Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attached an example question also 1 The following table contains prices and dividends for a stock. Al prices are after the dividend has been paid.

Attached an example question also

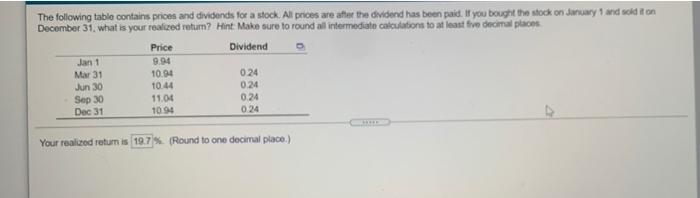

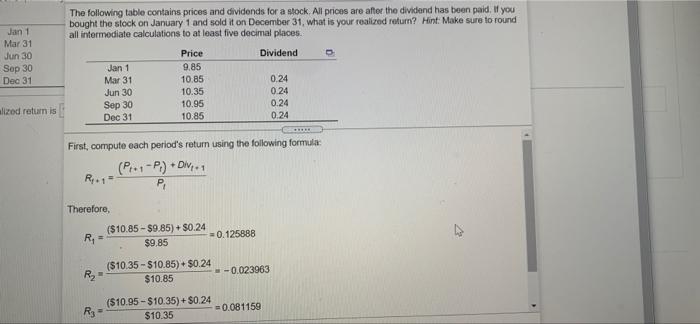

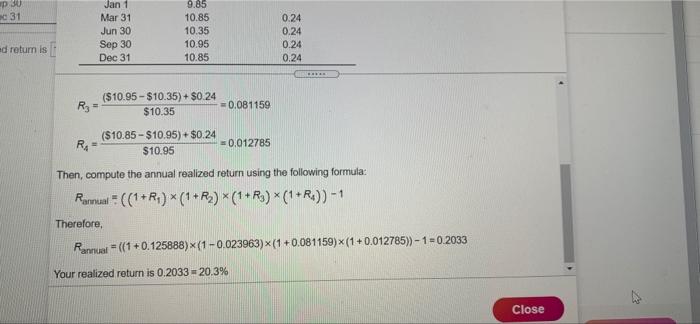

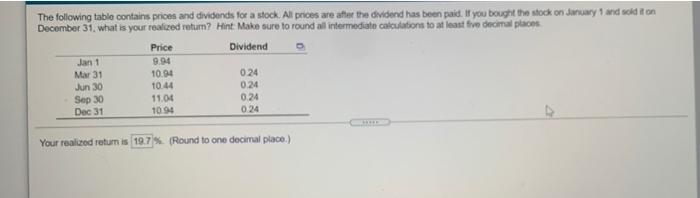

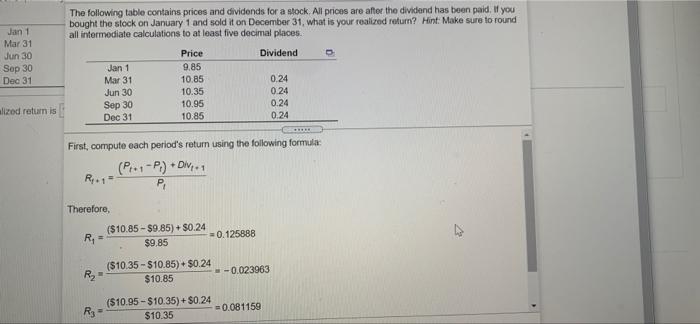

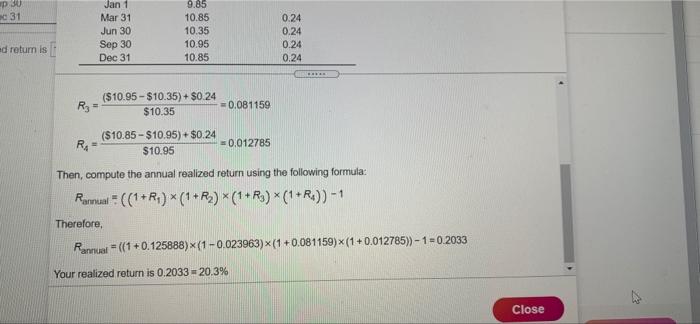

1 The following table contains prices and dividends for a stock. Al prices are after the dividend has been paid. If you bought the stock on January 1 and sold it on December 31, what is your realized return? Hint. Make sure to round all intermediate calculations to at least five decimal places Price Dividend Jan 1 9.94 10.94 024 Jun 30 10.44 0.24 Sep 30 11.04 0.24 Dec 31 10.94 Mar 31 024 Your realized return is 19.7% (Round to one decimal place) The following table contains prices and dividends for a stock. All prices are after the dividend has been paid. If you bought the stock on January 1 and sold it on December 31, what is your realized return? Hint: Make sure to round all intermediate calculations to at least five decimal places. Jan 1 Mar 31 Jun 30 Sop 30 Dec 31 Dividend Jan 1 Mar 31 Jun 30 Sep 30 Dec 31 Price 9.85 10 85 10.35 10.95 10.85 0.24 0.24 0.24 0.24 Aized return is First, compute each period's return using the following formula (Pre-P.) + Div 1 R. 1- P Therefore, ($10.85-$9.85) + $0.24 R, - = 0.125888 $9.85 ($10.35 - $10.85) + $0.24 R- -0.023963 $10.85 ($10.95 - $10.35)+S0.24 Ry - =0.081159 $10.35 30 31 Jan 1 Mar 31 Jun 30 Sep 30 Dec 31 9.85 10.85 10.35 10.95 10.85 0.24 0.24 0.24 0.24 d return is R3 ($10.95 - $10.35)+ $0.24 $10.35 =0.081159 ($10.85-$10.95) + $0.24 Ro- 0.012785 $10.95 Then, compute the annual realized return using the following formula: Rannual = ((1+R) *(1+R2) *(1+R) *(1+R)) - 1 Therefore, Rannust = {(1 +0.125888)*(1 -0.023963) (1 +0.081159) x (1 +0.012785) - 1 = 0.2033 Your realized return is 0.2033 20.3% Close

