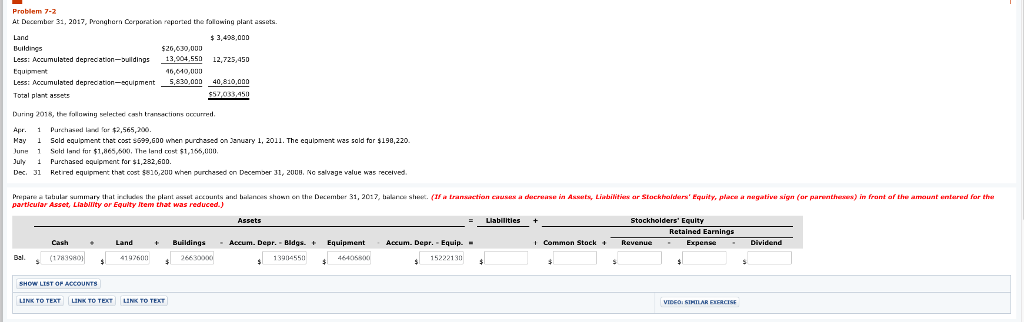

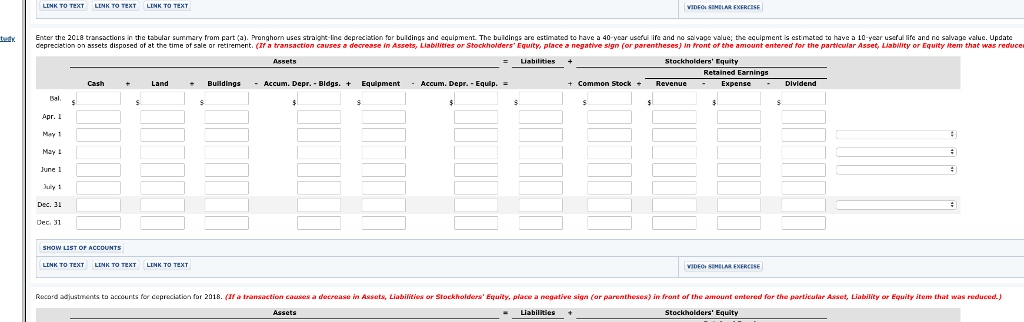

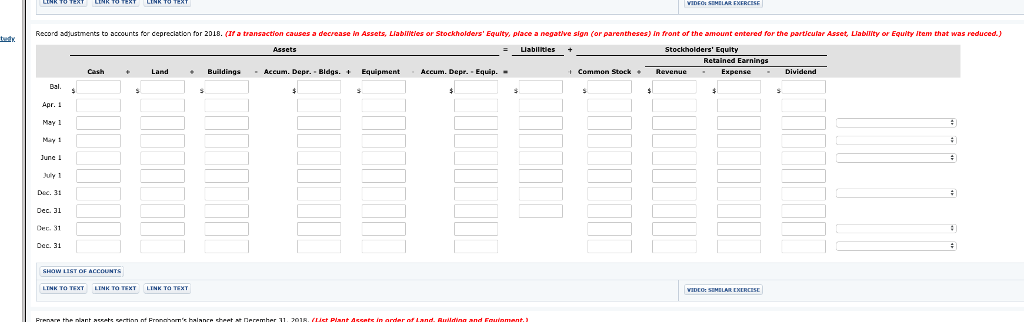

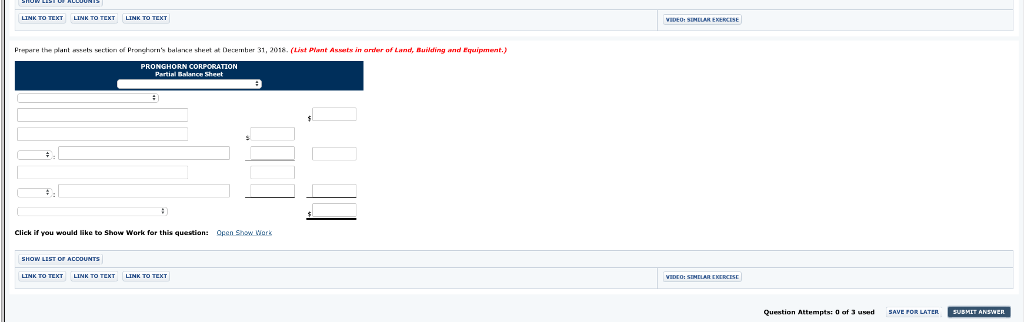

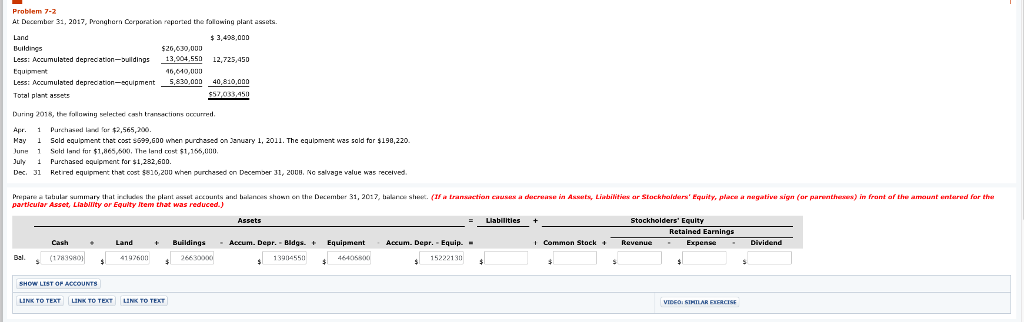

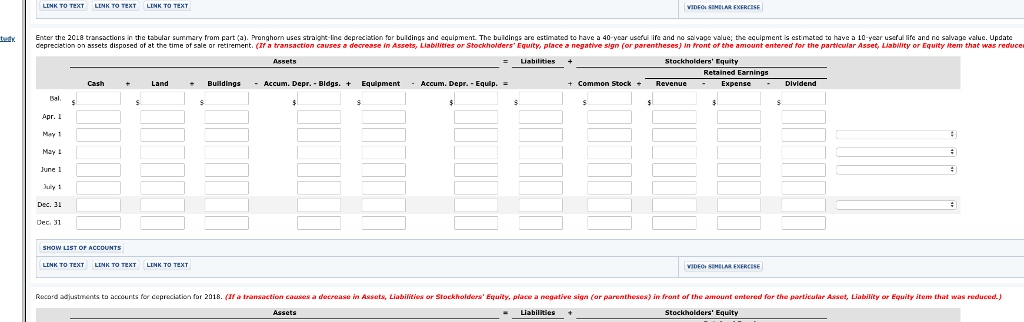

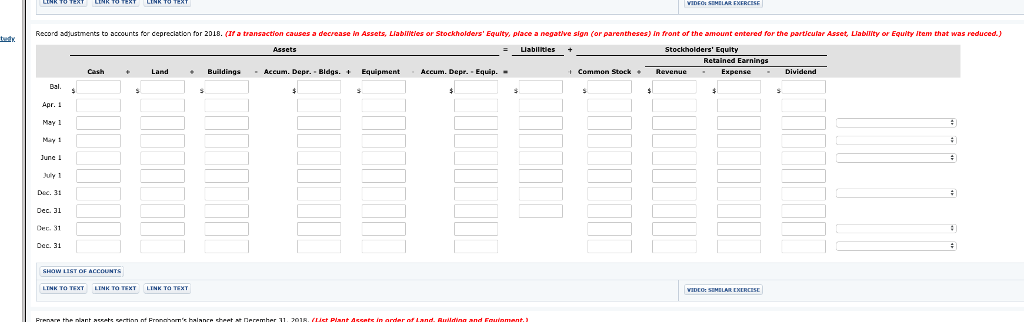

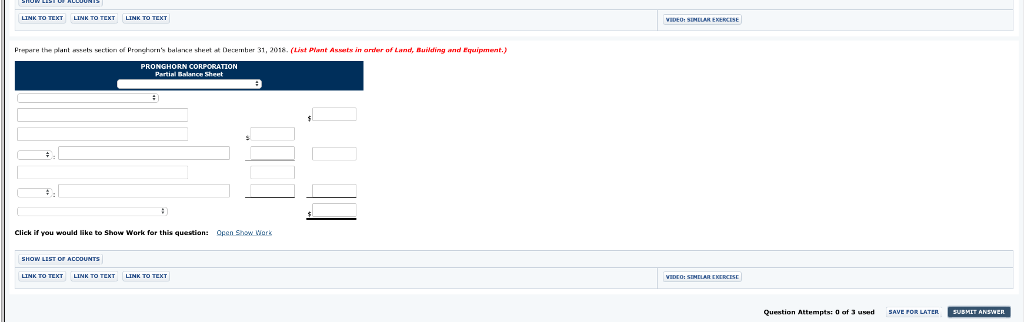

At Decembor 31, 2017, Prenghern Cerporation reported the following plant assets 3,498,000 Buildings Less: Accumulated deprecation-uldings Equipment Less: Accumulated deprecation-scuipment5.830,000 40.810,000 Total plant asses 26,030,000 13,04,550 12,725,45D During 2018, the falnwing selectec cash transsctions cecured Apr. 1 purchaiselladrur $2,565,20. May Scld equipment that costs099,600 wmer purthosed on Janu ary 1, 2011. The equipment was sold for $1.98,220. une Seld land fur $1,865,00 The land ost $1,16, Ju Purchased cquipment for $1,232,600. Dec. 1 Retred