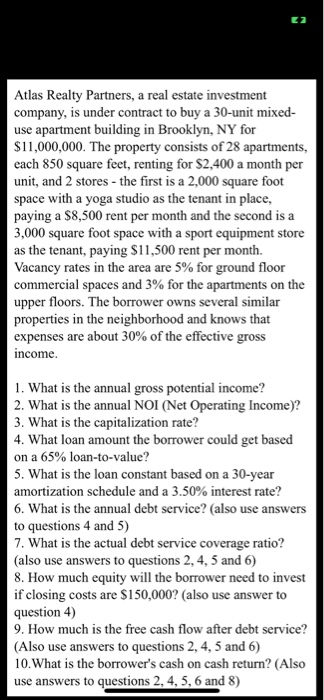

Atlas Realty Partners, a real estate investment company, is under contract to buy a 30-unit mixed- use apartment building in Brooklyn, NY for 1,000,000. The property consists of 28 apartments, each 850 square feet, renting for $2,400 a month per unit, and 2 stores- the first is a 2,000 square foot space with a yoga studio as the tenant in place, paying a $8,500 rent per month and the second is a 3,000 square foot space with a sport equipment store as the tenant, paying S11,500 rent per month. Vacancy rates in the area are 5% for ground floor commercial spaces and 3% for the apartments on the upper floors. The borrower owns several similar properties in the neighborhood and knows that expenses are about 30% of the effective gross ncome 1. What is the annual gross potential income? 2. What is the annual NOI (Net Operating Income)? 3. What is the capitalization rate? 4. What loan amount the borrower could get based on a 65% loan-to-value? 5. What is the loan constant based on a 30-year amortization schedule and a 3.50% interest rate? 6. What is the annual debt service? (also use answers to questions 4 and 5) 7. What is the actual debt service coverage ratio? (also use answers to questions 2, 4, 5 and 6) 8. How much equity will the borrower need to invest if closing costs are $150,000? (also use answer to question 4) 9. How much is the free cash flow after debt service? (Also use answers to questions 2, 4, 5 and 6) 10.What is the borrower's cash on cash return? (Also use answers to questions 2, 4, 5, 6 and 8) Atlas Realty Partners, a real estate investment company, is under contract to buy a 30-unit mixed- use apartment building in Brooklyn, NY for 1,000,000. The property consists of 28 apartments, each 850 square feet, renting for $2,400 a month per unit, and 2 stores- the first is a 2,000 square foot space with a yoga studio as the tenant in place, paying a $8,500 rent per month and the second is a 3,000 square foot space with a sport equipment store as the tenant, paying S11,500 rent per month. Vacancy rates in the area are 5% for ground floor commercial spaces and 3% for the apartments on the upper floors. The borrower owns several similar properties in the neighborhood and knows that expenses are about 30% of the effective gross ncome 1. What is the annual gross potential income? 2. What is the annual NOI (Net Operating Income)? 3. What is the capitalization rate? 4. What loan amount the borrower could get based on a 65% loan-to-value? 5. What is the loan constant based on a 30-year amortization schedule and a 3.50% interest rate? 6. What is the annual debt service? (also use answers to questions 4 and 5) 7. What is the actual debt service coverage ratio? (also use answers to questions 2, 4, 5 and 6) 8. How much equity will the borrower need to invest if closing costs are $150,000? (also use answer to question 4) 9. How much is the free cash flow after debt service? (Also use answers to questions 2, 4, 5 and 6) 10.What is the borrower's cash on cash return? (Also use answers to questions 2, 4, 5, 6 and 8)