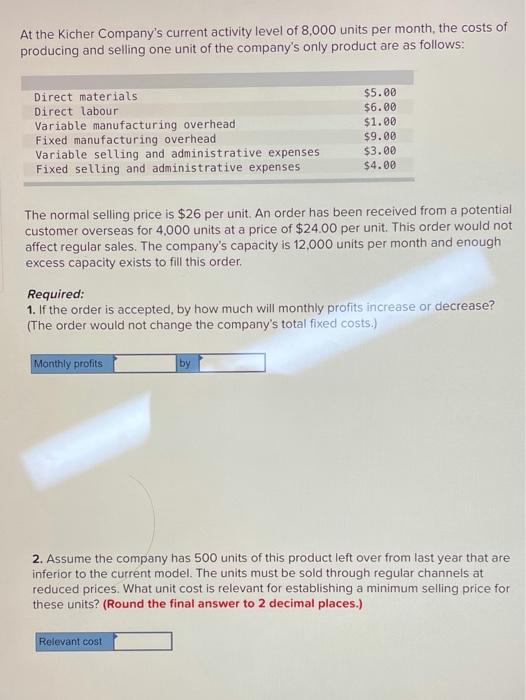

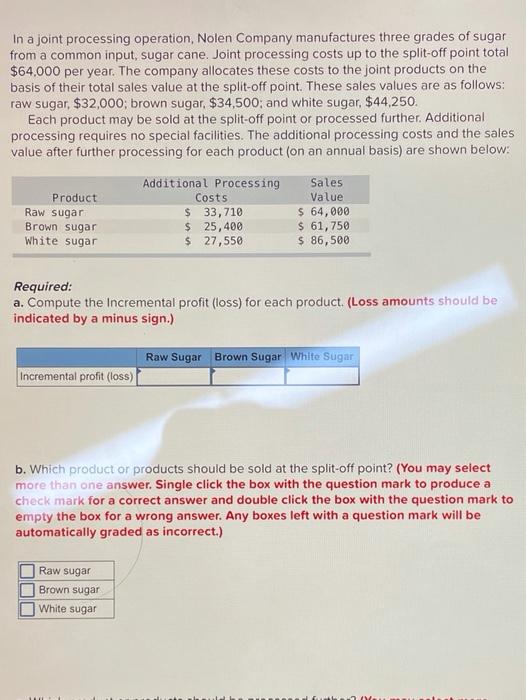

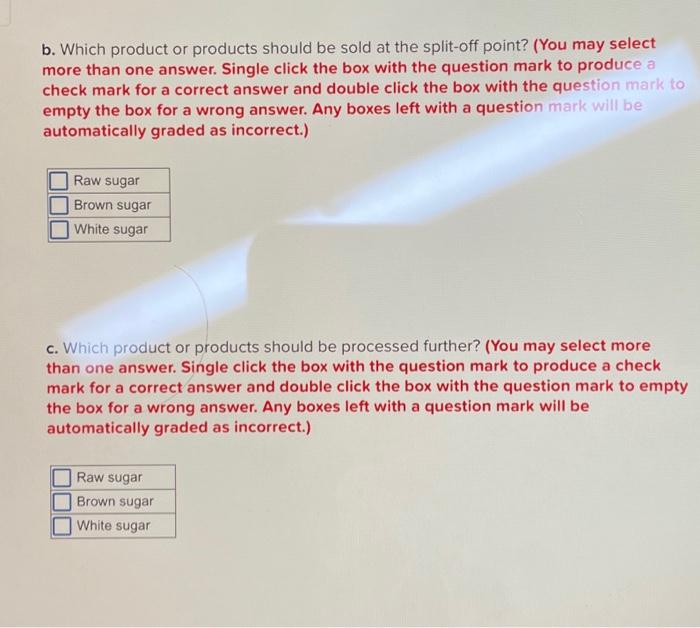

At the Kicher Company's current activity level of 8,000 units per month, the costs of producing and selling one unit of the company's only product are as follows: Direct materials Direct labour Variable manufacturing overhead Fixed manufacturing overhead Variable selling and administrative expenses Fixed selling and administrative expenses $5.00 $6.00 $1.00 $9.00 $3.00 $4.00 The normal selling price is $26 per unit. An order has been received from a potential customer overseas for 4,000 units at a price of $24.00 per unit. This order would not affect regular sales. The company's capacity is 12,000 units per month and enough excess capacity exists to fill this order. Required: 1. If the order is accepted, by how much will monthly profits increase or decrease? (The order would not change the company's total fixed costs.) Monthly profits by 2. Assume the company has 500 units of this product left over from last year that are inferior to the current model. The units must be sold through regular channels at reduced prices. What unit cost is relevant for establishing a minimum selling price for these units? (Round the final answer to 2 decimal places.) Relevant cost In a joint processing operation, Nolen Company manufactures three grades of sugar from a common input, sugar cane. Joint processing costs up to the split-off point total $64.000 per year. The company allocates these costs to the joint products on the basis of their total sales value at the split-off point. These sales values are as follows: raw sugar, $32,000; brown sugar, $34,500; and white sugar, $44.250. Each product may be sold at the split-off point or processed further. Additional processing requires no special facilities. The additional processing costs and the sales value after further processing for each product (on an annual basis) are shown below: Product Raw sugar Brown sugar White sugar Additional Processing Costs $ 33,710 $ 25,400 $ 27,550 Sales Value $ 64,000 $ 61,750 $ 86,500 Required: a. Compute the incremental profit (loss) for each product. (Loss amounts should be indicated by a minus sign.) Raw Sugar Brown Sugar White Sugar Incremental profit (loss) b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Raw sugar Brown sugar White sugar 1. b. Which product or products should be sold at the split-off point? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Raw sugar Brown sugar White sugar c. Which product or products should be processed further? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) Raw sugar Brown sugar White sugar