Question

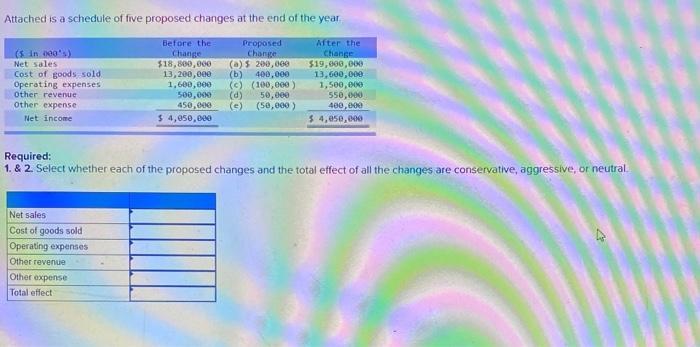

Attached is a schedule of five proposed changes at the end of the year. After the Change ($ in 000's) Net sales Before the

Attached is a schedule of five proposed changes at the end of the year. After the Change ($ in 000's) Net sales Before the Change $18,800,000 13,200,000 (b) Proposed Change (a) $ 200,000 400,000 $19,000,000 Cost of goods sold 13,600,000 Operating expenses 1,600,000 (c) (100,000) 1,500,000 Other revenue 500,000 (d) 50,000 550,000 Other expense 450,000 (e) (50,000) 400,000 Net income $ 4,050,000 $ 4,050,000 Required: 1. & 2. Select whether each of the proposed changes and the total effect of all the changes are conservative, aggressive, or neutral. Net sales Cost of goods sold Operating expenses Other revenue Other expense Total effect

Step by Step Solution

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Net sales Aggressive Cost of goods sold Aggressive Operating e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: J. David Spiceland, Wayne Thomas, Don Herrmann

3rd edition

9780077506902, 78025540, 77506901, 978-0078025549

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App