Answered step by step

Verified Expert Solution

Question

1 Approved Answer

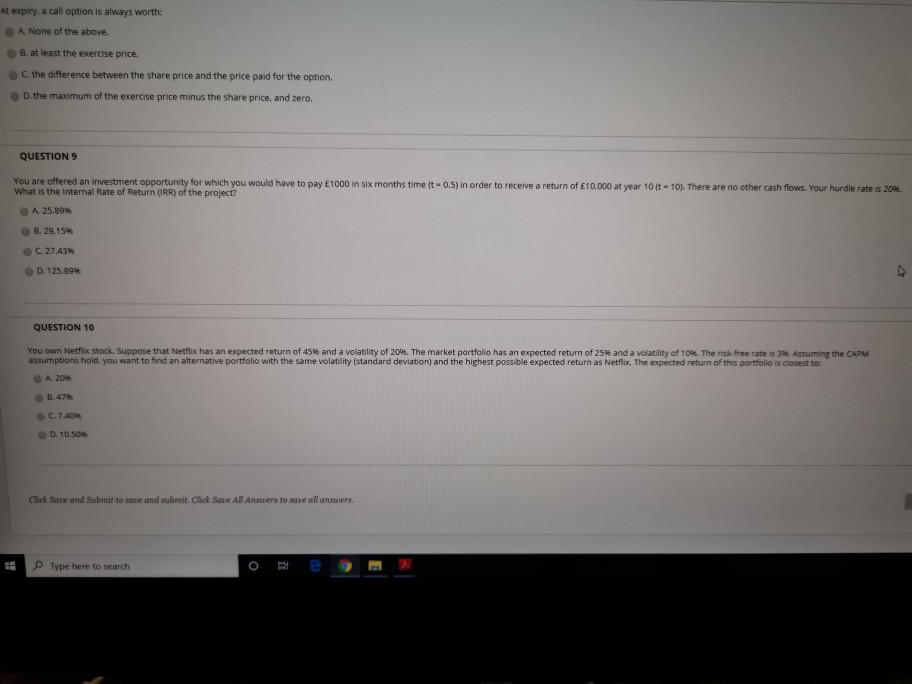

At expiry, a call option is always worth: A None of the above. B. at least the exercise price. the difference between the share price

At expiry, a call option is always worth: A None of the above. B. at least the exercise price. the difference between the share price and the price paid for the option D. the maximum of the exercise price minus the share price, and zero. QUESTION 9 You are offered an investment opportunity for which you would have to pay 1000 in six months time it - 0.5) in order to receive a return of 10.000 a year 10ft -10l. There are no other cash flows. Your hurdle rate is 20 What is the Internal Rate of Return (RR) of the project? A 25.89 B. 29.15 C 2743 D. 125.89 QUESTION 10 You own Netflix stock. Suppose that Netflix has an expected return of 45% and a volatility of 204. The market portfolio has an expected return of 25% and a volatility of 10%. The risk free rates 3. Assuming the CAPM assumptions hold, you want to find an alternative portfolio with the same volatility standard deviation) and the highest possible expected return as Netflix. The expected return of this portfolio is closest to A 204 7.40 D. 10.50 Chol S and Submit to see and bit. Click Save All Ant all annars Type here to search ofte 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started