1 The following table contains prices and dividends for a stock. Al prices are after the dividend has been paid. If you bought the stock on January 1 and sold it on December 31, what is your realized return? Hint. Make sure to round all intermediate calculations to at least five decimal places Price Dividend Jan 1 9.94 10.94 024 Jun 30 10.44 0.24 Sep 30 11.04 0.24 Dec 31 10.94 Mar 31 024 Your realized return is 19.7% (Round to one decimal place) The following table contains prices and dividends for a stock. All prices are after the dividend has been paid. If you bought the stock on January 1 and sold it on December 31, what is your realized return? Hint: Make sure to round all intermediate calculations to at least five decimal places. Jan 1 Mar 31 Jun 30 Sop 30 Dec 31 Dividend Jan 1 Mar 31 Jun 30 Sep 30 Dec 31 Price 9.85 10 85 10.35 10.95 10.85 0.24 0.24 0.24 0.24 Aized return is First, compute each period's return using the following formula (Pre-P.) + Div 1 R. 1- P Therefore, ($10.85-$9.85) + $0.24 R, - = 0.125888 $9.85 ($10.35 - $10.85) + $0.24 R- -0.023963 $10.85 ($10.95 - $10.35)+S0.24 Ry - =0.081159 $10.35 30 31 Jan 1 Mar 31 Jun 30 Sep 30 Dec 31 9.85 10.85 10.35 10.95 10.85 0.24 0.24 0.24 0.24 d return is R3 ($10.95 - $10.35)+ $0.24 $10.35 =0.081159 ($10.85-$10.95) + $0.24 Ro- 0.012785 $10.95 Then, compute the annual realized return using the following formula: Rannual = ((1+R) *(1+R2) *(1+R) *(1+R)) - 1 Therefore, Rannust = {(1 +0.125888)*(1 -0.023963) (1 +0.081159) x (1 +0.012785) - 1 = 0.2033 Your realized return is 0.2033 20.3% Close

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started