Answered step by step

Verified Expert Solution

Question

1 Approved Answer

at least help me only with the calcutation parts. please PART 1. PROBLEM SOLVING AND SYNTHESIS (50 Marks) Direction: Answer all questions: Show your solutions

at least help me only with the calcutation parts. please

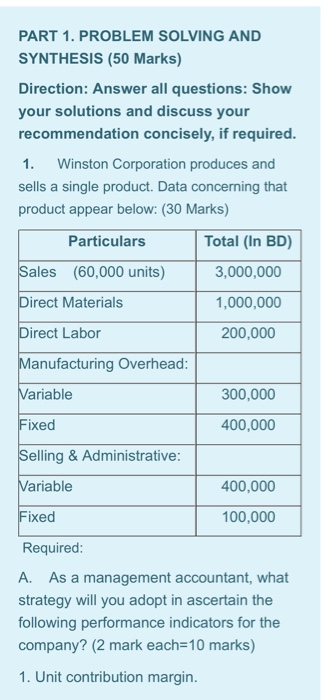

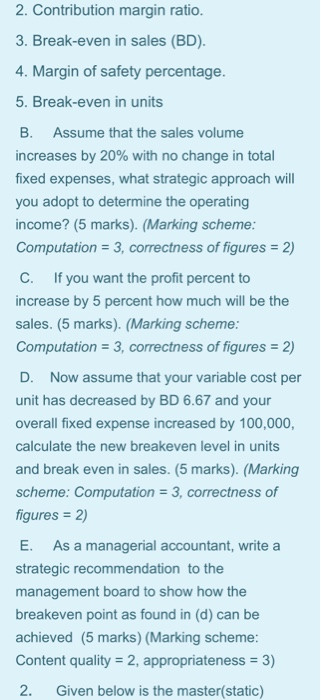

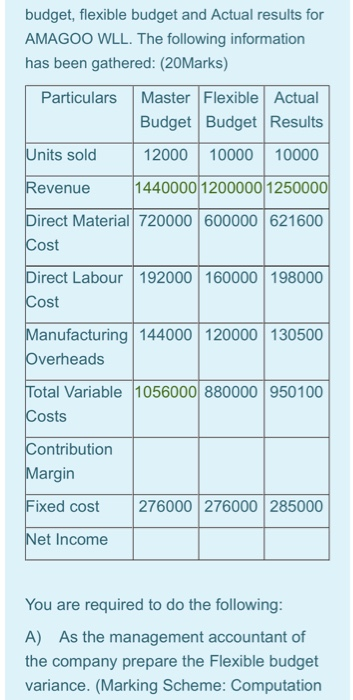

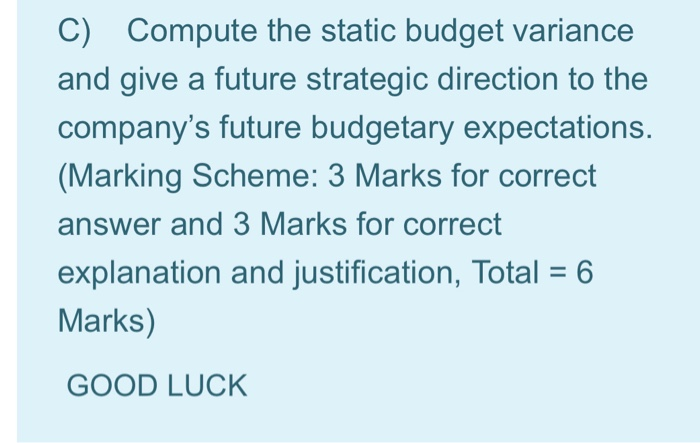

PART 1. PROBLEM SOLVING AND SYNTHESIS (50 Marks) Direction: Answer all questions: Show your solutions and discuss your recommendation concisely, if required. 1. Winston Corporation produces and sells a single product. Data concerning that product appear below: (30 Marks) Particulars Total (In BD) 3,000,000 Sales (60,000 units) 1,000,000 Direct Materials Direct Labor 200,000 Manufacturing Overhead: Variable 300,000 Fixed 400,000 Selling & Administrative: Variable 400,000 Fixed 100,000 Required: A. As a management accountant, what strategy will you adopt in ascertain the following performance indicators for the company? (2 mark each=10 marks) 1. Unit contribution margin. 2. Contribution margin ratio. 3. Break-even in sales (BD). 4. Margin of safety percentage. 5. Break-even in units B. Assume that the sales volume increases by 20% with no change in total fixed expenses, what strategic approach will you adopt to determine the operating income? (5 marks) (Marking scheme: Computation = 3, correctness of figures = 2) C. If you want the profit percent to increase by 5 percent how much will be the sales. (5 marks) (Marking scheme: Computation = 3, correctness of figures = 2) D. Now assume that your variable cost per unit has decreased by BD 6.67 and your overall fixed expense increased by 100,000, calculate the new breakeven level in units and break even in sales. (5 marks). (Marking scheme: Computation = 3, correctness of figures = 2) E. As a managerial accountant, write a strategic recommendation to the management board to show how the breakeven point as found in (d) can be achieved (5 marks) (Marking scheme: Content quality = 2, appropriateness = 3) 2. Given below is the master(static) budget, flexible budget and Actual results for AMAGOO WLL. The following information has been gathered: (20Marks) Particulars Master Flexible Actual Budget Budget Results Units sold 12000 10000 10000 Revenue 1440000 1200000 1250000 Direct Material 720000 600000 621600 Cost Direct Labour 192000 160000 198000 Cost Manufacturing 144000 120000 130500 Overheads Total Variable 1056000 880000 950100 Costs Contribution Margin Fixed cost 276000 276000 285000 Net Income You are required to do the following: A) As the management accountant of the company prepare the Flexible budget variance. (Marking Scheme: Computation C) Compute the static budget variance and give a future strategic direction to the company's future budgetary expectations. (Marking Scheme: 3 Marks for correct answer and 3 Marks for correct explanation and justification, Total = 6 Marks) GOOD LUCK Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started