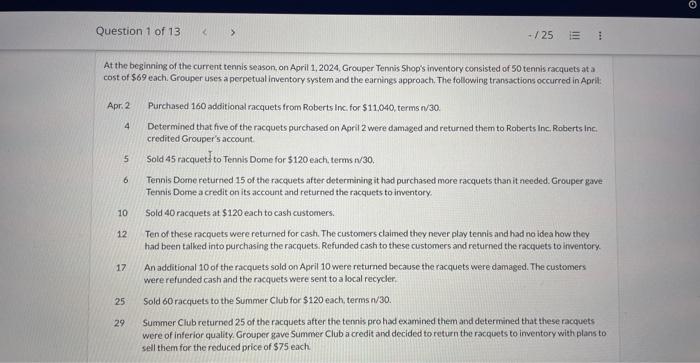

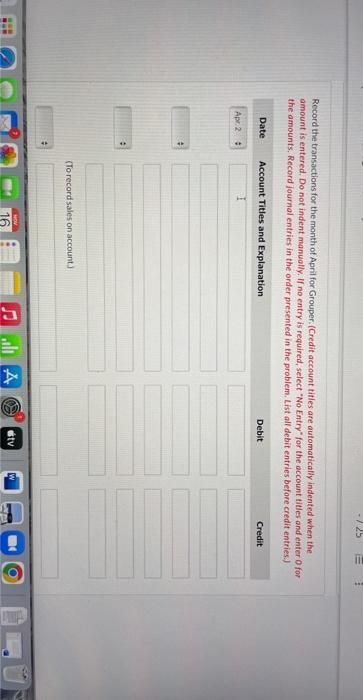

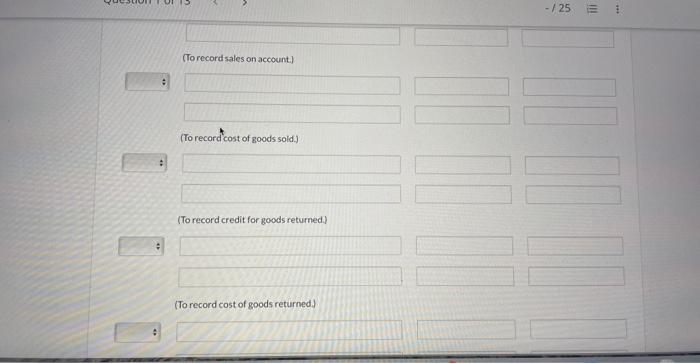

At the beginning of the current tennis season, on April 1,2024, Grouper Tennis Shop's imentory consisted of 50 tennis racquets at a cost of $69 each. Grouper uses a perpetual inventory system and the earnings approach. The following transactions occurred in April: Apr. 2 Purchased 160 additional racquets from Roberts Inc. for 511,040, terms n/30. 4 Determined that five of the racquets purchased on Aoril 2 were damaged and returned them to Roberts inc. Roberts inc: credited Grouper's account. 5 Sold 45 racquets to Tennis Dome for $120 each, terms n/30. 6 Tennis Dome returned 15 of the racquets after determining it had purchased more racquets than it needed. Grouper gave Tennis Dome a credit on its account and returned the racquets to irventory. 10 Sold 40 racquets at $120 each to cash customers. 12 Ten of these racquets were returned for cash. The customers claimed they never play tennis and had no idea how they had been talked into purchasing the racquets. Refunded cash to these customers and returned the racquets to inventory. 17 An additional 10 of the racquets sold on April 10 were returned because the racquets were damaged. The customers were refunded cash and the racquets were sent to a local recycler. 25. Sold 60 racquets to the Summer Club for $120 each, terms n/30. 29. Summer Club returned 25 of the racquets after the tennis prohad examined them and determined that these racquets were of inferior quality. Grouper gave Summer Club a credit and decided to return the racquets to inventory with plans to sell them for the reduced price of $75 each. Record the transoctions for the month of April for Grouper. (Credit account titles are automatically indented when the amount is entered. Do not indent manuolly. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. List all debit entries before eredit entries.) [To record sales on account] (To record cost of goods sold.) (To record credit for goods returned.) (To record cost of goods returned)