Answered step by step

Verified Expert Solution

Question

1 Approved Answer

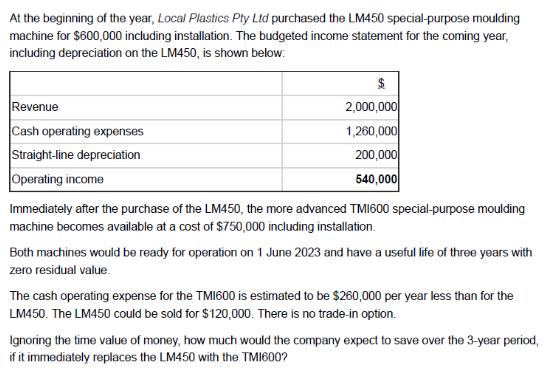

At the beginning of the year, Local Plastics Pty Ltd purchased the LM450 special-purpose moulding machine for $600,000 including installation. The budgeted income statement

At the beginning of the year, Local Plastics Pty Ltd purchased the LM450 special-purpose moulding machine for $600,000 including installation. The budgeted income statement for the coming year, including depreciation on the LM450, is shown below: Revenue Cash operating expenses Straight-line depreciation Operating income $ 2,000,000 1,260,000 200,000 540,000 Immediately after the purchase of the LM450, the more advanced TM1600 special-purpose moulding machine becomes available at a cost of $750,000 including installation. Both machines would be ready for operation on 1 June 2023 and have a useful life of three years with zero residual value. The cash operating expense for the TM1600 is estimated to be $260,000 per year less than for the LM450. The LM450 could be sold for $120,000. There is no trade-in option. Ignoring the time value of money, how much would the company expect to save over the 3-year period, if it immediately replaces the LM450 with the TM1600?

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the savings over the 3year period we need to consider the cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started