Question

Attached is the question: (This is everything provided, nothing is missing)(the attatched image has the formula right) Suppose that a person lives for two periods

Attached is the question: (This is everything provided, nothing is missing)(the attatched image has the formula right)

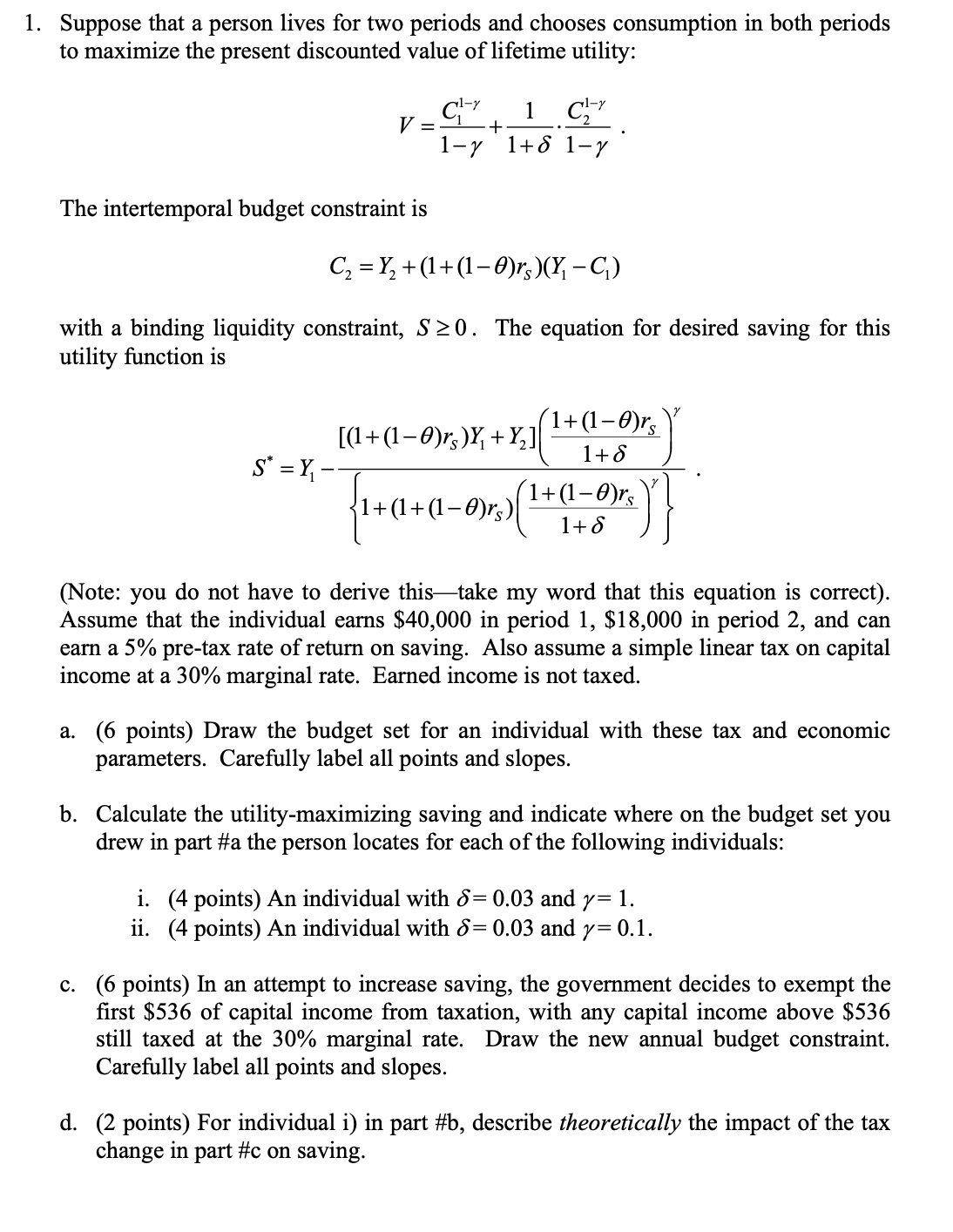

Suppose that a person lives for two periods and chooses consumption in both periods to maximize the present discounted value of lifetime utility:

C=Y+(1+(1??)r)(Y?C)22S11

with a binding liquidity constraint,S?0 . The equation for desired saving for this utility function is

1??1+?1??The intertemporal budget constraint is

C1??1C1??V=1+?2.

[(1+(1??)r)Y+Y]?1+(1??)r??S1 2?1+?S?

*??S=Y?.

1

?S?1+?S??

????1+(1+(1??)r)?1+(1??)r? ?

???? ??

(Note: you do not have to derive this?take my word that this equation is correct). Assume that the individual earns $40,000 in period 1, $18,000 in period 2, and can earn a 5% pre-tax rate of return on saving. Also assume a simple linear tax on capital income at a 30% marginal rate. Earned income is not taxed.

- (6 points) Draw the budget set for an individual with these tax and economic parameters. Carefully label all points and slopes.

- Calculate the utility-maximizing saving and indicate where on the budget set you drew in part #a the person locates for each of the following individuals:

- (4 points) An individual with?= 0.03 and?= 1.

- (4 points) An individual with?= 0.03 and?= 0.1.

- (6 points) In an attempt to increase saving, the government decides to exempt the first $536 of capital income from taxation, with any capital income above $536 still taxed at the 30% marginal rate. Draw the new annual budget constraint. Carefully label all points and slopes.

- (2 points) For individual i) in part #b, describetheoreticallythe impact of the tax change in part #c on saving.

e. (6 points) For each of the individuals in part #b, calculate how the movement to the new tax system in part #c changed theiractualsaving and indicate where on the budget constraint you drew in part #c the person now locates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started