Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the end of the current year, analysts expect BlackBerry's EBIT to be $17.5M and they expect the same earnings annually in perpetuity. The

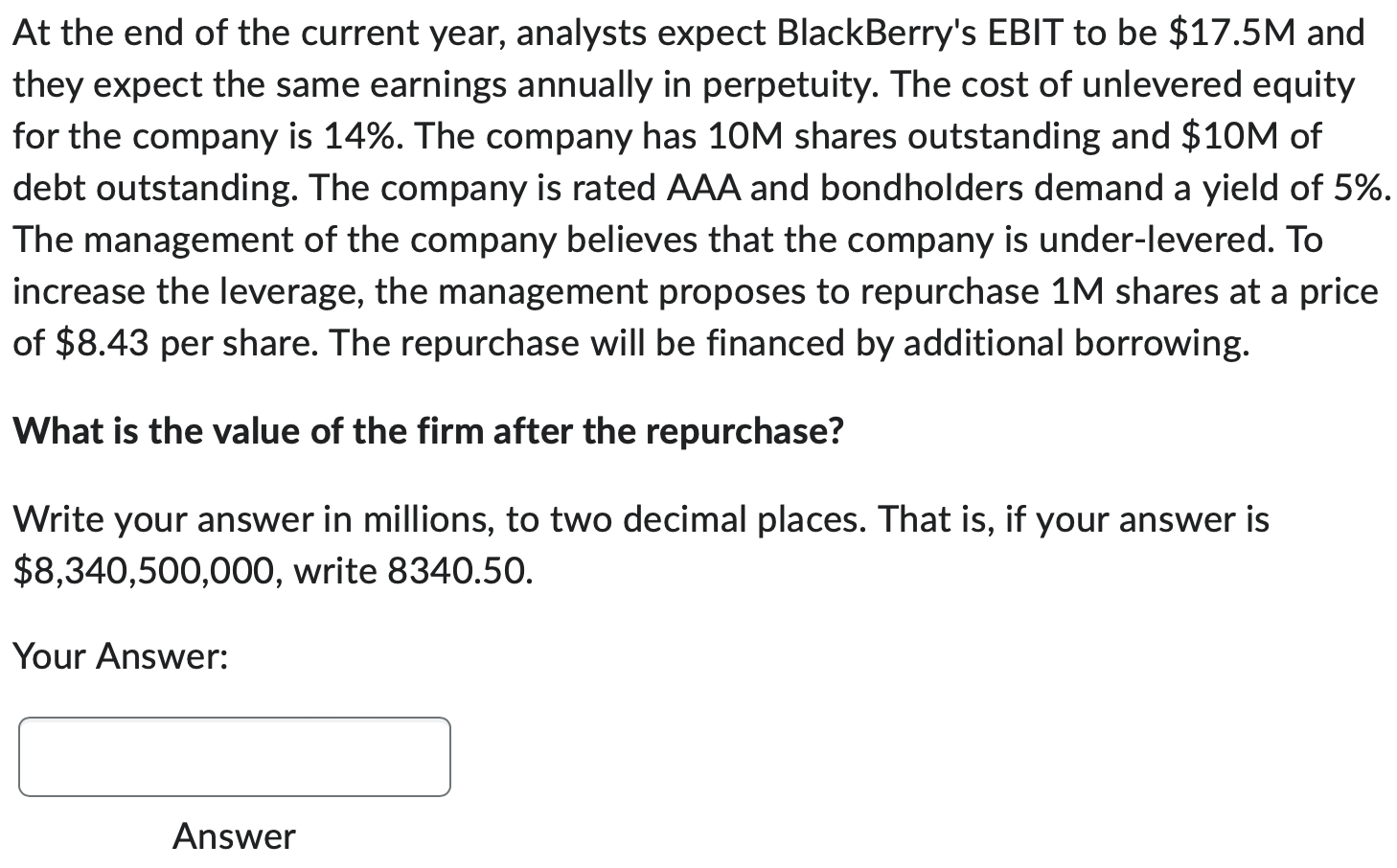

At the end of the current year, analysts expect BlackBerry's EBIT to be $17.5M and they expect the same earnings annually in perpetuity. The cost of unlevered equity for the company is 14%. The company has 10M shares outstanding and $10M of debt outstanding. The company is rated AAA and bondholders demand a yield of 5%. The management of the company believes that the company is under-levered. To increase the leverage, the management proposes to repurchase 1M shares at a price. of $8.43 per share. The repurchase will be financed by additional borrowing. What is the value of the firm after the repurchase? Write your answer in millions, to two decimal places. That is, if your answer is $8,340,500,000, write 8340.50. Your Answer: Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started