Answered step by step

Verified Expert Solution

Question

1 Approved Answer

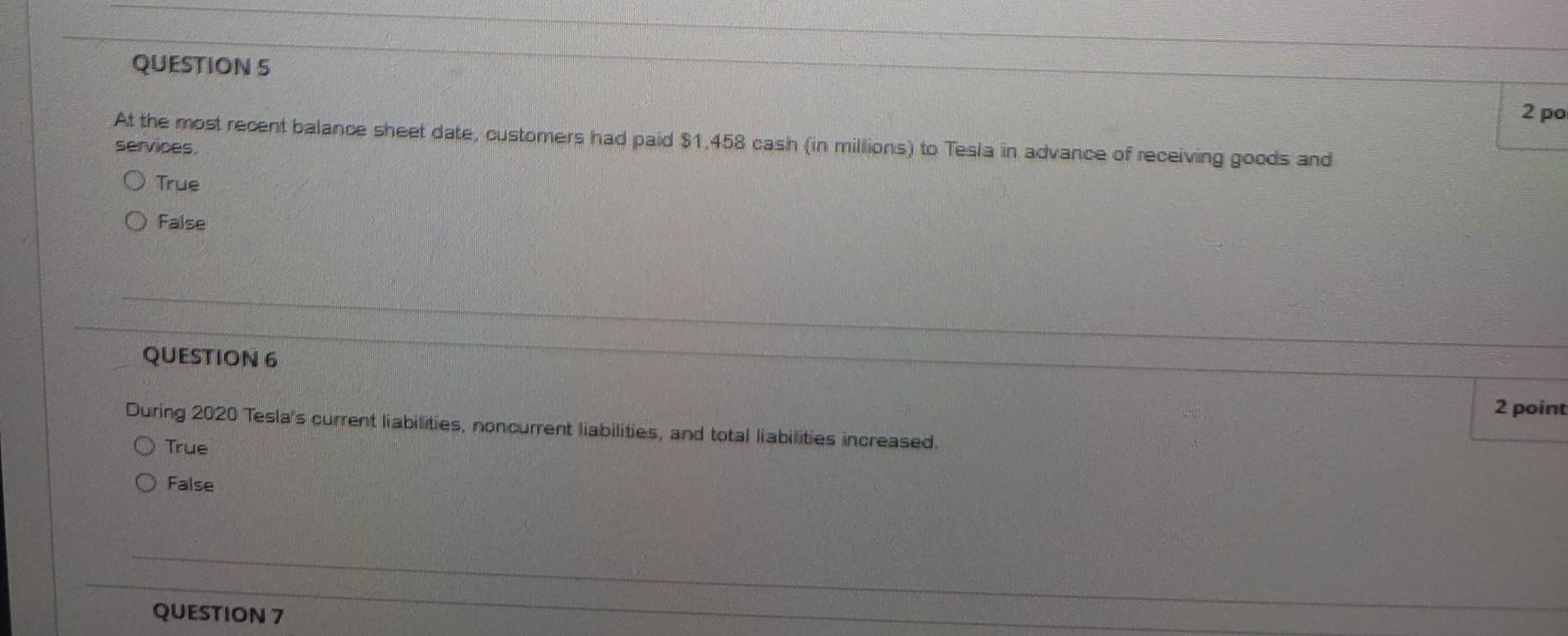

At the most recent balance sheet date, customers had paid $1,458 cash (in milions) to Tesla in advance of receiving goods and Services. True False

