Answered step by step

Verified Expert Solution

Question

1 Approved Answer

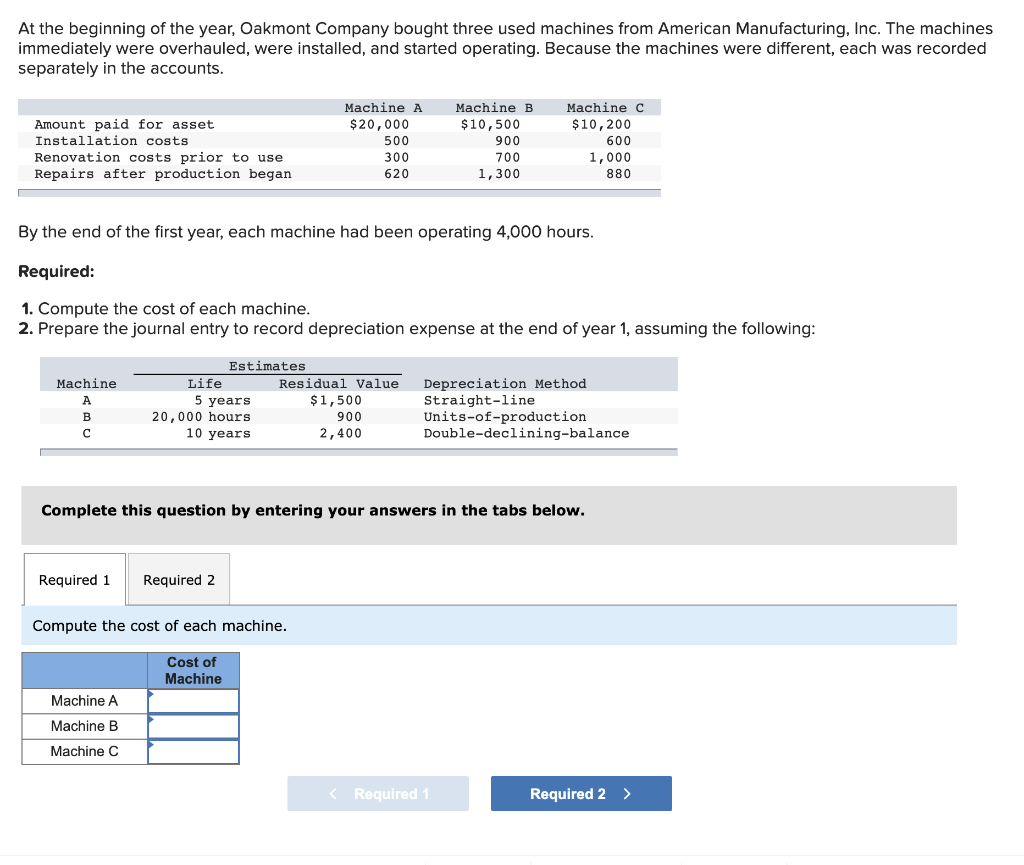

At the beginning of the year, Oakmont Company bought three used machines from American Manufacturing, Inc. The machines immediately were overhauled, were installed, and

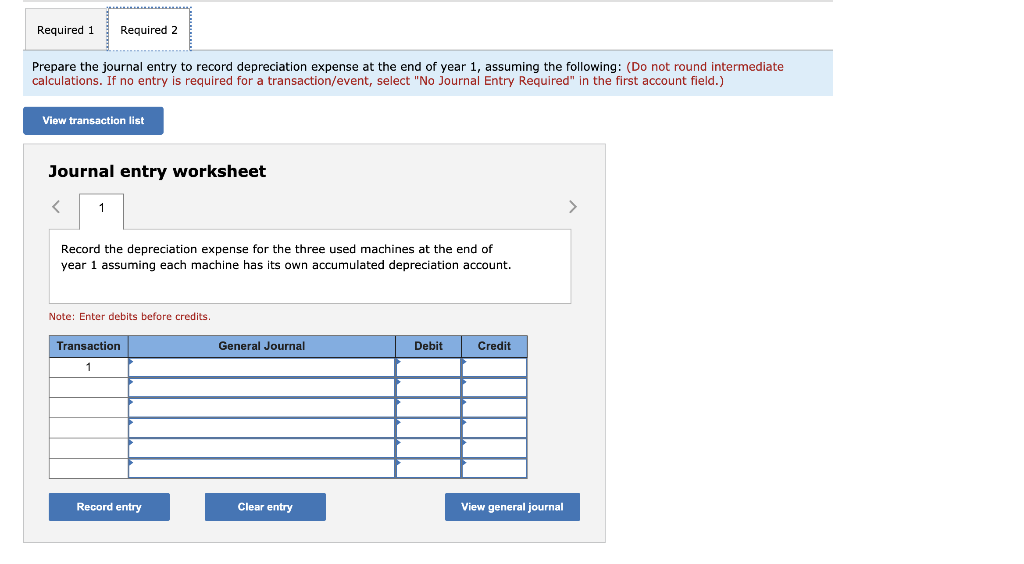

At the beginning of the year, Oakmont Company bought three used machines from American Manufacturing, Inc. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Machine A Machine B Machine C Amount paid for asset Installation costs $20,000 $10,500 $10,200 500 900 600 Renovation costs prior to use Repairs after production began 300 700 1,000 620 1,300 880 By the end of the first year, each machine had been operating 4,000 hours. Required: 1. Compute the cost of each machine. 2. Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: Estimates achine Life Residual Value Depreciation Method Straight-line Units-of-production Double-declining-balance 5 years $1,500 900 A 20,000 hours 10 years 2,400 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cost of each machine. Cost of Machine Machine A Machine B Machine C < Required 1 Required 2 > Required 1 Required 2 Prepare the journal entry to record depreciation expense at the end of year 1, assuming the following: (Do not round intermediate calculations. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 > Record the depreciation expense for the three used machines at the end of year 1 assuming each machine has its own accumulated depreciation account. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Part 1 Explanation Please Note Repairs after production has began would not form pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started