Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At year-end 2019, Wallace Landscaping's total assets were $2.21 million, and its accounts payable were $305,000. Sales, which in 2019 were $2.4 million, are expected

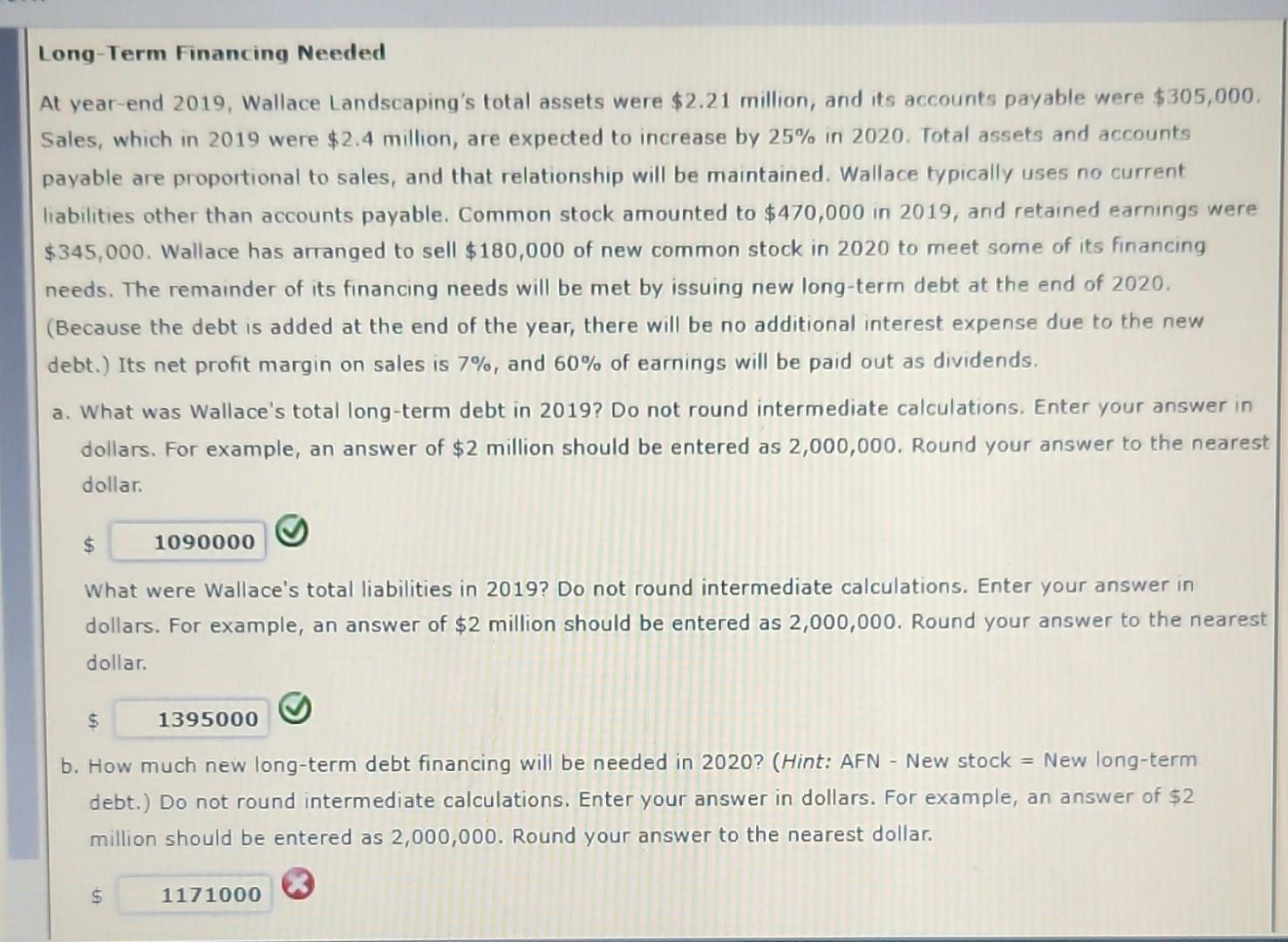

At year-end 2019, Wallace Landscaping's total assets were $2.21 million, and its accounts payable were $305,000. Sales, which in 2019 were $2.4 million, are expected to increase by 25% in 2020 . Total assets and accounts payable are proportional to sales, and that relationship will be maintained. Wallace typically uses no current liabilities other than accounts payable. Common stock amounted to $470,000 in 2019, and retained earnings were $345,000. Wallace has arranged to sell $180,000 of new common stock in 2020 to meet some of its financing needs. The remainder of its financing needs will be met by issuing new long-term debt at the end of 2020 . (Because the debt is added at the end of the year, there will be no additional interest expense due to the new debt.) Its net profit margin on sales is 7%, and 60% of earnings will be paid out as dividends. a. What was Wallace's total long-term debt in 2019? Do not round intermediate calculations. Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollar. $ What were Wallace's total liabilities in 2019? Do not round intermediate calculations. Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollar. b. How much new long-term debt financing will be needed in 2020? (Hint: AFN - New stock = New long-term debt.) Do not round intermediate calculations. Enter your answer in dollars. For example, an answer of $2 million should be entered as 2,000,000. Round your answer to the nearest dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started