Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At December 31, 20X0, Crowe Company is a private entity with 75,000 common shares while Dylan Inc. has 40,000 common shares outstanding and is

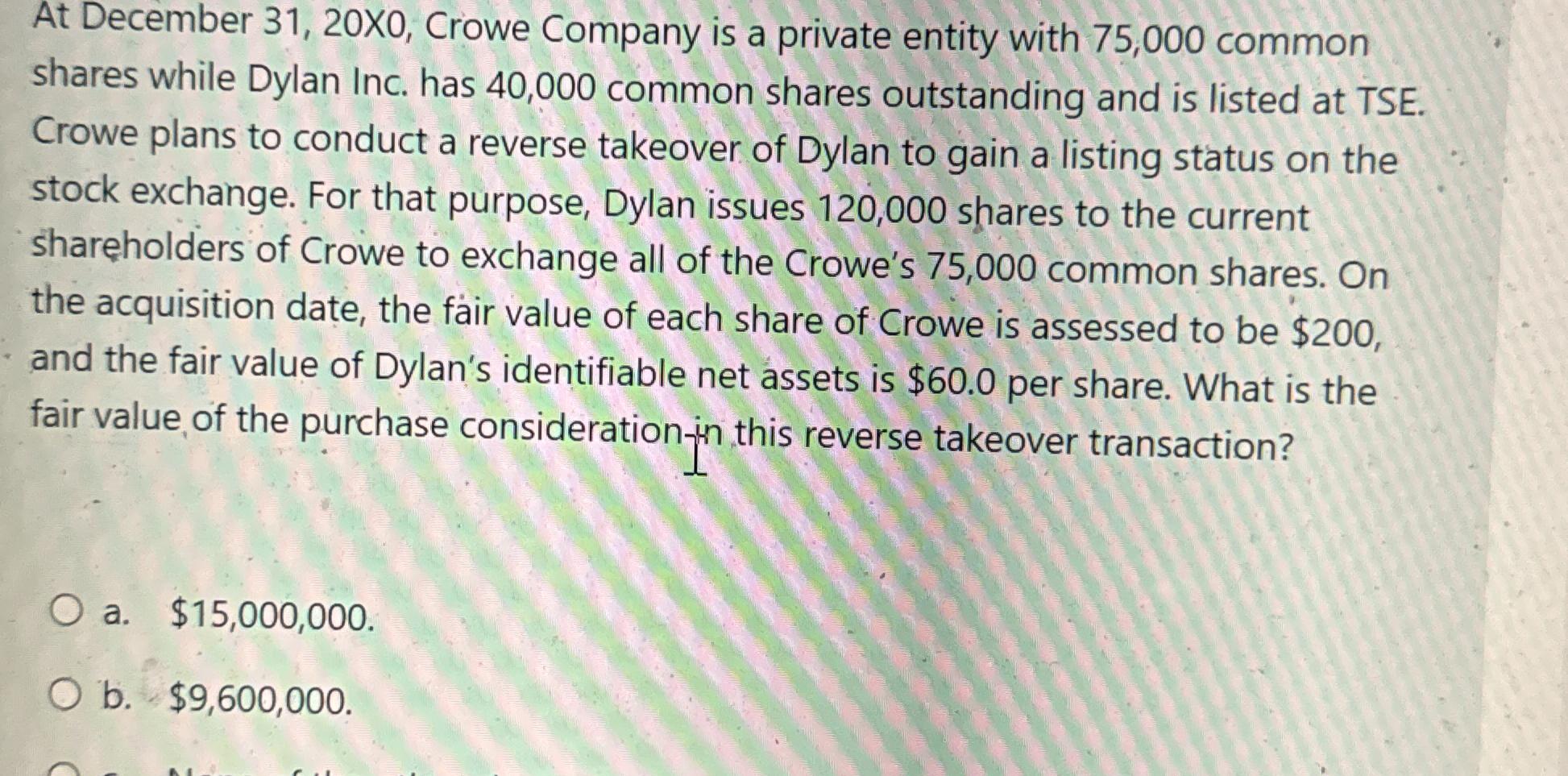

At December 31, 20X0, Crowe Company is a private entity with 75,000 common shares while Dylan Inc. has 40,000 common shares outstanding and is listed at TSE. Crowe plans to conduct a reverse takeover of Dylan to gain a listing status on the stock exchange. For that purpose, Dylan issues 120,000 shares to the current shareholders of Crowe to exchange all of the Crowe's 75,000 common shares. On the acquisition date, the fair value of each share of Crowe is assessed to be $200, and the fair value of Dylan's identifiable net assets is $60.0 per share. What is the fair value of the purchase consideration-in this reverse takeover transaction? O a. $15,000,000. O b. $9,600,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started