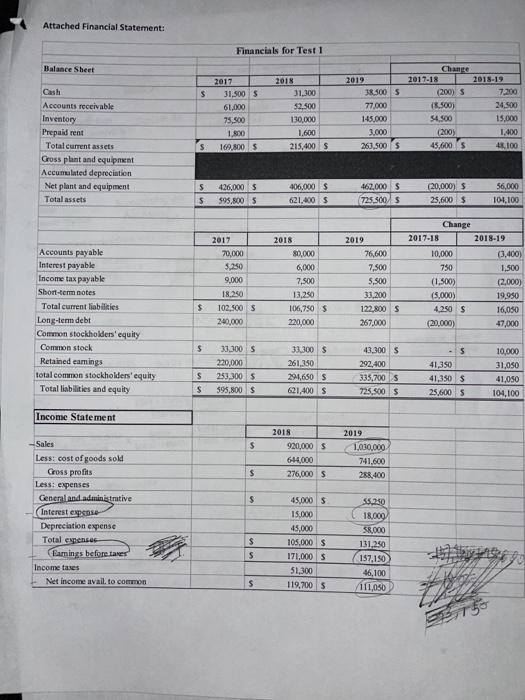

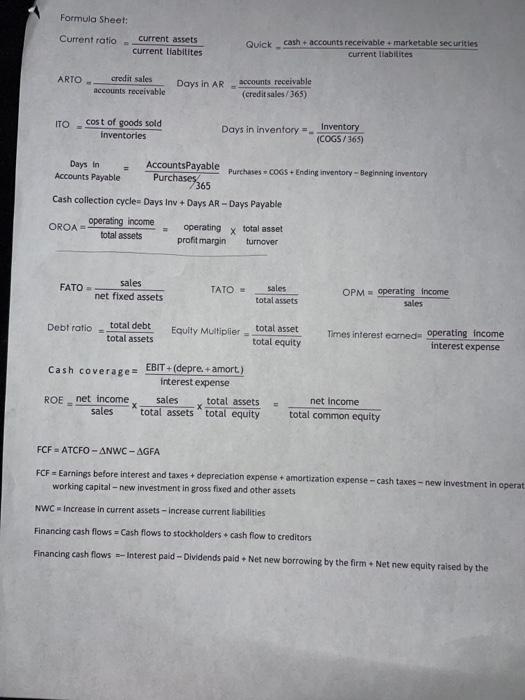

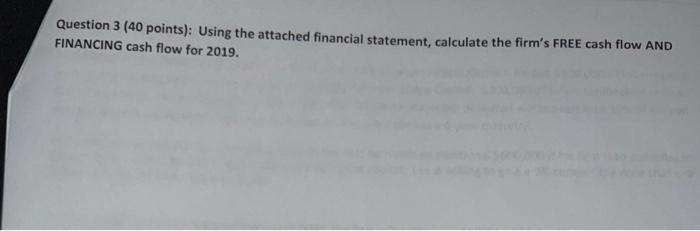

Attached Financial Statement: Financials for Test 1 Balance Sheet $ Cash Accounts receivable Inventory Prepaid rent Total current assets Gross plant and equipment Accumulated depreciation Net plant and equipment Total assets 2017 31,500 $ 61,000 75,500 1.800 169,800 $ 2018 31,300 $2.500 130,000 1.600 215,400 S 2019 38.500 5 77.000 145.000 3.000 263,500 5 2017-18 (200) 5 (8.500) 54.500 (200) 45,600 2018-19 72200 24.500 15,000 1,400 LR100 $ 426,000 $ 595,800 5 406,000 $ 621.400 462,000 $ 725.500 5 (20,000) $ 25,600 56,000 104,100 $ 2017 2018 2019 70,000 5.250 9,000 18.250 102,500 5 240,000 80,000 6,000 7,500 13,250 106,750 $ 220,000 Accounts payable Interest payable Income tax payable Short-term notes Total current liabilities Long-term debt Common stockholders' equity Common stock Retained earings total common stockholders' equity Total liabilities and equity 76,600 7,500 5,500 33,200 122.800 S 267.000 Change 2017-18 10,000 750 (1,500) (5,000) 4,250 $ (20,000) 2018-19 (3,400) 1,500 (2,000) 19,950 $ 16,050 47,000 s 33,300 $ 220,000 253,300 S 595,800 S 33.300 $ 261,350 29-4,650 S 621,400 S 43300 S 292,400 335,700S 725.500 5 $ - 5 41,350 41,350 $ 25,600 10,000 31,050 41.050 104,100 S Income Statement $ 2018 920,000 $ 644,000 276,000 S 2019 1,030,000 741.600 288.400 $ $ Sales Less: cost of goods sold Gross profits Less: expenses General and administrative Interest expose Depreciation expense Total expenses samnings before takes Income taxes Net income avail. to common $ 45,000 $ 15.000 45.000 105,000 171.000 $ 51.300 119,700 5 5259 18,000 58,000 131,250 157,150 46,100 111,050 $ S Formula Sheet: Current ratio current assets current liabitites Quick cash + accounts receivable marketable securities Current liabilites ARTO- credit sales accounts receivable Days in AR accounts receivable (credit sales/365) ITO cost of goods sold Inventories Days in inventory = Inventory (COGS/365) Days in Accounts Payable Purchases COGS +Ending inventory - Beginning inventory Accounts Payable Purchases 7365 Cash collection cycle-Days Inv+Days AR - Days Payable OROA operating income operating X total asset total assets profit margin turnover FATO sales net fixed assets TATO sales total assets OPM operating Income sales Debt ratio total debt total assets Equity Multiplier total asset total equity Times interest eamed operating income interest expense Cash coverage EBIT +(depre.+amort) interest expense sales total assets X total assets total equity ROE net income sales net Income total common equity FCF ATCFO-ANWC - AGFA FCF Earnings before interest and taxes + depreciation expense + amortization expense - cash taxes-new investment in operat working capital-new investment in gross fixed and other assets NWC Increase in current assets - Increase current liabilities Financing cash flows =Cash flows to stockholders .cash flow to creditors Financing cash flows --Interest paid - Dividends paid + Net new borrowing by the firm . Net new equity raised by the Question 3 (40 points): Using the attached financial statement, calculate the firm's FREE cash flow AND FINANCING cash flow for 2019