Answered step by step

Verified Expert Solution

Question

1 Approved Answer

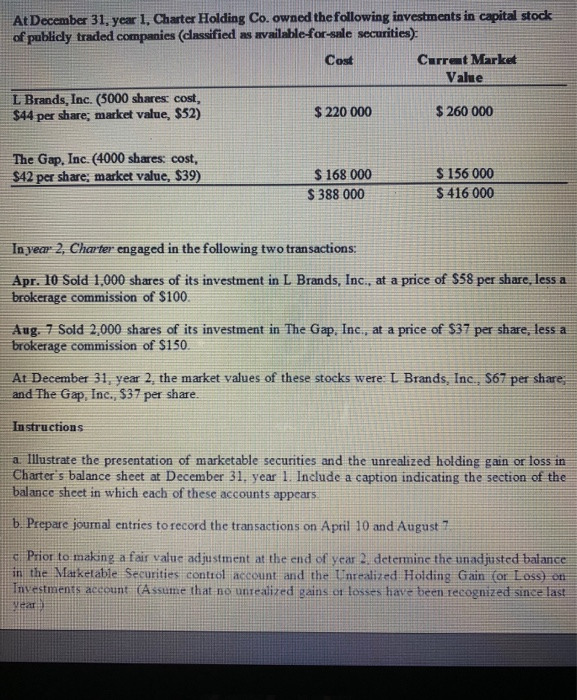

At December 31, year 1, Charter Holding Co. owned the following investments in capital stock of publicly traded companies (classified as available - for -

At December 31, year 1, Charter Holding Co. owned the following investments in capital stock of publicly traded companies (classified as available - for - sale securities) Cont Cirrat Market Vale L Brands, Inc. (5000 shares cost, 844 per share; market value, $ 52) $ 220 000 $ 260 000 The Ga, Inc. (4000 shats: cost, 342 per share; market value, $ 39) $ 168,000 $ 388,000 $ 156,000 $ 416,000 Inveer 2, Cliater engaged in the following two transactions: Apr 10 Sold 1, 000 shares of its investment in L Brands, Inc. , at a price of $ 58 per share, less a brokerage commission of $ 100. Aug Sold2000 shares of its investment in The Gap, Inc. at a price of $ 37 par share less a brokerage commission of S150 At December 31, ear 2, the market values of th = 5 = stocks were: L Brands, Ine 567 per share and The Gap. ne. 537 per share, Instructions a Illustrate the presentation of marketable securities and the unrealized holding gain or lo55 in Charters balance sheet at December 31, year 1. Include a caption indicating the section of the balance sheet in which each of these accounts appears b Prepare journal entries to record the transactions on April 10 and August Prior to taking a fair value 1 silent at the end of war 2 tetermine the un 11 jisfed balance in the War ketab Securities Grill unit ali 1 the Tr lied Holdinha Giairi (Or Loss) CFA | 111 ins, Isses have beeni Tetragilized surface last and silents atteclarit (Assuite That I line ali dl - 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started