Answered step by step

Verified Expert Solution

Question

1 Approved Answer

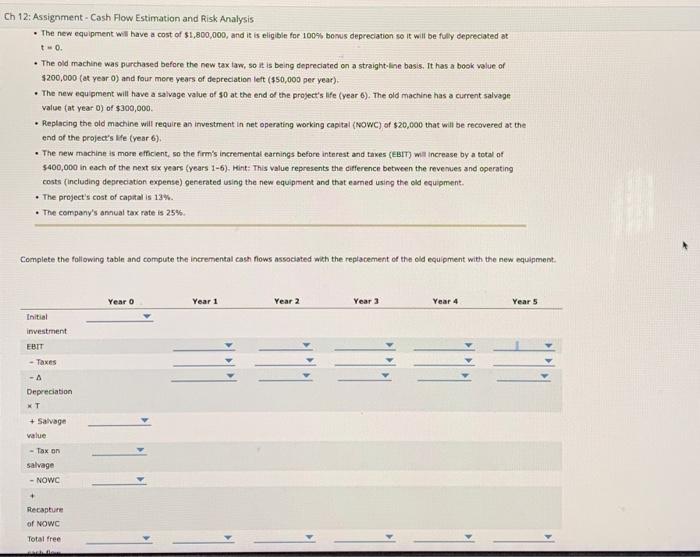

at times firms, we need to decide if they want to continue to use their current equipment replace the equipment with newer equipment. The company

at times firms, we need to decide if they want to continue to use their current equipment replace the equipment with newer equipment. The company will need to do replacement analysis determine which option is the best financial decision for the company.

Low Rosso Co. Is considering replacing an existing piece of equipment. The project involves the following:

the part that is cut off is: Total free cash flow.

Part 2 (pls help)

The net present value (NPV) of the replacement project is:

A) $88,194

B) $76,690

C) $57, 518

D) $92,028

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started