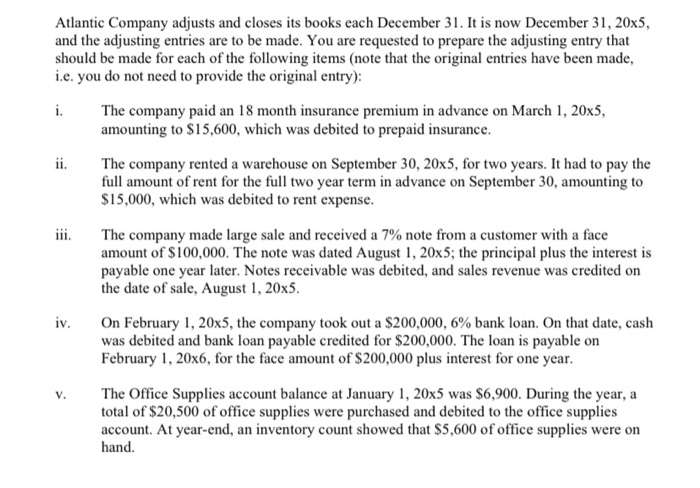

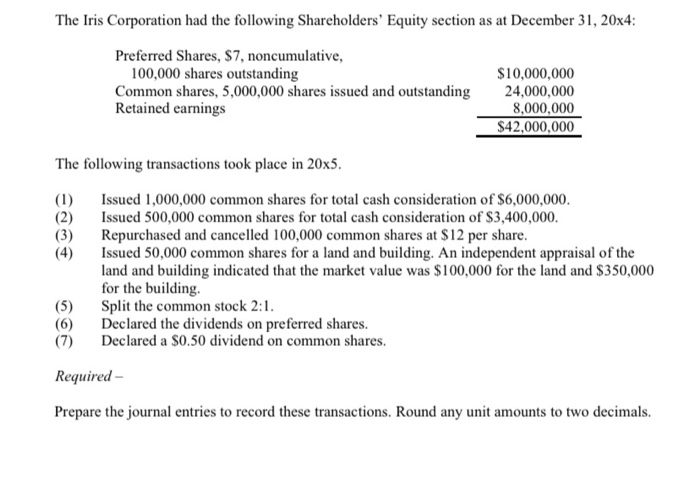

Atlantic Company adjusts and closes its books each December 31. It is now December 31, 20x5, and the adjusting entries are to be made. You are requested to prepare the adjusting entry that should be made for each of the following items (note that the original entries have been made, i.e. you do not need to provide the original entry): i. The company paid an 18 month insurance premium in advance on March 1, 20x5, amounting to $15,600, which was debited to prepaid insurance. The company rented a warehouse on September 30, 20x5, for two years. It had to pay the full amount of rent for the full two year term in advance on September 30, amounting to $15,000, which was debited to rent expense. The company made large sale and received a 7% note from a customer with a face amount of $100,000. The note was dated August 1, 20x5; the principal plus the interest is payable one year later. Notes receivable was debited, and sales revenue was credited on the date of sale, August 1, 20x5. On February 1, 20x5, the company took out a $200,000, 6% bank loan. On that date, cash was debited and bank loan payable credited for $200,000. The loan is payable on February 1, 20x6, for the face amount of $200,000 plus interest for one year. The Office Supplies account balance at January 1, 20x5 was $6,900. During the year, a total of $20,500 of office supplies were purchased and debited to the office supplies account. At year-end, an inventory count showed that $5,600 of office supplies were on hand. The Iris Corporation had the following Shareholders' Equity section as at December 31, 20x4: Preferred Shares, S7, noncumulative, 100,000 shares outstanding Common shares, 5,000,000 shares issued and outstanding Retained earnings $10,000,000 24,000,000 8,000,000 $42,000,000 The following transactions took place in 20x5. (1) Issued 1,000,000 common shares for total cash consideration of $6,000,000 Issued 500,000 common shares for total cash consideration of $3,400,000. Repurchased and cancelled 100,000 common shares at $12 per share. Issued 50,000 common shares for a land and building. An independent appraisal of the land and building indicated that the market value was $100,000 for the land and $350,000 for the building Split the common stock 2:1. Declared the dividends on preferred shares. Declared a $0.50 dividend on common shares. Required - Prepare the journal entries to record these transactions. Round any unit amounts to two decimals