-cash investing and financing activities.

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 WASHINGTON COMPANY OPERATING ACTIVITY SECTION USING DIRECT METHOD ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started