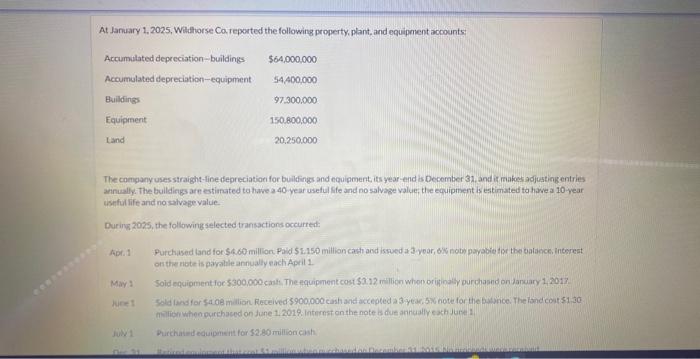

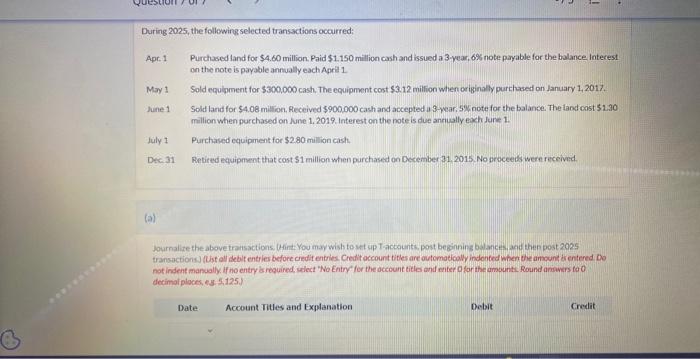

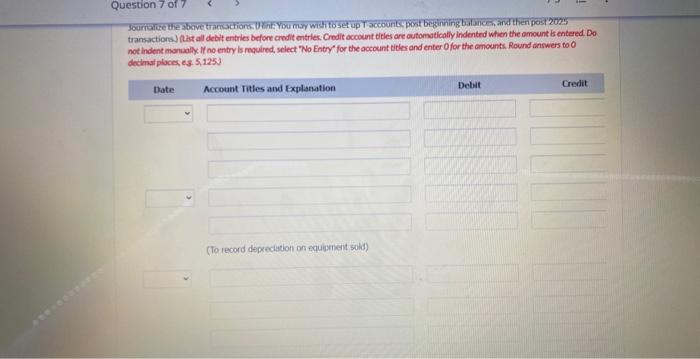

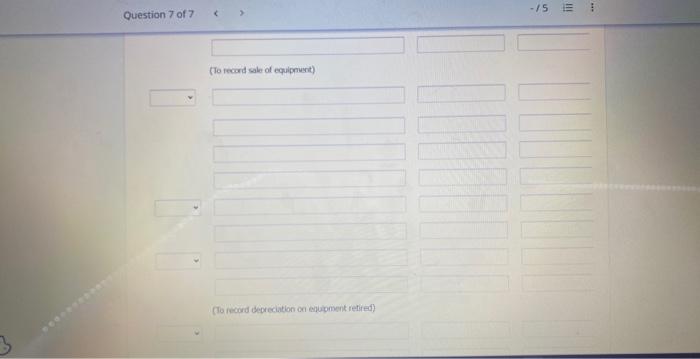

At January 1, 2025, Wilatworse Ca, reported the following property, plant, and equipment accounts The comgany uses straight-line depreciation for buildings and equipment, its year-end is becember 31, and it makos adjuating entries annually. The bullings are estirated to have a 40 -year useful Mite and no salvage yalue, the equipnent is estimated to havea 10 year uspful life and no satvage value. During 2075, the following selected transactions oceurted: Ape. 1 Purchased land for $4.60 million. Fald 51.150 million cash and issued a 3 vear, 6K nob payabie tor the ealachce intereat on the note is parohle annually each Aprit 1. May? Soid equipmentfoc 5300,000 cath The equipment cost 53.12 millich whon oriminaty purchased on danuary 1,2013 Malibe when purchased on June 1.2019. Interest on the note is due anrually each Jupe 1 During 2025 , the following selected transactions occurred: Apt. 1 Purchased land for $4.60 million. Paid $1.150 million cash and issued a 3 -year, 6% note payable for the balance laterest on the note is payable annully yeach April 1 May 1 Sold equloment for $300,000 cash. The equipment cost $3.12 million when originally purchased on January 1,2017. June 1 Sold land for $4,08 milion. Feceived $900000 cash and accepted u 9 - wear, 5 . note for the balance. The land cast 52.90 million when purchased on June 1, 2019, Interest on the note is due ancigally each Jure 1. July 1 Purchased equipment for $2.80 million cash. Dec. 31. Retired equipment that cost 51 million when purchased on December 31.2015 . No groceeds were received. (a) Wournalite the above transactions. (Hint You may wish to st up T-actounti, post beginning balances. and then post 2025 transactions) (Uist all deblt entries before credit entries Credit account titles are outomatically indonted when bhe amoun drentered Do not indent manually. if no entry is required, select "Wo Entry" for the occount titlo and evter O for the amountt Round armavers to o decimalploces, es 5,125. transactions) (that all debit entries before credit entries. Credit occount titles are cutomotically indented when the amount is ented Do not indent monwolly If no entry s required, select "No Entry" for the occount tites and enter Ofor the emounts Round anwwers to 0 decinat ploces es 5, 125 Question 7 of 7 151 (To record sale of equipniert) (To iecord depreciation on equipment reticed) Question 7 of 7 15; (To record depreclation on equipment retired) (To record disposal of equipment) eTextbook and Media List of Accounts Attempts. of 3 used