Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of October, Laura lamented the company's situation: in the middle of production of Flint-T's most popular long-sleeve T- shirt, the company

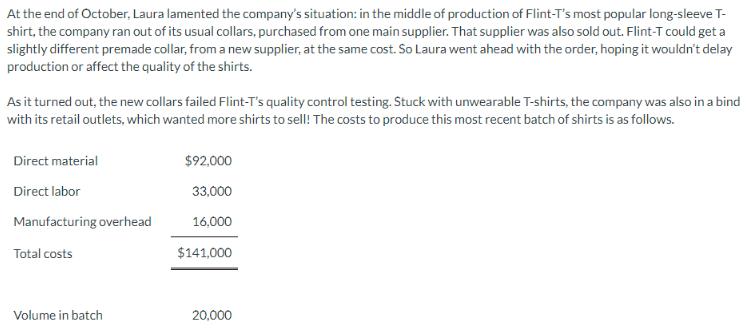

At the end of October, Laura lamented the company's situation: in the middle of production of Flint-T's most popular long-sleeve T- shirt, the company ran out of its usual collars, purchased from one main supplier. That supplier was also sold out. Flint-T could get a slightly different premade collar, from a new supplier, at the same cost. So Laura went ahead with the order, hoping it wouldn't delay production or affect the quality of the shirts. As it turned out, the new collars failed Flint-T's quality control testing. Stuck with unwearable T-shirts, the company was also in a bind with its retail outlets, which wanted more shirts to sell! The costs to produce this most recent batch of shirts is as follows. Direct material Direct labor Manufacturing overhead Total costs Volume in batch $92,000 33,000 16,000 $141,000 20,000 How much cost does Flint-T have tied up in each of these T-shirts? If it normally sells these shirts for $13 to the retailer, how much gross margin per unit does it generate on these sales? (Round answers to 2 decimal places, e.g. 15.25.) Total cost Gross margin LA $ $ /unit /unit

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cost tied up in each Tshirt and the gross margin per unit well use the gi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started