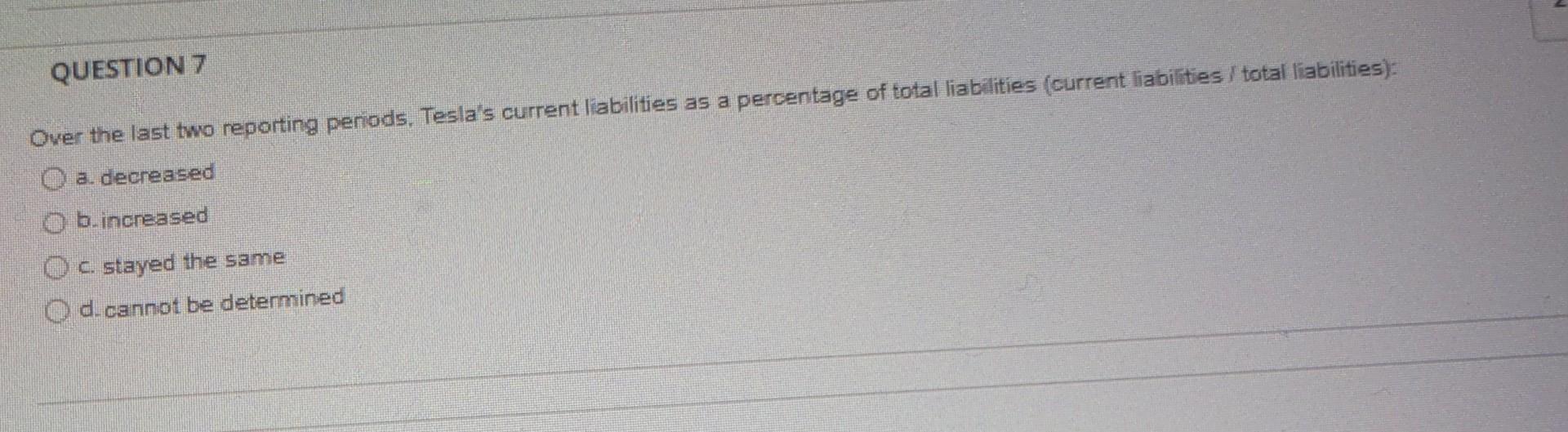

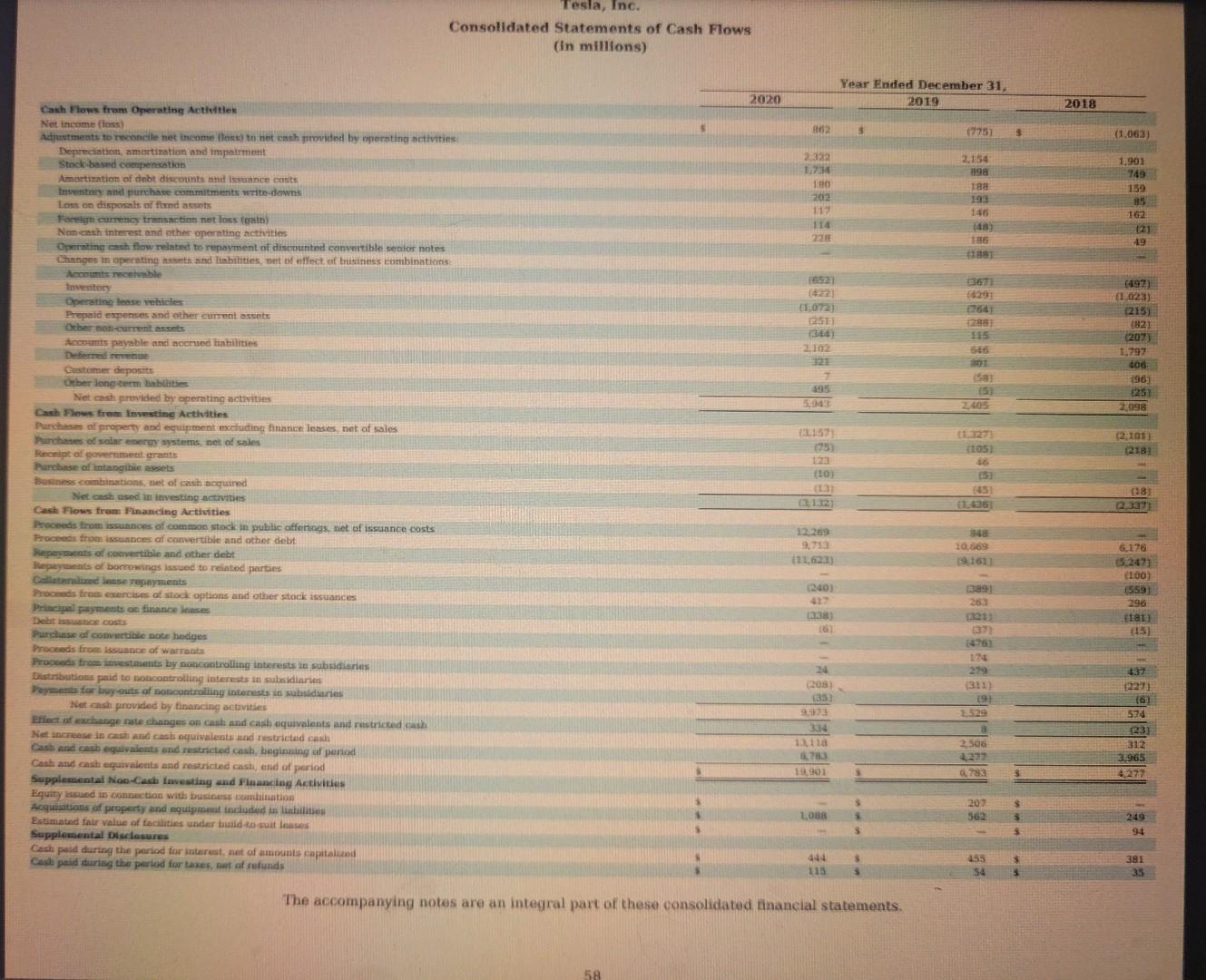

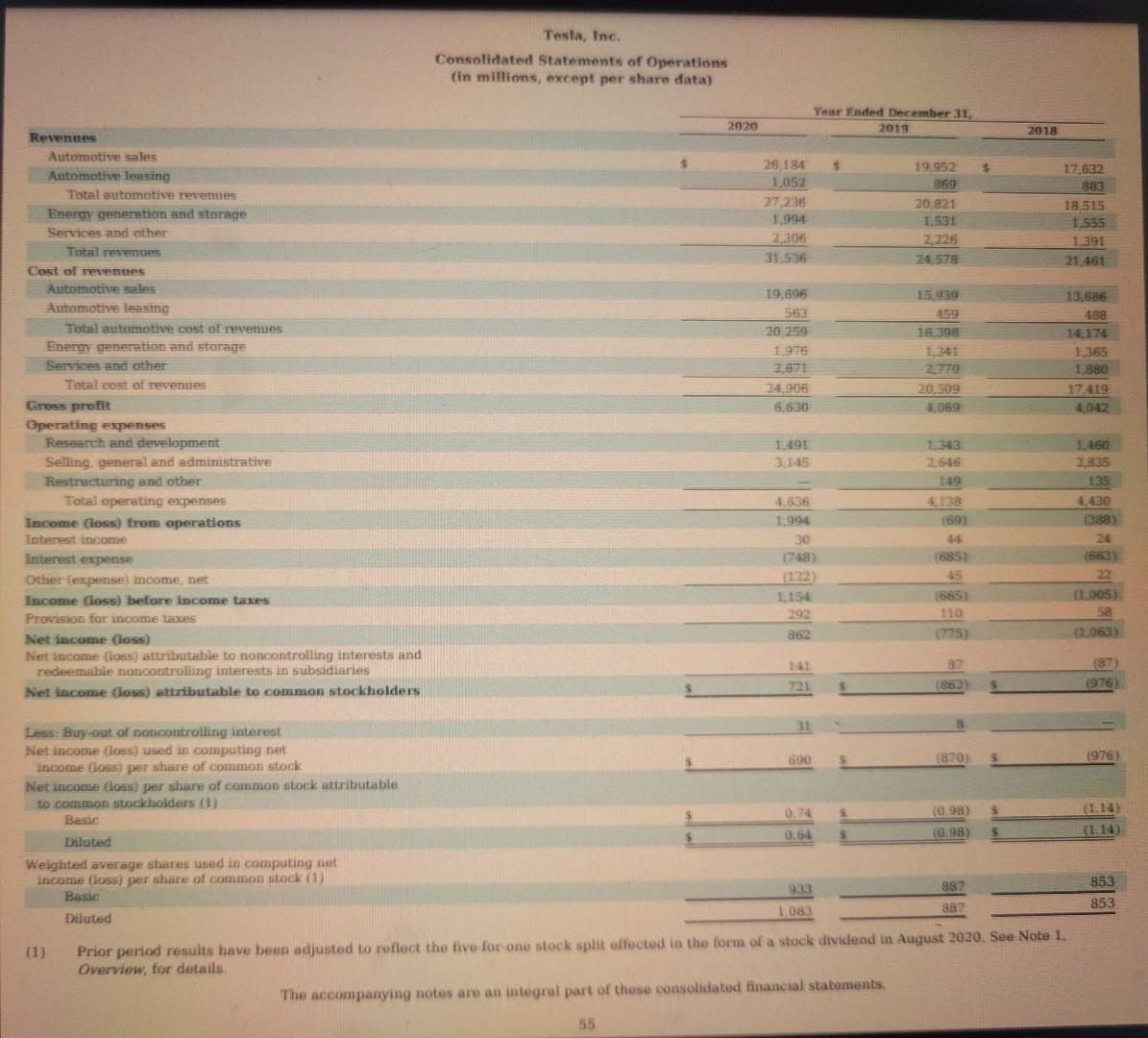

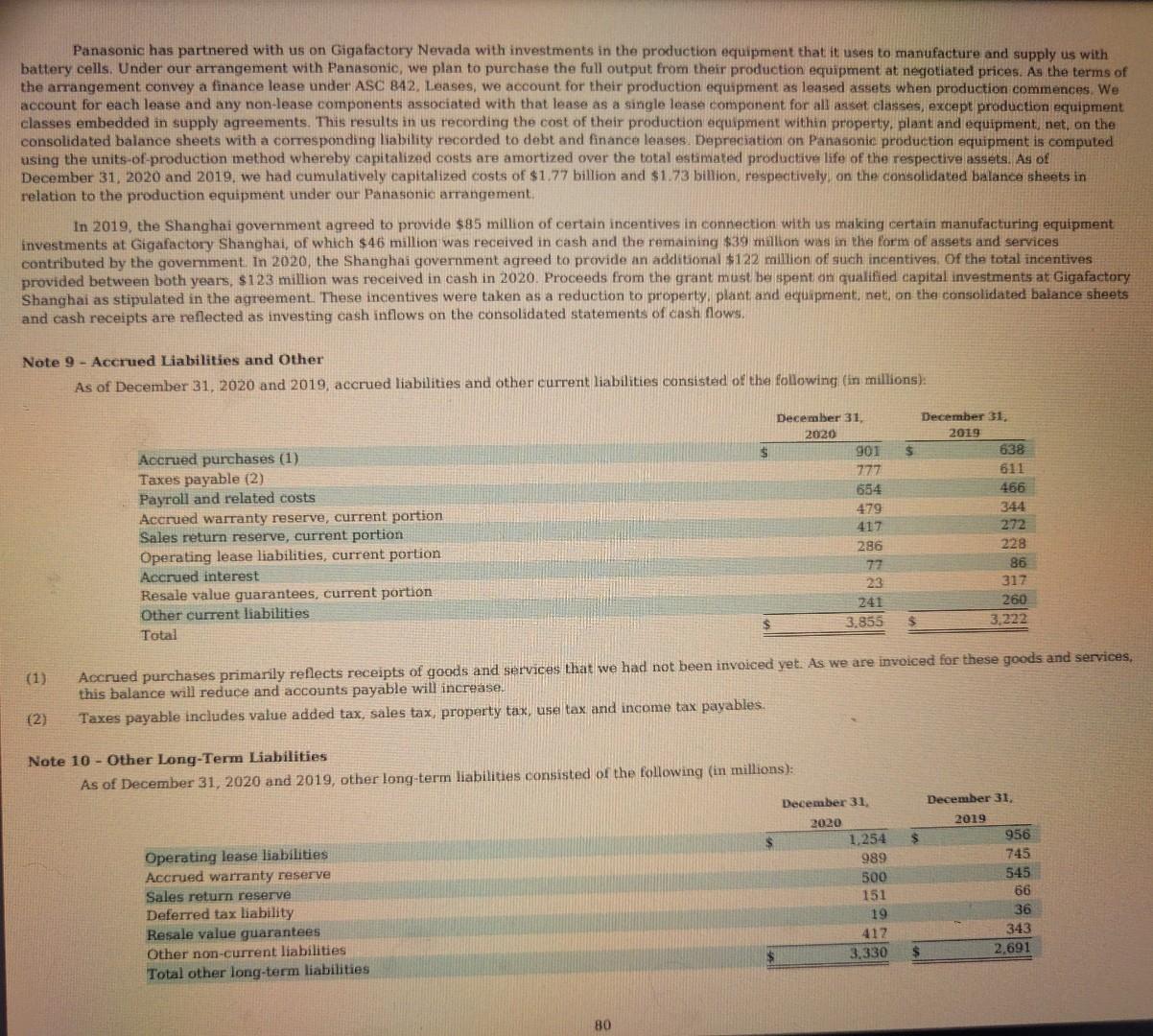

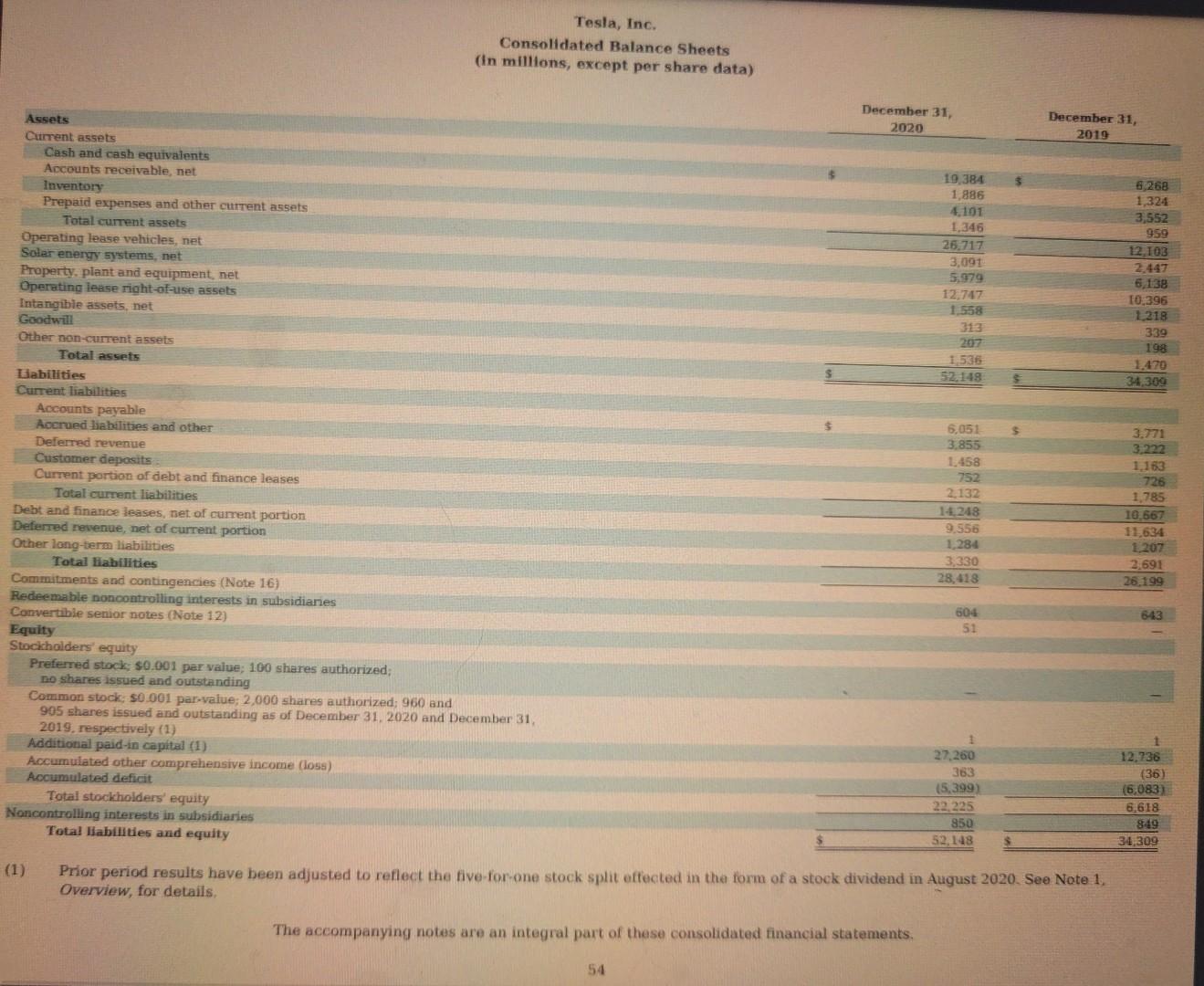

At the most recent balance sheet date, customers had paid $1,458 cash (in milions) to Tesla in advance of receiving goods and Services. True False QUESTION 6 During 2020 Tesla's current liabilities, noncurrent liabilities, and total liabilities increased. True False Ower the last two reporting periods. Tesla's current liabilities as a percentage of total liabilities (current liabilities I total liabilities): a. decreased b. increased c. stayed the same d. cannot be determined Consolidated Statements of Cash Flows Tesla, Inc. Consolidated Statements of Operations Panasonic has partnered with us on Gigafactory Nevada with