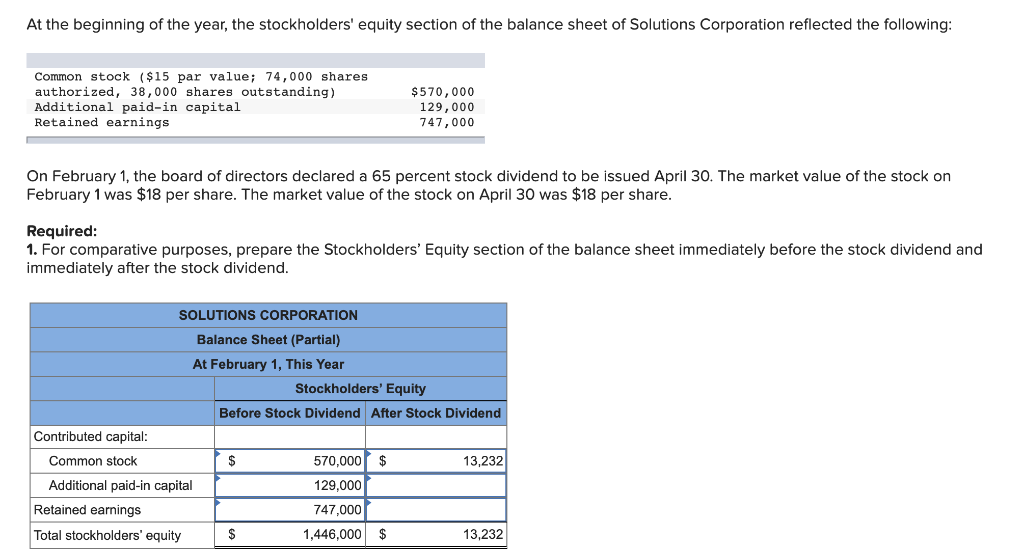

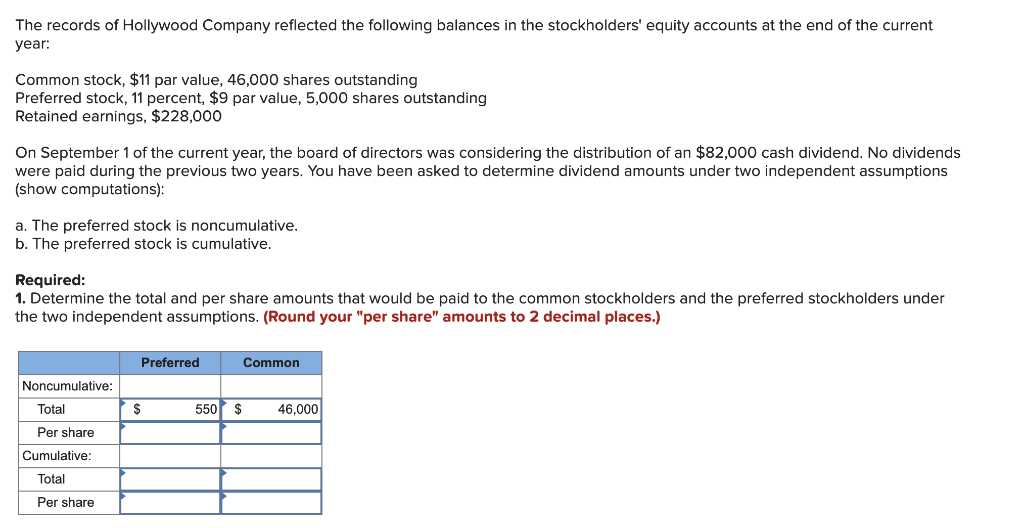

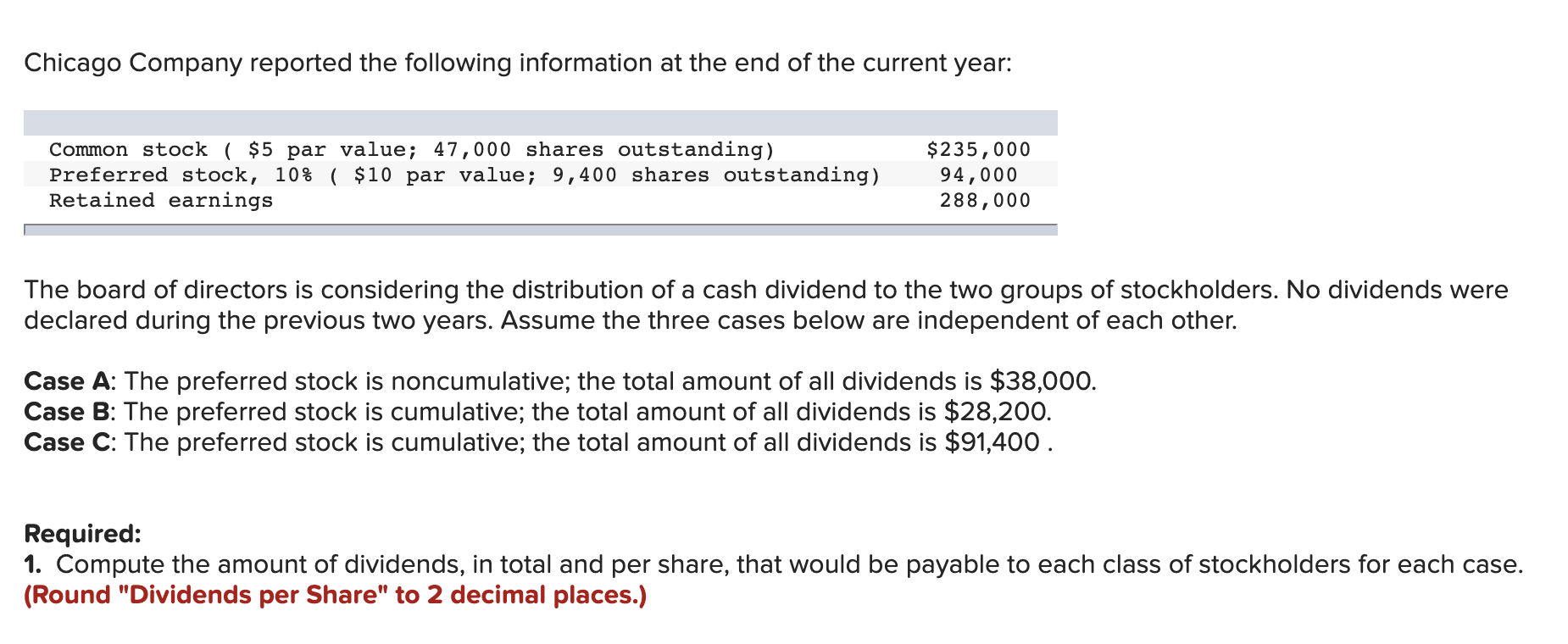

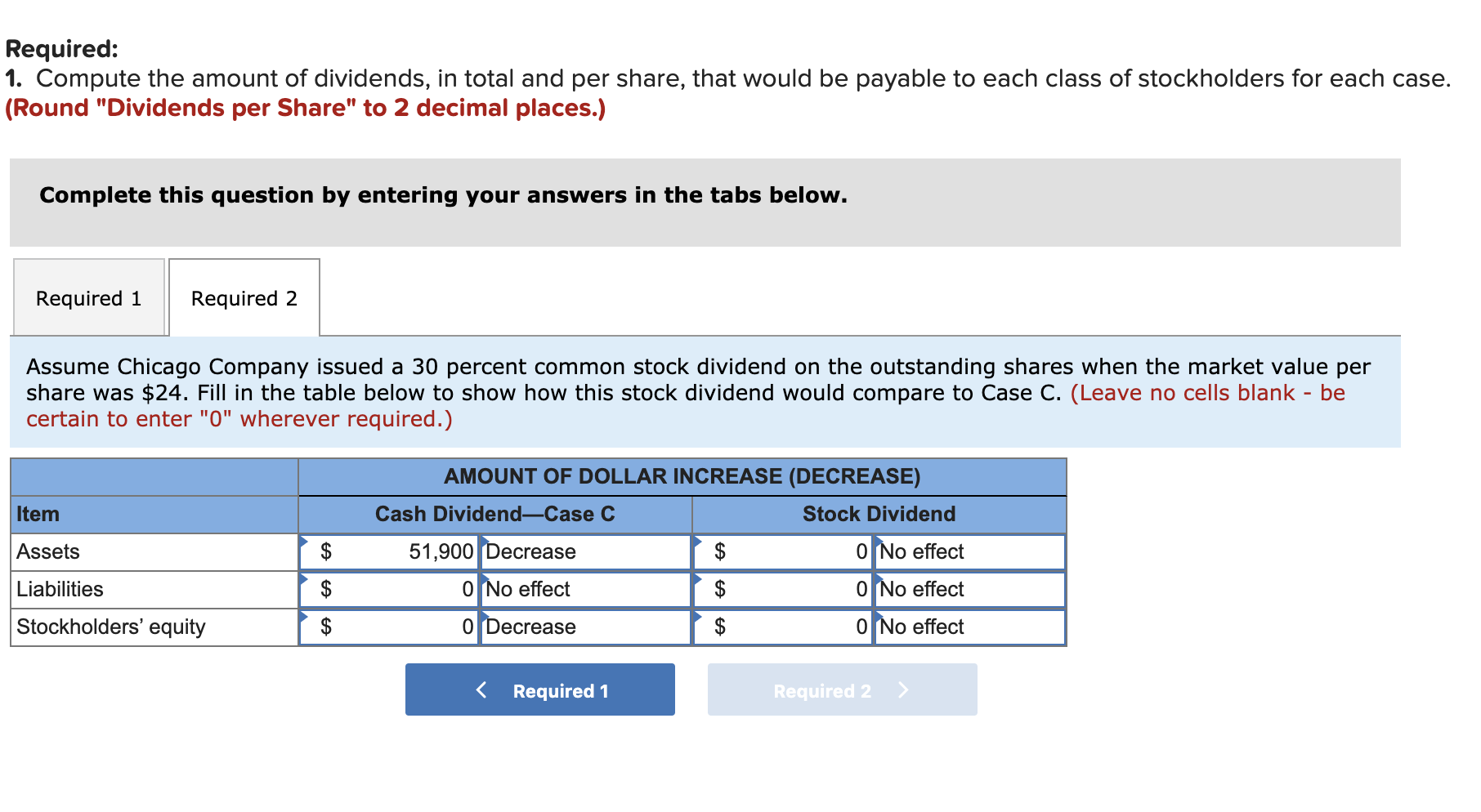

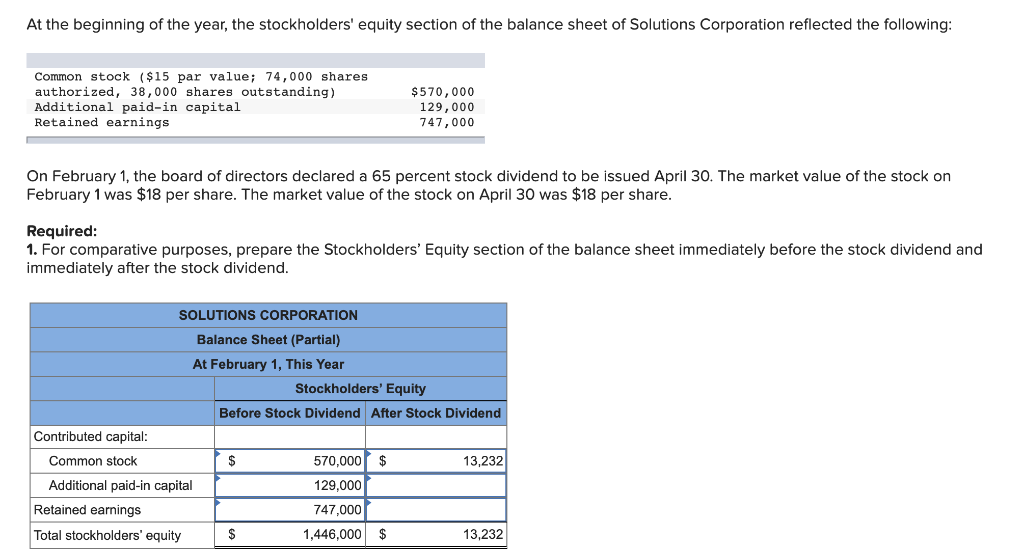

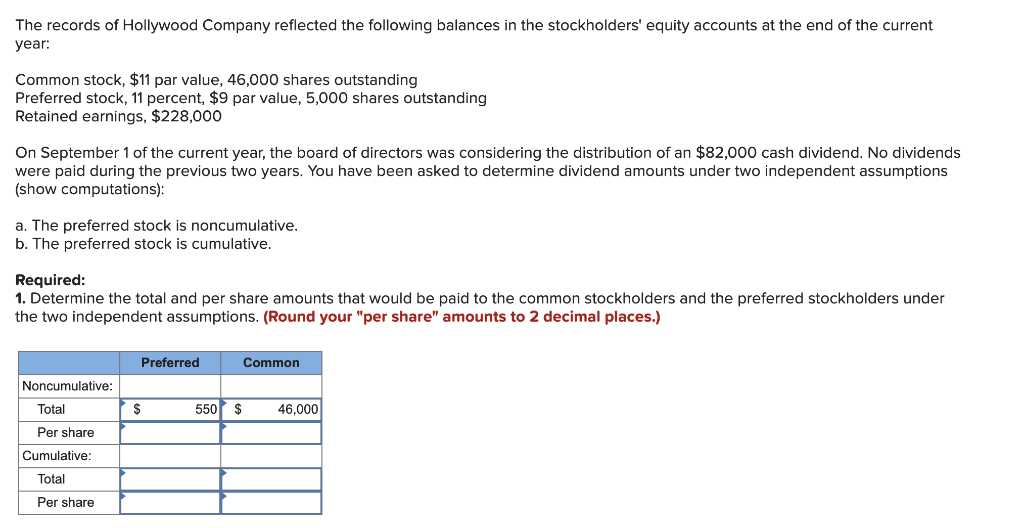

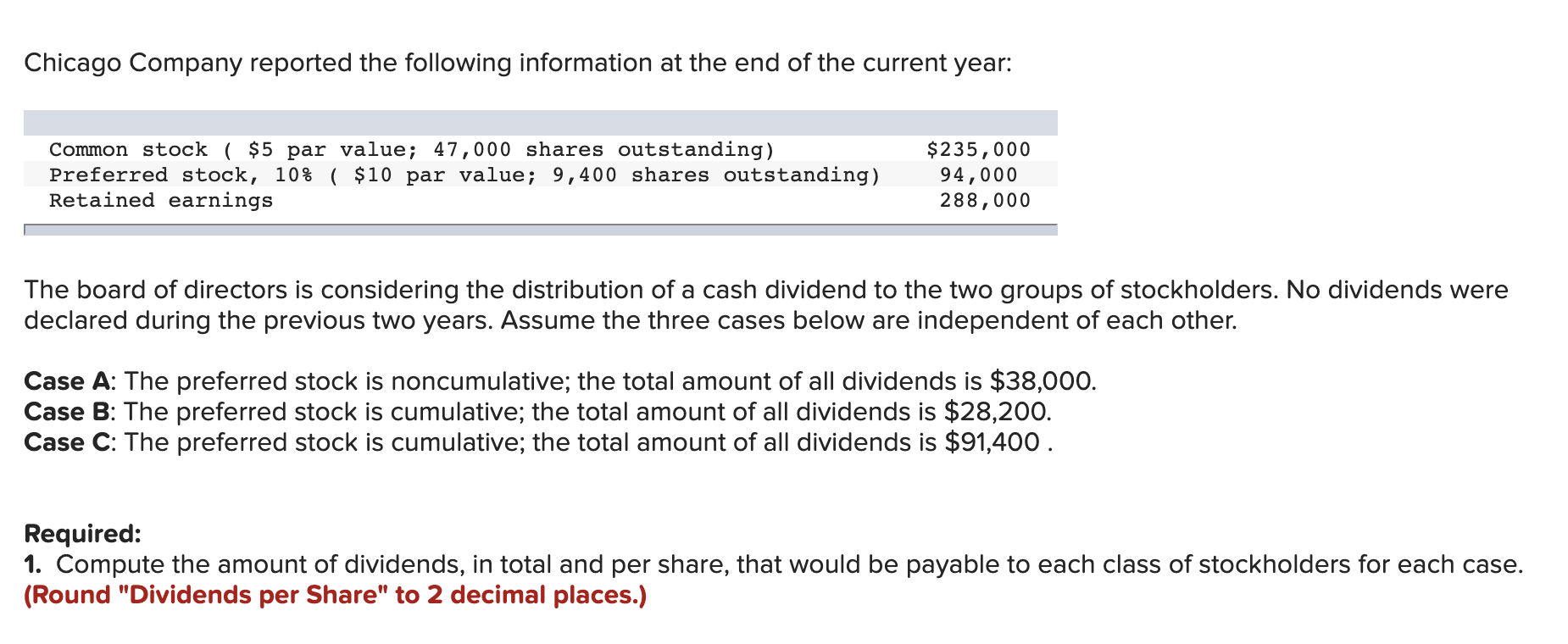

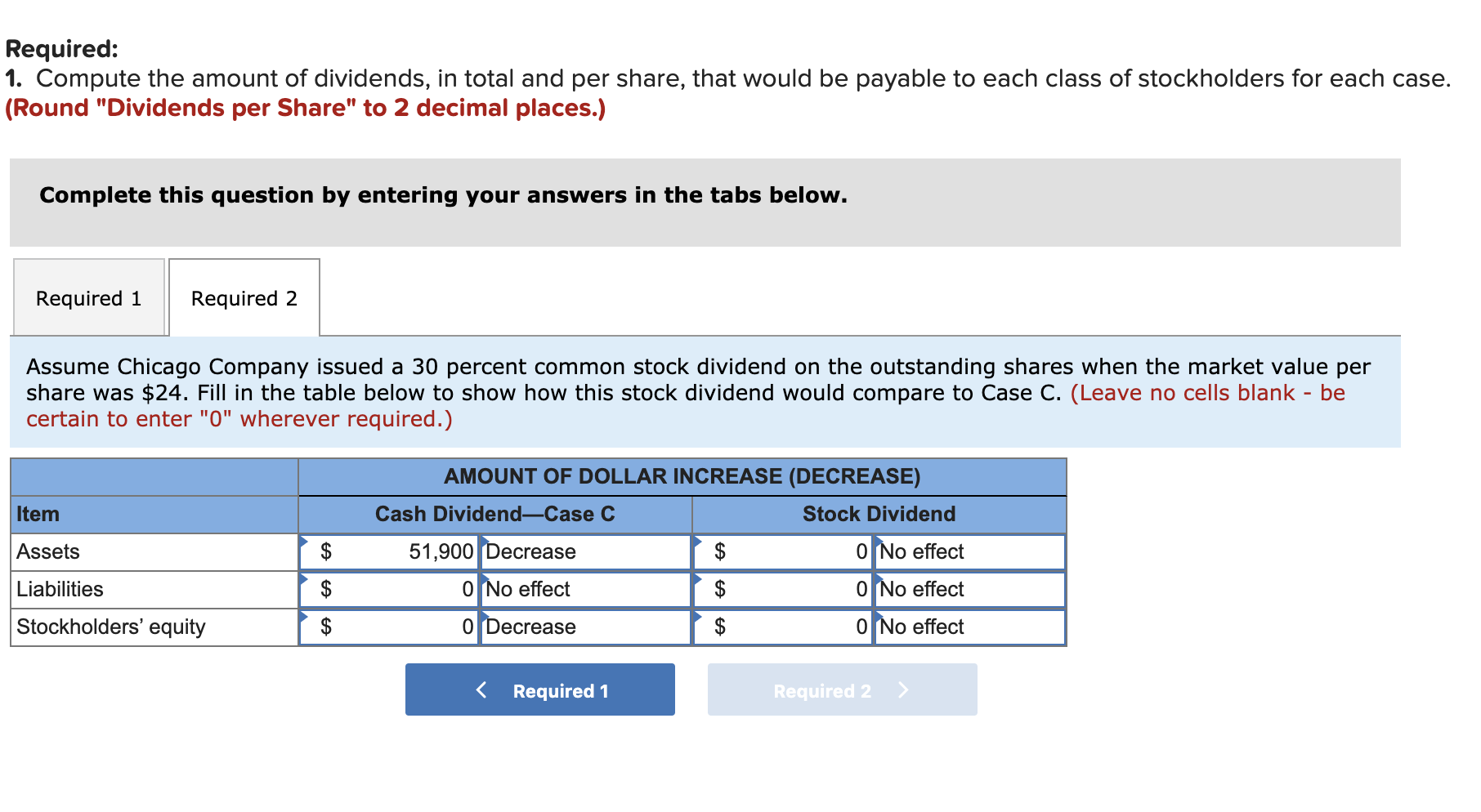

At the beginning of the year, the stockholders' equity section of the balance sheet of Solutions Corporation reflected the following: Common stock ($15 par value; 74,000 shares authorized, 38,000 shares outstanding) Additional paid-in capital Retained earnings $570,000 129,000 747,000 On February 1, the board of directors