Answered step by step

Verified Expert Solution

Question

1 Approved Answer

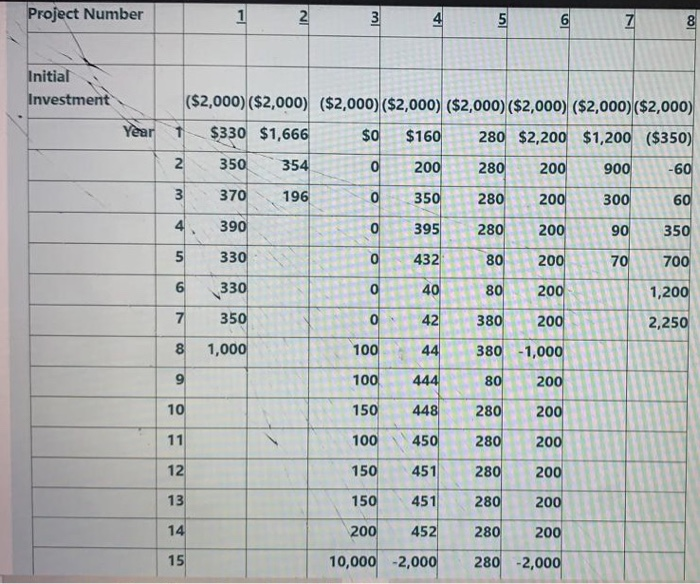

attached is the questuon and the table is related to the question. please show working out. Investment Appraisal The core's capital budgeting and resource allocation

attached is the questuon and the table is related to the question.

please show working out.

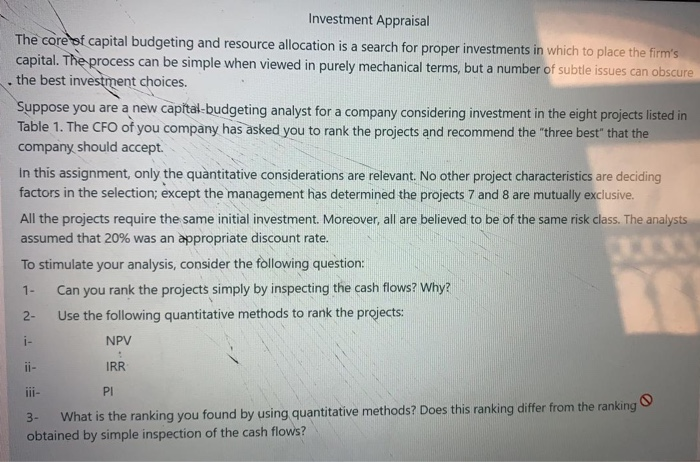

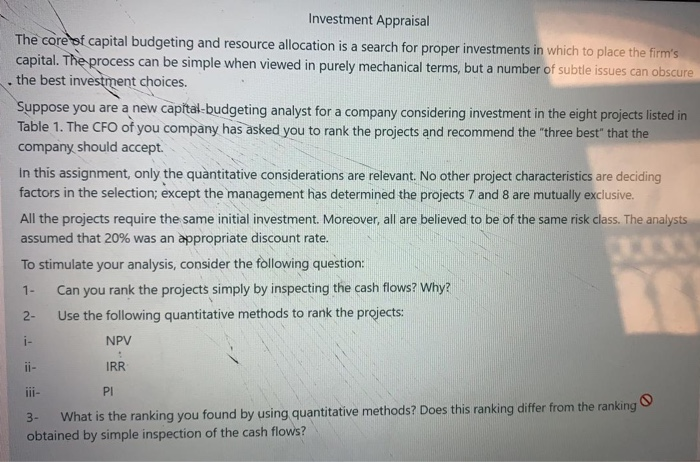

Investment Appraisal The core's capital budgeting and resource allocation is a search for proper investments in which to place the firm's capital. The process can be simple when viewed in purely mechanical terms, but a number of subtle issues can obscure the best investment choices. Suppose you are a new capital-budgeting analyst for a company considering investment in the eight projects listed in Table 1. The CFO of you company has asked you to rank the projects and recommend the "three best" that the company should accept. In this assignment, only the quantitative considerations are relevant. No other project characteristics are deciding factors in the selection, except the management has determined the projects 7 and 8 are mutually exclusive. All the projects require the same initial investment. Moreover, all are believed to be of the same risk class. The analysts assumed that 20% was an appropriate discount rate. To stimulate your analysis, consider the following question: 1 Can you rank the projects simply by inspecting the cash flows? Why? 2- Use the following quantitative methods to rank the projects: NPV IRR PI 3. What is the ranking you found by using quantitative methods? Does this ranking differ from the ranking obtained by simple inspection of the cash flows? Project Number Initial Investment Year ($2,000) ($2,000) ($2,000) ($2,000) ($2,000) ($2,000) ($2,000) ($2,000) 1 $330 $1,666 $0 $160 280 $2,200 $1,200 ($350) 2 350 354 200 280 200 900 -60 350 280 200 300 60 280 200 90 350 20070 700 330 1,200 2,250 8 1,000 CO NN O CO m mm O NON CO O O CO I TOTOOOOOO O O O 350 O CO mm O CO NNNNNNNNN oooooo m CO 150 N O CO 450 N CO O in N CO O m N CO N CO 200 10,000 -2,000 280 -2,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started