Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of its fiscal year 2020, an analyst made the following forecast for ABC, Inc. (in millions of dollars): Cash flow from operation

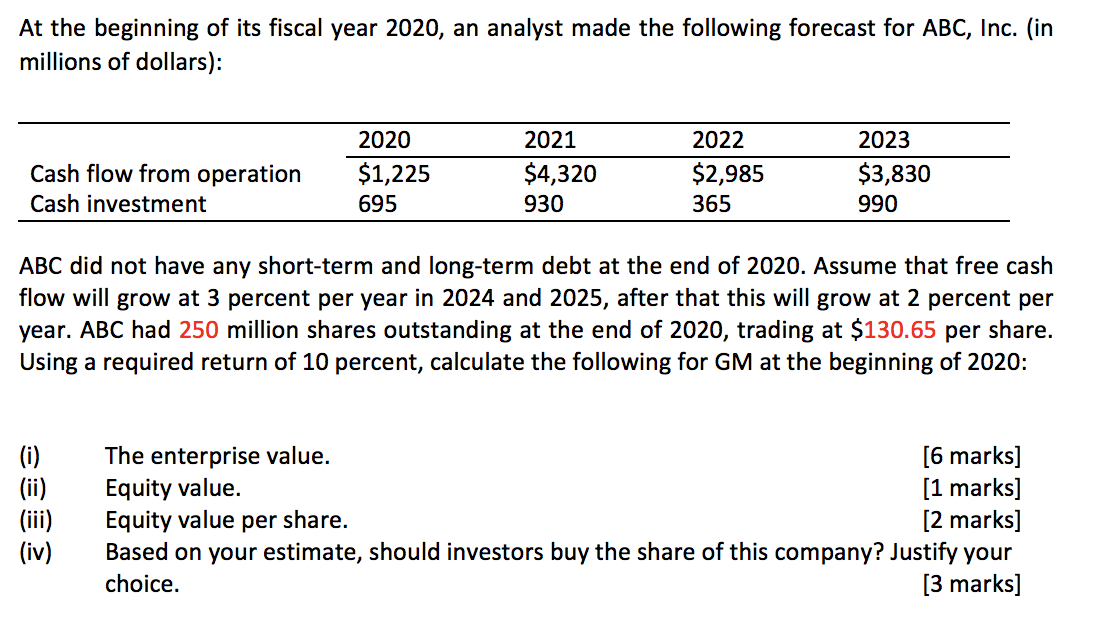

At the beginning of its fiscal year 2020, an analyst made the following forecast for ABC, Inc. (in millions of dollars): Cash flow from operation Cash investment 2020 $1,225 695 2021 $4,320 930 2022 $2,985 365 2023 $3,830 990 ABC did not have any short-term and long-term debt at the end of 2020. Assume that free cash flow will grow at 3 percent per year in 2024 and 2025, after that this will grow at 2 percent per year. ABC had 250 million shares outstanding at the end of 2020, trading at $130.65 per share. Using a required return of 10 percent, calculate the following for GM at the beginning of 2020: (i) (ii) $ The enterprise value. [6 marks] Equity value. [1 marks] Equity value per share. [2 marks] Based on your estimate, should investors buy the share of this company? Justify your choice. [3 marks] (iv) At the beginning of its fiscal year 2020, an analyst made the following forecast for ABC, Inc. (in millions of dollars): Cash flow from operation Cash investment 2020 $1,225 695 2021 $4,320 930 2022 $2,985 365 2023 $3,830 990 ABC did not have any short-term and long-term debt at the end of 2020. Assume that free cash flow will grow at 3 percent per year in 2024 and 2025, after that this will grow at 2 percent per year. ABC had 250 million shares outstanding at the end of 2020, trading at $130.65 per share. Using a required return of 10 percent, calculate the following for GM at the beginning of 2020: (i) (ii) $ The enterprise value. [6 marks] Equity value. [1 marks] Equity value per share. [2 marks] Based on your estimate, should investors buy the share of this company? Justify your choice. [3 marks] (iv)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started