equipment thst cost $810,2UU when purchased on Decemper 31,2008, Nc salvage velue was received Prepareatammary that rclaes the plant assnt accouns a banoes particufar Asset, Lrabilnty or Equity Item that was reduced shoun on the Dacmer 31, 2017, ..(aEransaction cusas a dlecrease in Assets, Liabinties ar Stockholdars Equity, place a negative sign (or parenthees)in fromt of the amount entared for tha Stockholders' Equity Retained Earnings Cash LandBuildings Accum. Depr. Bldgs.+Equipment Aceum. Depr. -Equip. t Common Stock Revenue (128380)1976006 0000 390455n LIST OF AOCOUNTS LINS TO TEAT LIN TO TEXT LINK TO TEXT At Decembor 31, 2017, Prenghern Cerporation reported the following plant assets 3,498,000 Buildings Less: Accumulated deprecation-uldings Equipment Less: Accumulated deprecation-scuipment5.830,000 40.810,000 Total plant asses 26,030,000 13,04,550 12,725,45D During 2018, the falnwing selectec cash transsctions cecured Apr. 1 purchaiselladrur $2,565,20. May Scld equipment that costs099,600 wmer purthosed on Janu ary 1, 2011. The equipment was sold for $1.98,220. une Seld land fur $1,865,00 The land ost $1,16, Ju Purchased cquipment for $1,232,600. Dec. 1 Retred equipment thst cost $810,2UU when purchased on Decemper 31,2008, Nc salvage velue was received Prepareatammary that rclaes the plant assnt accouns a banoes particufar Asset, Lrabilnty or Equity Item that was reduced shoun on the Dacmer 31, 2017, ..(aEransaction cusas a dlecrease in Assets, Liabinties ar Stockholdars Equity, place a negative sign (or parenthees)in fromt of the amount entared for tha Stockholders' Equity Retained Earnings Cash LandBuildings Accum. Depr. Bldgs.+Equipment Aceum. Depr. -Equip. t Common Stock Revenue (128380)1976006 0000 390455n LIST OF AOCOUNTS LINS TO TEAT LIN TO TEXT LINK TO TEXT