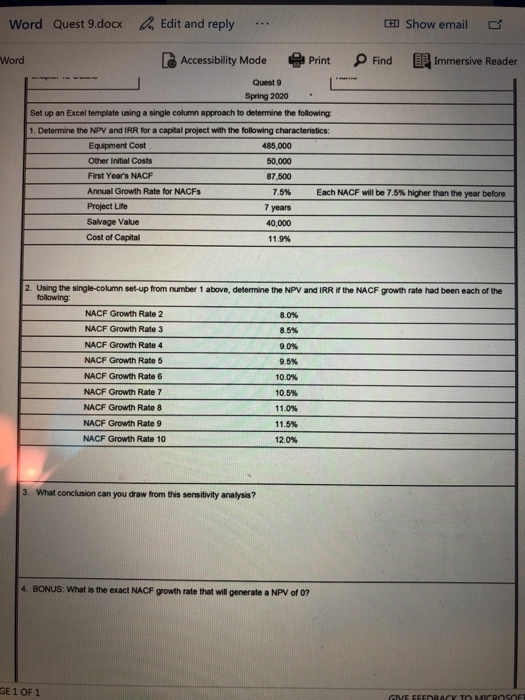

based off of questions 1 and 2 that I have already answered in the spreadsheet, can you please answer 3 and 4 from the very first picture?

