Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Betty couldn't believe it. The small piece of undeveloped property adjacent to her restaurant just went up for sale! She'd been waiting for this

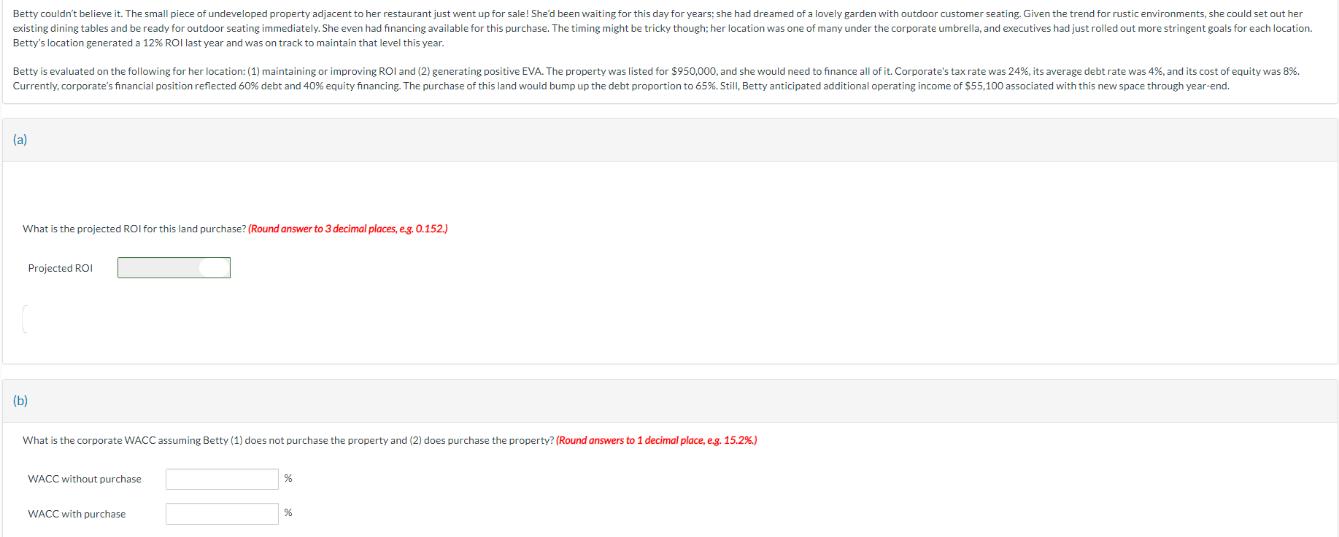

Betty couldn't believe it. The small piece of undeveloped property adjacent to her restaurant just went up for sale! She'd been waiting for this day for years; she had dreamed of a lovely garden with outdoor customer seating. Given the trend for rustic environments, she could set out her existing dining tables and be ready for outdoor seating immediately. She even had financing available for this purchase. The timing might be tricky though: her location was one of many under the corporate umbrella, and executives had just rolled out more stringent goals for each location. Betty's location generated a 12% ROI last year and was on track to maintain that level this year. Betty is evaluated on the following for her location: (1) maintaining or improving ROI and (2) generating positive EVA. The property was listed for $950,000, and she would need to finance all of it. Corporate's tax rate was 24%, its average debt rate was 4%, and its cost of equity was 8%. Currently, corporate's financial position reflected 60% debt and 40% equity financing. The purchase of this land would bump up the debt proportion to 65%. Still, Betty anticipated additional operating income of $55,100 associated with this new space through year-end. (a) What is the projected ROI for this land purchase? (Round answer to 3 decimal places, e.g. 0.152.) (b) Projected ROI What is the corporate WACC assuming Betty (1) does not purchase the property and (2) does purchase the property? (Round answers to 1 decimal place, e.g. 15.2%) WACC without purchase WACC with purchase. %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the projected ROI for the land purchase well use the following formula ROI Net Operat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started