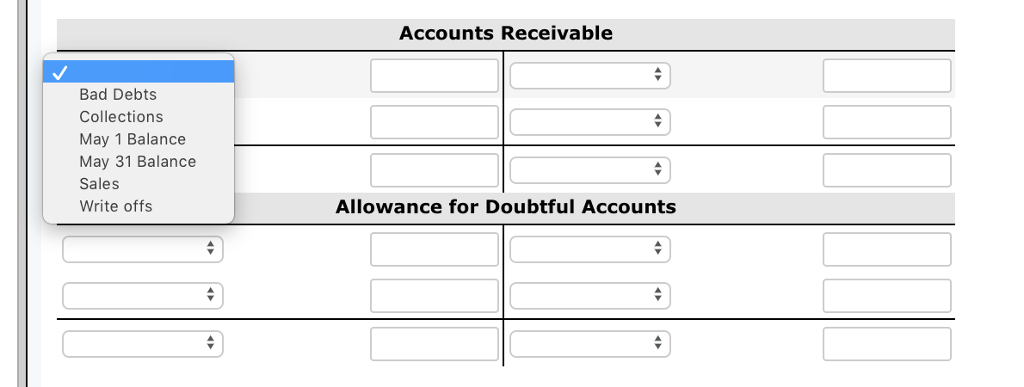

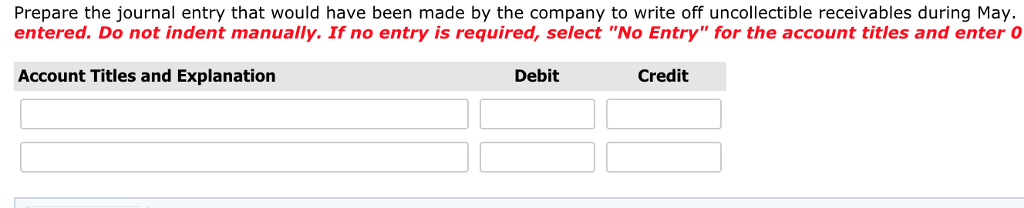

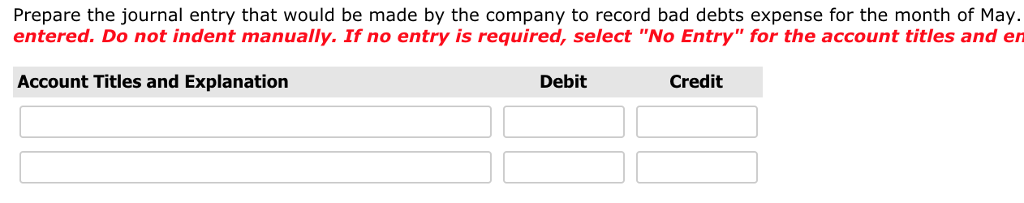

| At the beginning of May, Sweetwater Limited, which records adjusting entries at the end of each month, had an Accounts Receivable amount of $30,000 and an Allowance for Doubtful Accounts balance of $5,400. During May, the company had credit sales of $39,900 and collected $35,000 from customers. It also wrote off a certain amount of uncollectible receivables during the month and recorded a certain amount of bad debts expense at the end of the month. No accounts that were written off during the month were subsequently recovered. At the end of May, after all journal entries had been recorded and posted, the balance in Accounts Receivable was $31,700 while Allowance for Doubtful Accounts had a balance of $4,900 |