AT&T: Provides telecommunication services. AT&T has made major acquisitions of other companies in recent years. Brown Forman: Distills hard liquors, which require aging, and manufactures

- AT&T: Provides telecommunication services. AT&T has made major acquisitions of other companies in recent years.

- Brown Forman: Distills hard liquors, which require aging, and manufactures tonic waters.

- Citibank: Lends money to businesses and consumers, and conducts financial consulting services. Operating expenses for Citibank include compensation expense and estimated losses from uncollectible loans.

- Commonwealth Edison: Generates and sells electricity to businesses and households. Currently operates under regulatory authority that sets electric rates but will transition into more competitive, less regulatory environment in the years ahead.

- Delta: Provides airline transportation services.

- Eli Lilly: Develops, manufactures, and markets prescription drugs.

- Nike: Designs and markets athletic footwear and apparel. Nike outsources the manufacturing to firms in East Asia and outsources the retailing to retail and specialty stores.

- USLife: Provides life insurance services. During the lag between collecting insurance premiums from policyholders and paying out benefits, USLife invests the cash in various financial securities. Operating expenses include the current year's portion of the amount USLife expects ultimately to pay to policyholders.

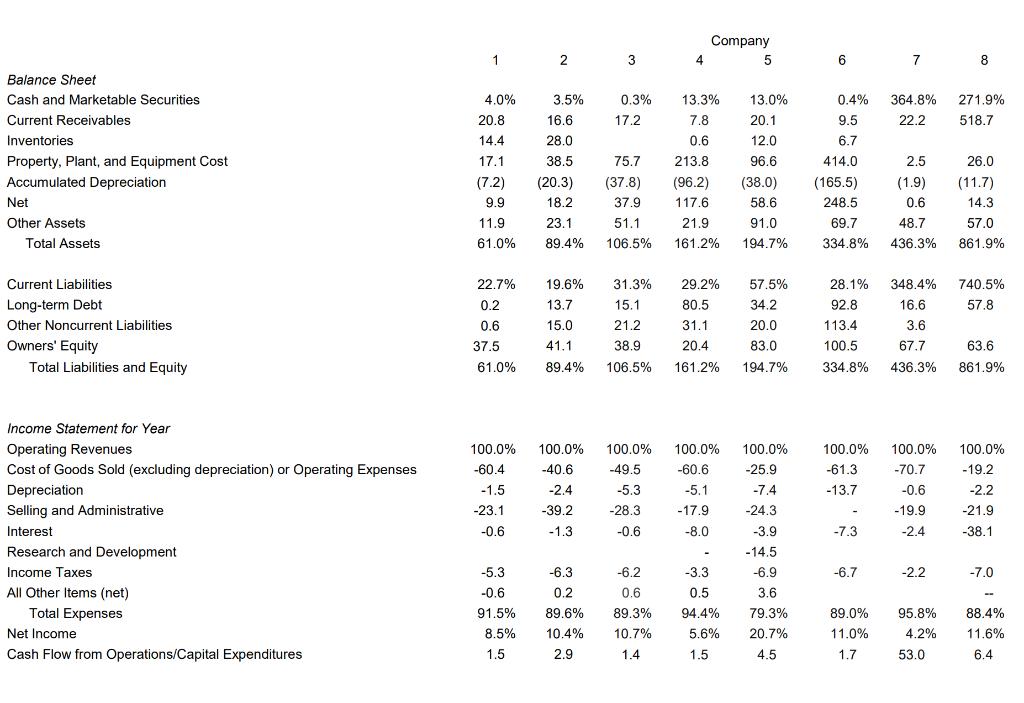

Use whatever clues that you can to match the companies in Exhibit 1.15 with the firms listed above

Identify who company 1, 2, 3, 4, 5, 6, and 7 is

-give reasons why each company is which

Company 1 3 4 5 6. 7 8 Balance Sheet Cash and Marketable Securities 4.0% 3.5% 0.3% 13.3% 13.0% 0.4% 364.8% 271.9% Current Receivables 20.8 16.6 17.2 7.8 20.1 9.5 22.2 518.7 Inventories 14.4 28.0 0.6 12.0 6.7 Property, Plant, and Equipment Cost 17.1 38.5 75.7 213.8 96.6 414.0 2.5 26.0 Accumulated Depreciation (7.2) (20.3) (37.8) (96.2) (38.0) (165.5) (1.9) (11.7) Net 9.9 18.2 37.9 117.6 58.6 248.5 0.6 14.3 Other Assets 11.9 23.1 51.1 21.9 91.0 69.7 48.7 57.0 Total Assets 61.0% 89.4% 106.5% 161.2% 194.7% 334.8% 436.3% 861.9% Current Liabilities 22.7% 19.6% 31.3% 29.2% 57.5% 28.1% 348.4% 740.5% Long-term Debt 0.2 13.7 15.1 80.5 34.2 92.8 16.6 57.8 Other Noncurrent Liabilities 0.6 15.0 21.2 31.1 20.0 113.4 3.6 Owners' Equity Total Liabilities and Equity 37.5 41.1 38.9 20.4 83.0 100.5 67,7 63.6 61.0% 89.4% 106.5% 161.2% 194.7% 334.8% 436.3% 861.9% Income Statement for Year Operating Revenues Cost of Goods Sold (excluding depreciation) or Operating Expenses 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% 100.0% -60.4 -40.6 -49.5 -60.6 -25.9 -61.3 -70.7 -19.2 Depreciation -1.5 -2.4 -5.3 -5.1 -7.4 -13.7 -0.6 -2.2 Selling and Administrative -23.1 -39.2 -28.3 -17.9 -24.3 -19.9 -21.9 Interest -0.6 -1.3 -0.6 -8.0 -3.9 -7.3 -2.4 -38.1 Research and Development - -14,5 Income Taxes -5.3 -6.3 -6.2 -3.3 -6.9 -6.7 -2.2 -7.0 All Other Items (net) -0.6 0.2 0.6 0.5 3.6 Total Expenses 91.5% 89.6% 89.3% 94.4% 79.3% 89.0% 95.8% 88.4% Net Income 8.5% 10.4% 10.7% 5.6% 20.7% 11.0% 4.2% 11.6% Cash Flow from Operations/Capital Expenditures 1.5 2.9 1.4 1.5 4.5 1.7 53.0 6.4

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Brown Forman Higher Inventories due to higher ageing of liqou...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started