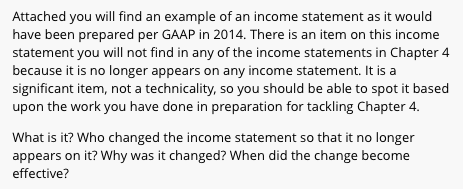

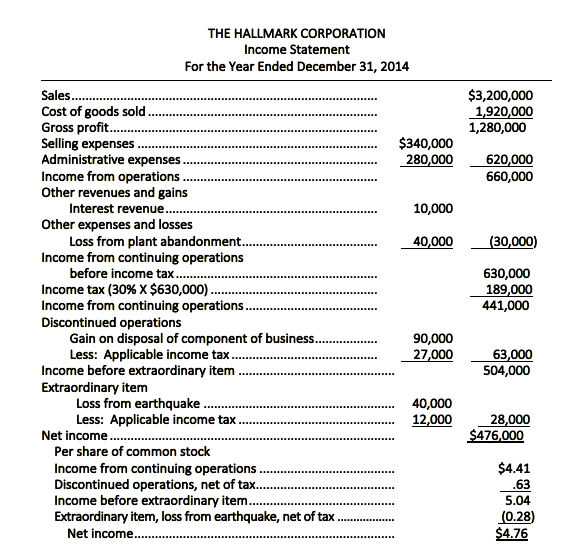

Attached you will find an example of an income statement as it would have been prepared per GAAP in 2014. There is an item on this income statement you will not find in any of the income statements in Chapter 4 because it is no longer appears on any income statement. It is a significant item, not a technicality, so you should be able to spot it based upon the work you have done in preparation for tackling Chapter 4. What is it? Who changed the income statement so that it no longer appears on it? Why was it changed? When did the change become effective? THE HALLMARK CORPORATION Income Statement For the Year Ended December 31, 2014 $3,200,000 1,920,000 1,280,000 $340,000 280,000 620,000 660,000 10,000 40,000 (30,000) Sales Cost of goods sold Gross profit.... Selling expenses Administrative expenses Income from operations Other revenues and gains Interest revenue.. Other expenses and losses Loss from plant abandonment. Income from continuing operations before income tax.. Income tax (30% X $630,000).. Income from continuing operations. Discontinued operations Gain on disposal of component of business. Less: Applicable income tax... Income before extraordinary item Extraordinary item Loss from earthquake. Less: Applicable income tax Net income....... Per share of common stock Income from continuing operations Discontinued operations, net of tax... Income before extraordinary item.. Extraordinary item, loss from earthquake, net of tax. Net income..... 630,000 189,000 441,000 90,000 27,000 63,000 504,000 40,000 12,000 28,000 $476,000 $4.41 .63 5.04 (0.28) $4.76 Attached you will find an example of an income statement as it would have been prepared per GAAP in 2014. There is an item on this income statement you will not find in any of the income statements in Chapter 4 because it is no longer appears on any income statement. It is a significant item, not a technicality, so you should be able to spot it based upon the work you have done in preparation for tackling Chapter 4. What is it? Who changed the income statement so that it no longer appears on it? Why was it changed? When did the change become effective? THE HALLMARK CORPORATION Income Statement For the Year Ended December 31, 2014 $3,200,000 1,920,000 1,280,000 $340,000 280,000 620,000 660,000 10,000 40,000 (30,000) Sales Cost of goods sold Gross profit.... Selling expenses Administrative expenses Income from operations Other revenues and gains Interest revenue.. Other expenses and losses Loss from plant abandonment. Income from continuing operations before income tax.. Income tax (30% X $630,000).. Income from continuing operations. Discontinued operations Gain on disposal of component of business. Less: Applicable income tax... Income before extraordinary item Extraordinary item Loss from earthquake. Less: Applicable income tax Net income....... Per share of common stock Income from continuing operations Discontinued operations, net of tax... Income before extraordinary item.. Extraordinary item, loss from earthquake, net of tax. Net income..... 630,000 189,000 441,000 90,000 27,000 63,000 504,000 40,000 12,000 28,000 $476,000 $4.41 .63 5.04 (0.28) $4.76