declared a 65 percent stock dividend to be issued April 30. The market value of the stock on February 1 was $18 per share. The market value of the stock on April 30 was $18 per share. Required: 1. For comparative purposes, prepare the Stockholders' Equity section of the balance sheet immediately before the stock dividend and immediately after the stock dividend. SOLUTIONS CORPORATION Balance Sheet (Partial) At February 1, This Year Stockholders' Equity Before Stock Dividend After Stock Dividend Contributed capital: Common stock 570,000 $ 13,232 Additional paid-in capital 129,000 Retained earnings 747,000 Total stockholders' equity $ 1,446,000 $ 13,232 The records of Hollywood Company reflected the following balances in the stockholders' equity accounts at the end of the current year: Common stock, $11 par value, 46,000 shares outstanding Preferred stock, 11 percent, $9 par value, 5,000 shares outstanding Retained earnings, $228,000 On September 1 of the current year, the board of directors was considering the distribution of an $82,000 cash dividend. No dividends were paid during the previous two years. You have been asked to determine dividend amounts under two independent assumptions (show computations): a. The preferred stock is noncumulative. b. The preferred stock is cumulative. Required: 1. Determine the total and per share amounts that would be paid to the common stockholders and the preferred stockholders under the two independent assumptions. (Round your "per share" amounts to 2 decimal places.) Preferred Common S 550 $ 46,000 Noncumulative: Total Per share Cumulative: Total Per share Chicago Company reported the following information at the end of the current year: Common stock ( $5 par value; 47,000 shares outstanding) Preferred stock, 10% ( $10 par value; 9,400 shares outstanding) Retained earnings $ 235,000 94,000 288,000 The board of directors is considering the distribution of a cash dividend to the two groups of stockholders. No dividends were declared during the previous two years. Assume the three cases below are independent of each other. Case A: The preferred stock is noncumulative; the total amount of all dividends is $38,000. Case B: The preferred stock is cumulative; the total amount of all dividends is $28,200. Case C: The preferred stock is cumulative; the total amount of all dividends is $91,400. Required: 1. Compute the amount of dividends, in total and per share, that would be payable to each class of stockholders for each case. (Round "Dividends per Share" to 2 decimal places.) Required: 1. Compute the amount of dividends, in total and per share, that would be payable to each class of stockholders for each case. (Round "Dividends per Share" to 2 decimal places.) Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume Chicago Company issued a 30 percent common stock dividend on the outstanding shares when the market value per share was $24. Fill in the table below to show how this stock dividend would compare to Case C. (Leave no cells blank - be certain to enter "0" wherever required.) Item Assets AMOUNT OF DOLLAR INCREASE (DECREASE) Cash DividendCase C Stock Dividend 51,900 Decrease $ 0 No effect 0 No effect $ 0 No effect 0Decrease $ 0 No effect | $ $ $ Liabilities Stockholders' equity