Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ATG - 2 0 1 - 0 1 WEEK SIX PRE - CLASS WORK CASE - 3 NOVEMEBER 2 OXX TRANSACTIONS This week we continue

ATG

WEEK SIX PRECLASS WORK

CASE

NOVEMEBER OXX TRANSACTIONS

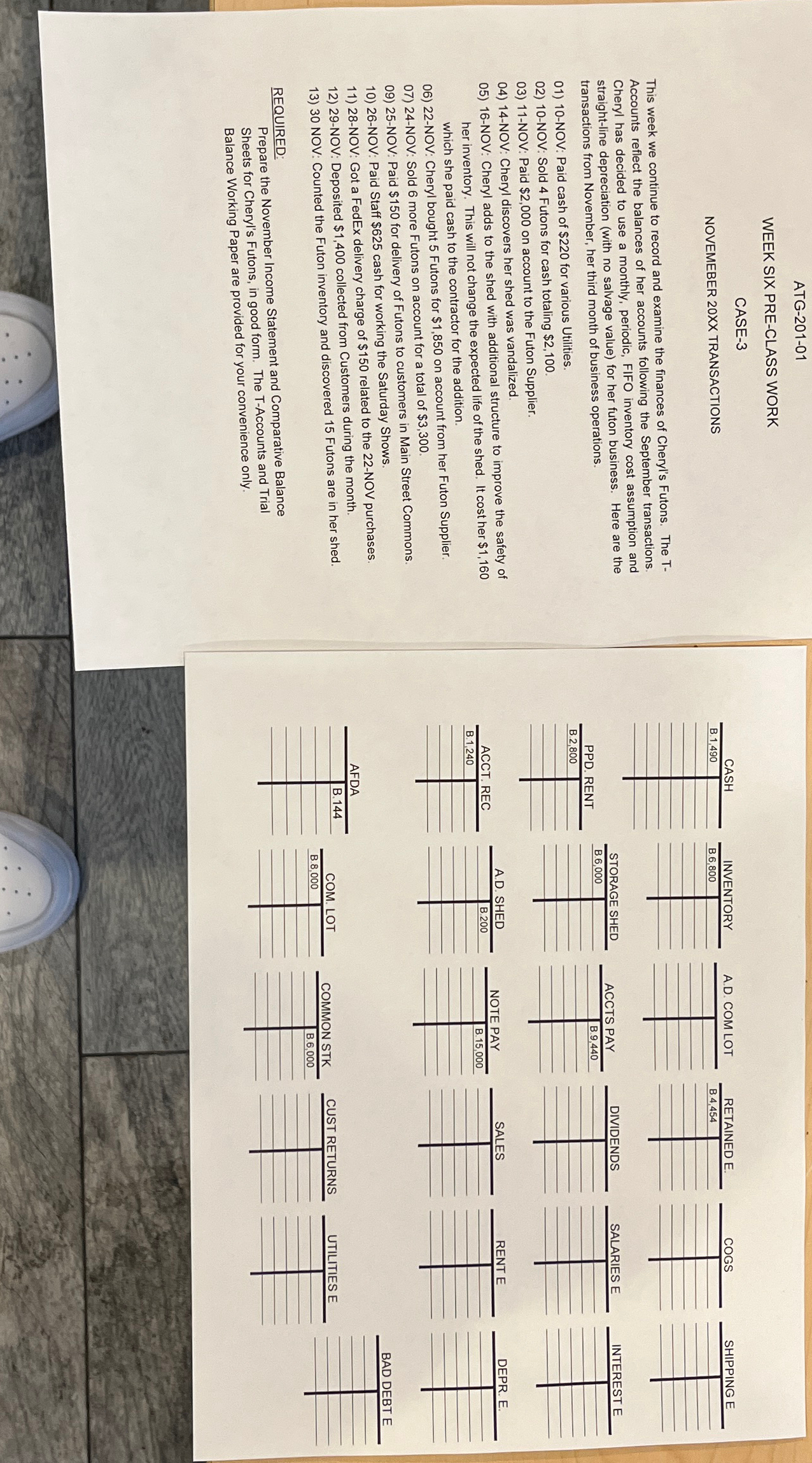

This week we continue to record and examine the finances of Cheryl's Futons. The TAccounts reflect the balances of her accounts following the September transactions. Cheryl has decided to use a monthly, periodic, FIFO inventory cost assumption and straightline depreciation with no salvage value for her futon business. Here are the transactions from November, her third month of business operations.

NOV: Paid cash of $ for various Utilities.

NOV: Sold Futons for cash totaling $

NOV: Paid $ on account to the Futon Supplier.

NOV: Cheryl discovers her shed was vandalized.

NOV: Cheryl adds to the shed with additional structure to improve the safety of her inventory. This will not change the expected life of the shed. It cost her $ which she paid cash to the contractor for the addition.

NOV: Cheryl bought Futons for $ on account from her Futon Supplier.

NOV: Sold more Futons on account for a total of $

NOV: Paid $ for delivery of Futons to customers in Main Street Commons.

NOV: Paid Staff $ cash for working the Saturday Shows.

NOV: Got a FedEx delivery charge of $ related to the NOV purchases.

NOV: Deposited $ collected from Customers during the month.

NOV: Counted the Futon inventory and discovered Futons are in her shed.

REQUIRED:

Prepare the November Income Statement and Comparative Balance Sheets for Cheryl's Futons, in good form. The TAccounts and Trial Balance Working Paper are provided for your convenience only.

tableAFDAB

tableCOM LOTB

UTILITIES E

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started