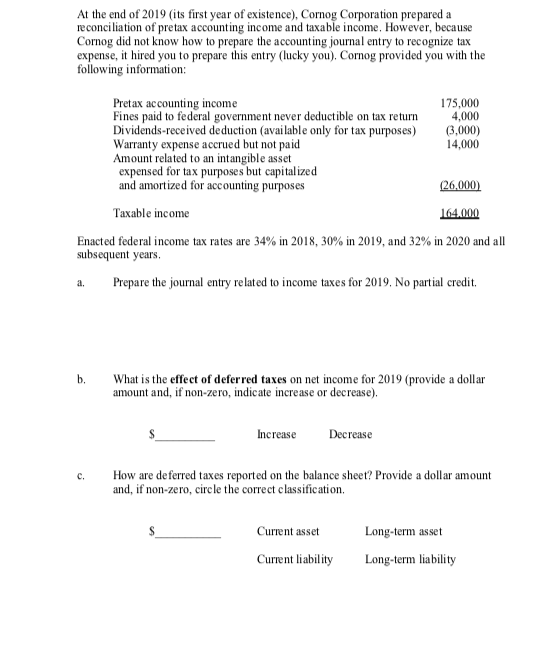

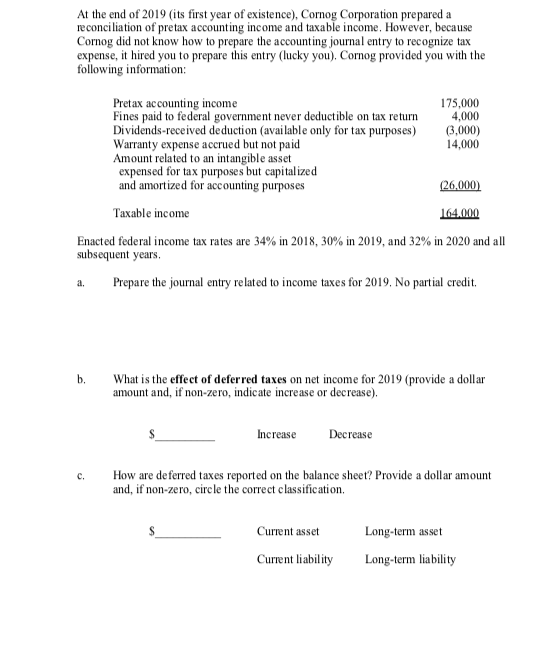

At the end of 2019 (its first year of existence), Comog Corporation prepared a reconciliation of pretax accounting income and taxable income. However, because Comog did not know how to prepare the accounting journal entry to recognize tax expense, it hired you to prepare this entry (lucky you). Comog provided you with the following information: Pretax accounting income Fines paid to federal government never deductible on tax return Dividends-received deduction (available only for tax purposes) Warranty expense accrued but not paid Amount related to an intangible asset expensed for tax purposes but capitalized and amortized for accounting purposes 175,000 4,000 (3.000) 14,000 (26,000) Taxable income 164.000 Enacted federal income tax rates are 34% in 2018, 30% in 2019, and 32% in 2020 and all subsequent years. a. Prepare the journal entry related to income taxes for 2019. No partial credit b. What is the effect of deferred taxes on net income for 2019 (provide a dollar amount and, if non-zero, indicate increase or decrease). Increase Decrease c. How are deferred taxes reported on the balance sheet? Provide a dollar amount and, if non-zero, circle the correct classification. Current asset Long-term asset Current liability Long-term liability At the end of 2019 (its first year of existence), Comog Corporation prepared a reconciliation of pretax accounting income and taxable income. However, because Comog did not know how to prepare the accounting journal entry to recognize tax expense, it hired you to prepare this entry (lucky you). Comog provided you with the following information: Pretax accounting income Fines paid to federal government never deductible on tax return Dividends-received deduction (available only for tax purposes) Warranty expense accrued but not paid Amount related to an intangible asset expensed for tax purposes but capitalized and amortized for accounting purposes 175,000 4,000 (3.000) 14,000 (26,000) Taxable income 164.000 Enacted federal income tax rates are 34% in 2018, 30% in 2019, and 32% in 2020 and all subsequent years. a. Prepare the journal entry related to income taxes for 2019. No partial credit b. What is the effect of deferred taxes on net income for 2019 (provide a dollar amount and, if non-zero, indicate increase or decrease). Increase Decrease c. How are deferred taxes reported on the balance sheet? Provide a dollar amount and, if non-zero, circle the correct classification. Current asset Long-term asset Current liability Long-term liability