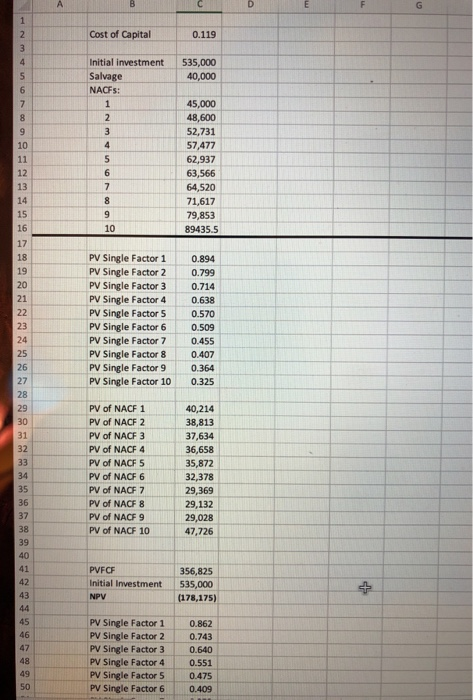

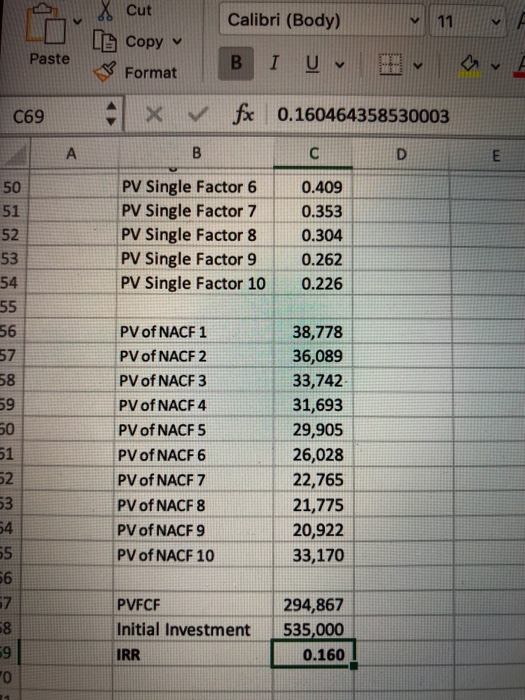

Word Quest 9.docx Edit and reply e Show email Word Find IF Immersive Reader Accessibility Mode Print Quest 9 Spring 2020 . Set up an Excel template using a single column approach to determine the following 1. Determine the NPV and IRR for a capital project with the following characteristics: Equipment Cost 485.000 Other Initial Costs 50.000 First Year's NACF 87,500 Annual Growth Rate for NACF5 7 .5% Ea Project Lite Salvage Value 40.000 Cost of Capital 11.99 before 2. Using the single-column sel-up from number 1 above, determine the NPV and IRR Ir the NACF growth rate had been each of the following NACF Growth Rate 2 8 .0% NACF Growth Rate 3 8.5% NACF Growth Rate 4 0 .0% NACF Growth Rate 5 0.5% NACF Growth Rate 6 1 0.0% NACF Growth Rate 7 1 0.5% NACF Growth Rate 8 11.0% NACF Growth Rate 9 let 11.5% NACF Growth Rate 10 12.0% 3. What conclusion can you draw from this sensitivity analysis? 4. BONUS: What is the exact NACF growth rate that will generate a NPV of O? SE 1 OF 1 C Cost of Capital 0.119 Initial investment Salvage NACFS: 535,000 40,000 45,000 48,600 52,731 57,477 62,937 63,566 64,520 71,617 79,853 89435.5 10 PV Single Factor 1 PV Single Factor 2 PV Single Factor 3 PV Single Factor 4 PV Single Factor 5 PV Single Factor 6 PV Single Factor 7 PV Single Factor 8 PV Single Factor 9 PV Single Factor 10 0.894 0.799 0.714 0.638 0.570 0.509 0.455 0.407 0.364 0.325 PV of NACF 1 PV of NACF 2 PV of NACF 3 PV of NACF 4 PV of NACF 5 PV of NACF 6 PV of NACF 7 PV of NACF 8 PV of NACF 9 PV of NACF 10 40,214 38,813 37,634 36,658 35,872 32,378 29,369 29,132 29,028 47,726 PVFCF Initial Investment NPV 356,825 535,000 (178,175) PV Single Factor 1 PV Single Factor 2 PV Single Factor 3 PV Single Factor 4 PV Single Factor 5 PV Single Factor 6 0.862 0.743 0.640 0.551 0.475 0.409 Calibri (Body) v 11 X Cut LG Copy Format Paste BI U av 069 x fx 0.160464358530003 PV Single Factor 6 PV Single Factor 7 PV Single Factor 8 PV Single Factor 9 PV Single Factor 10 0.409 0.353 0.304 0.262 0.226 OOood By uygu PV of NACF 1 PV of NACF 2 PV of NACF 3 PV of NACF 4 PV of NACF 5 PV of NACF 6 PV of NACF 7 PV of NACF 8 PV of NACF 9 PV of NACF 10 38,778 36,089 33,742 31,693 29,905 26,028 22,765 21,775 20,922 33,170 PVFCF Initial Investment IRR 294,867 535,000 0.160 Word Quest 9.docx Edit and reply e Show email Word Find IF Immersive Reader Accessibility Mode Print Quest 9 Spring 2020 . Set up an Excel template using a single column approach to determine the following 1. Determine the NPV and IRR for a capital project with the following characteristics: Equipment Cost 485.000 Other Initial Costs 50.000 First Year's NACF 87,500 Annual Growth Rate for NACF5 7 .5% Ea Project Lite Salvage Value 40.000 Cost of Capital 11.99 before 2. Using the single-column sel-up from number 1 above, determine the NPV and IRR Ir the NACF growth rate had been each of the following NACF Growth Rate 2 8 .0% NACF Growth Rate 3 8.5% NACF Growth Rate 4 0 .0% NACF Growth Rate 5 0.5% NACF Growth Rate 6 1 0.0% NACF Growth Rate 7 1 0.5% NACF Growth Rate 8 11.0% NACF Growth Rate 9 let 11.5% NACF Growth Rate 10 12.0% 3. What conclusion can you draw from this sensitivity analysis? 4. BONUS: What is the exact NACF growth rate that will generate a NPV of O? SE 1 OF 1 C Cost of Capital 0.119 Initial investment Salvage NACFS: 535,000 40,000 45,000 48,600 52,731 57,477 62,937 63,566 64,520 71,617 79,853 89435.5 10 PV Single Factor 1 PV Single Factor 2 PV Single Factor 3 PV Single Factor 4 PV Single Factor 5 PV Single Factor 6 PV Single Factor 7 PV Single Factor 8 PV Single Factor 9 PV Single Factor 10 0.894 0.799 0.714 0.638 0.570 0.509 0.455 0.407 0.364 0.325 PV of NACF 1 PV of NACF 2 PV of NACF 3 PV of NACF 4 PV of NACF 5 PV of NACF 6 PV of NACF 7 PV of NACF 8 PV of NACF 9 PV of NACF 10 40,214 38,813 37,634 36,658 35,872 32,378 29,369 29,132 29,028 47,726 PVFCF Initial Investment NPV 356,825 535,000 (178,175) PV Single Factor 1 PV Single Factor 2 PV Single Factor 3 PV Single Factor 4 PV Single Factor 5 PV Single Factor 6 0.862 0.743 0.640 0.551 0.475 0.409 Calibri (Body) v 11 X Cut LG Copy Format Paste BI U av 069 x fx 0.160464358530003 PV Single Factor 6 PV Single Factor 7 PV Single Factor 8 PV Single Factor 9 PV Single Factor 10 0.409 0.353 0.304 0.262 0.226 OOood By uygu PV of NACF 1 PV of NACF 2 PV of NACF 3 PV of NACF 4 PV of NACF 5 PV of NACF 6 PV of NACF 7 PV of NACF 8 PV of NACF 9 PV of NACF 10 38,778 36,089 33,742 31,693 29,905 26,028 22,765 21,775 20,922 33,170 PVFCF Initial Investment IRR 294,867 535,000 0.160