investments in the production equipment that it uses to manufacture and supply us with battery cells. Under our arrangement with Panasonic, we plan to purchase the full output from their production equipment at negotiated prices. As the terms of the arrangement convey a finance lease under ASC 842, Leases, we account for their production equipment as leased assets when production commences. We account for each lease and any non-lease components associated with that lease as a single lease component for all asset classes, except production equipment classes embedded in supply agreements. This results in us recording the cost of their production equipment within property, plant and equipment, net, an the consolidated balance sheets with a corresponding liability recorded to debt and finance leases. Depreciation on Panasonic production equipment is computed using the units-of-production method whereby capitalized costs are amortized over the total estimated productive life of the respective assets. As of December 31,2020 and 2019 , we had cumulatively capitalized costs of $1.77 billion and $1.73 billion, respectively, on the consolidated balance sheets in relation to the production equipment under our Panasonic arrangement: In 2019, the Shanghai government agreed to provide $85 million of certain incentives in connection with us making certain manufacturing equipment investments at Gigafactory Shanghai, of which $46 million was received in cash and the remaining $39 million was in the form of assets and services contributed by the government. In 2020, the Shanghai government agreed to provide an additional $122 million of such incentives, Of the total incentives provided between both years, $123 million was received in cash in 2020 . Proceeds from the grant must be spent an qualified capital investments at Gigafactory Shanghai as stipulated in the agreement. These incentives were taken as a reduction to property. plant and equipment, net, on the consolidated balance sheets and cash receipts are reflected as investing cash inflows on the consolidated statements of cash flows. Note 9 - Accrued Liabilities and Other As of December 31, 2020 and 2019, accrued liabilities and other current liabilities consisted of the following (in millions): (1) Accrued purchases primarily reflects receipts of goods and services that we had not been invoiced yet. As we are invoiced for these goods and services, this balance will reduce and accounts payable will increase. (2) Taxes payable includes value added tax, sales tax, property tax, use tax and income tax payables. Note 10 - Other Long-Term Liahilities As of December 31, 2020 and 2019 , other long-term liabilities consisted of the following (in millions): Tesla, Inc. Consolidated Balance Sheets (In millions, except per share data) (1) Prior period results have been adjusted to reflect the five-for-one stock split effected in the form of a stock dividend in August 2020 . See Note 1 . Overview, for details. The accompanying notes are an integral part of these consolidated financial statements. 54 Tesha 2020 Annual Report Balance Sheet - PDF page 54. Income Statement - PDF page 55. Statement of Cash Flows - PDF page 58. Accrued Liabilities Note - PDF page 80. Chapters 9 and 10 Financial Statement Notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started