Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study 1: The following describes the cash receipts procedures for a medium-sized online and catalogue-based retailer. Customer payments come directly to the general

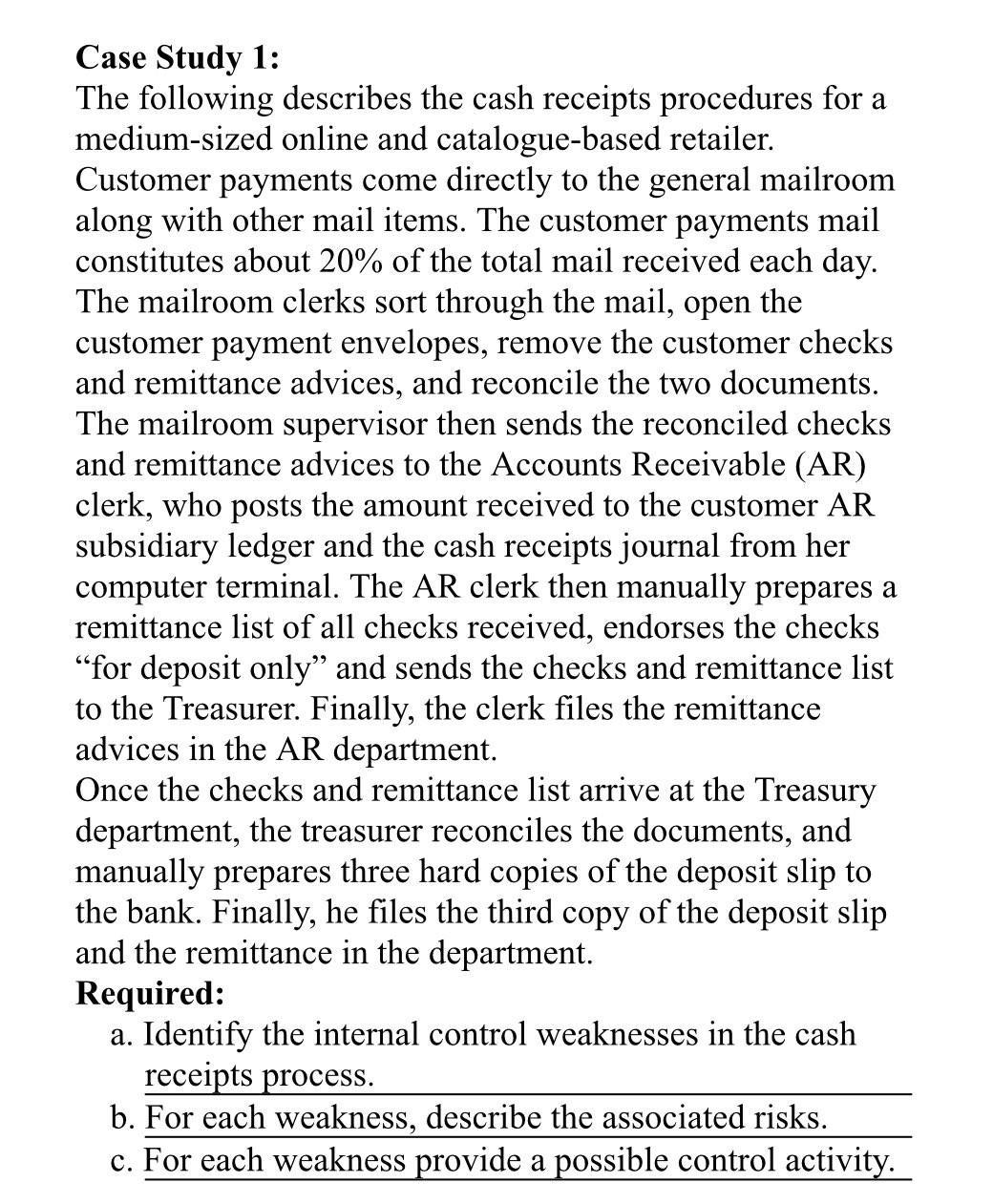

Case Study 1: The following describes the cash receipts procedures for a medium-sized online and catalogue-based retailer. Customer payments come directly to the general mailroom along with other mail items. The customer payments mail constitutes about 20% of the total mail received each day. The mailroom clerks sort through the mail, open the customer payment envelopes, remove the customer checks and remittance advices, and reconcile the two documents. The mailroom supervisor then sends the reconciled checks and remittance advices to the Accounts Receivable (AR) clerk, who posts the amount received to the customer AR subsidiary ledger and the cash receipts journal from her computer terminal. The AR clerk then manually prepares a remittance list of all checks received, endorses the checks "for deposit only" and sends the checks and remittance list to the Treasurer. Finally, the clerk files the remittance advices in the AR department. Once the checks and remittance list arrive at the Treasury department, the treasurer reconciles the documents, and manually prepares three hard copies of the deposit slip to the bank. Finally, he files the third copy of the deposit slip and the remittance in the department. Required: a. Identify the internal control weaknesses in the cash receipts process. b. For each weakness, describe the associated risks. c. For each weakness provide a possible control activity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started