Question

At the beginning of 2016, John Cornell decided to quit his job as a construction company supervisor and formed his own residential housing construction company.

At the beginning of 2016, John Cornell decided to quit his job as a construction company supervisor and formed his own residential housing construction company. When he resigned, he had a contract to build a custom home at a price of $400,000. The full price was payable in cash when the house was completed.

By year-end 2016, Cornells new company Luxury Homes, Inc. had spent $50,000 for labor, $107,740 for materials, and $3,800 in miscellaneous expenses in connection with the construction of the new home. Cornell estimated that the project was 70 percent complete at year-end. In addition, construction materials on hand at year-end 2016 had cost $2,600.

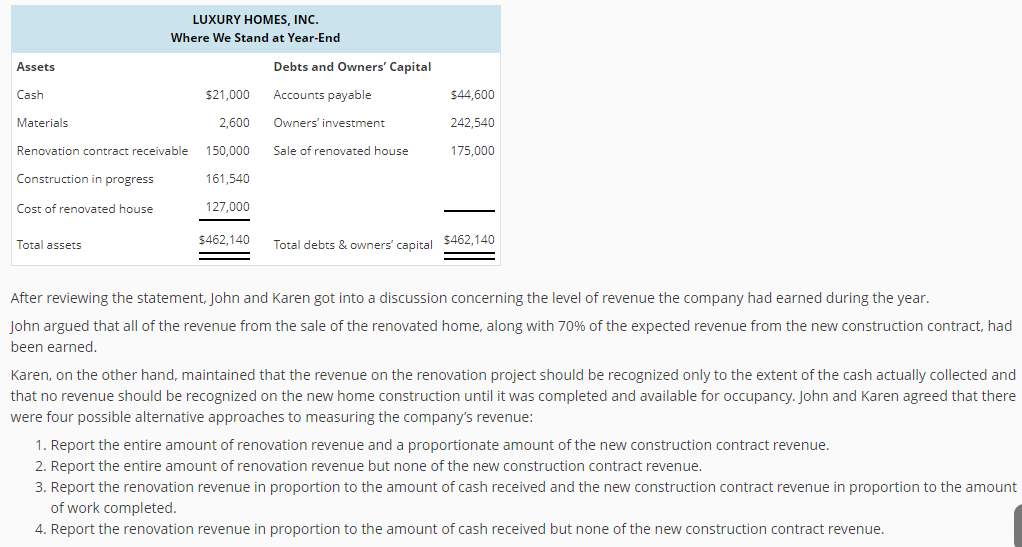

During the year, Luxury Homes, Inc., had also purchased a small house for $95,000, spent $32,000 fixing it up, and then sold it on November 1, 2016, for $175,000. The buyer paid $25,000 down and signed a note for the remainder of the balance due. The note called for interest at a rate of 12 percent per year, with a lump- sum payment for the outstanding balance payable at the end of 2018. Johns wife, Karen, kept the accounting records for Luxury Homes, Inc., and on December 31, she prepared the following statement:

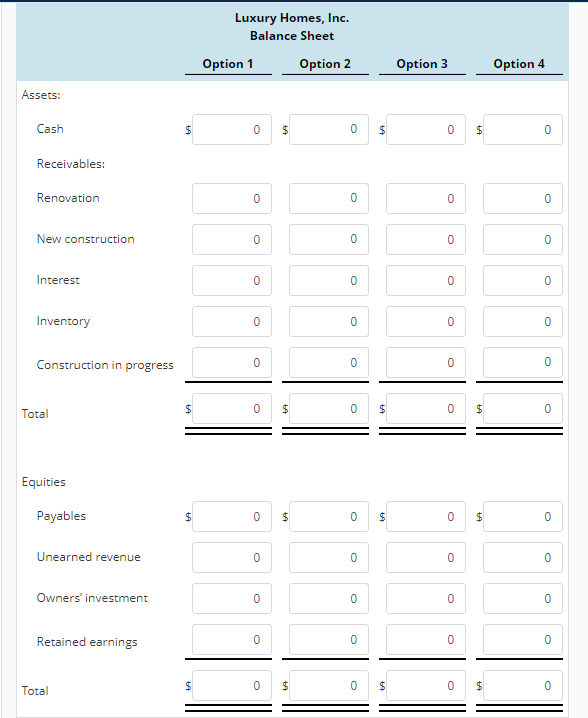

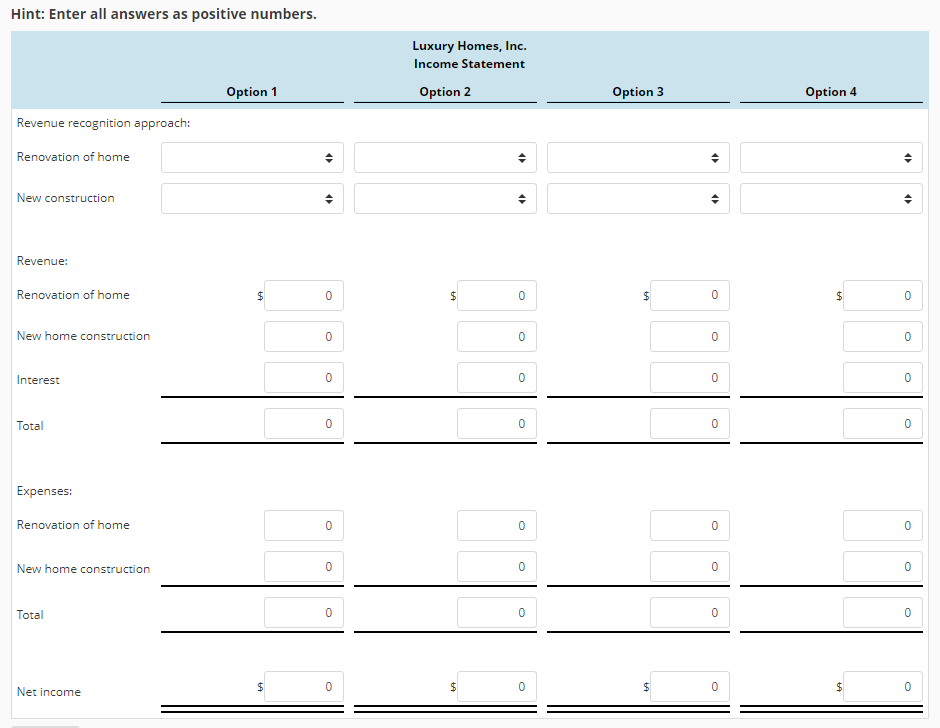

Required Prepare the balance sheets and income statements that would result under each of the four approaches. Round your answers to the nearest dollar.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started