Answered step by step

Verified Expert Solution

Question

1 Approved Answer

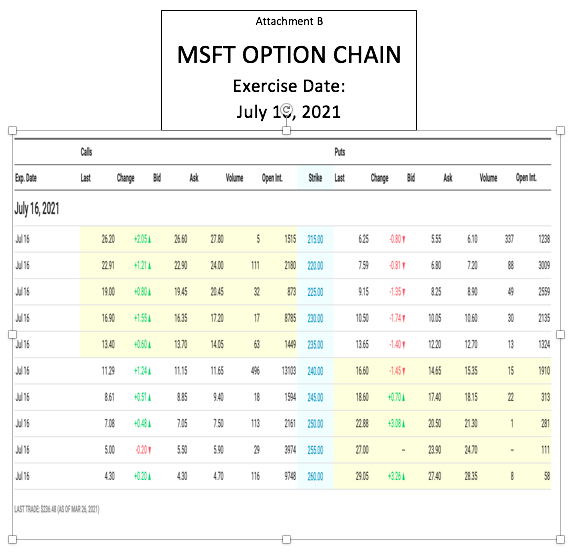

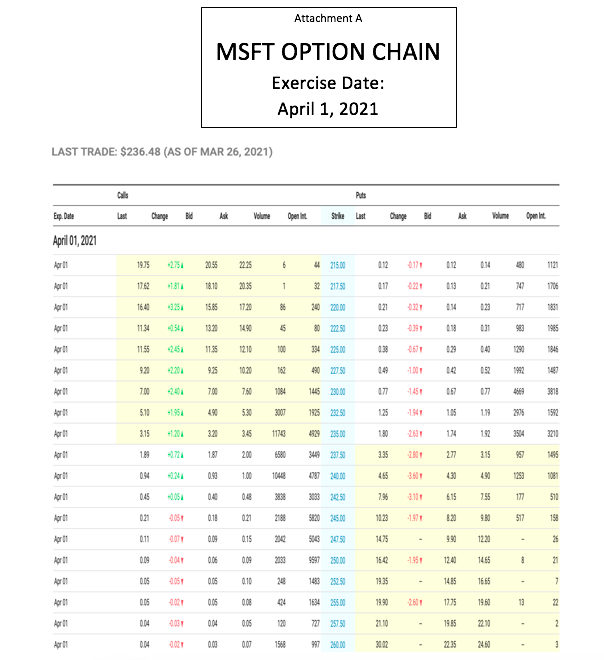

Attachments A and B to this problem set are copies of the Option Chain for Microsoft Inc. (NYSE:MSFT) as of Friday, March 26. An option

- Attachments A and B to this problem set are copies of the Option Chain for Microsoft Inc. (NYSE:MSFT) as of Friday, March 26. An option chain shows pricing quotes for options expiring on a particular date for a particular stock. (Options are usually bought or sold based on lots of 100 shares but quoted on a per share basis. For purposes of this question, assume that all transactions are on a per share basis.) Attachment A shows American MSFT options expiring April 1, 2021, and Attachment B shows American MSFT options expiring July 16, 2021. Answer the following questions based on your review of these attachments (noting that the Closing Price for MSFT on March 26 was $236.48 per share):

a. If on March 26 you bought a July 16 MSFT 240 call option at the last trade price, and MSFT closes at $230 on July 16, where would you stand? What if MSFT closes at $260 on May 15? b. Compare the last trade prices of an April 1 and July 16 250 put option. What explains the difference? c. If you bought one share of MSFT on March 26 at its closing price and also bought one July 16 240 put option, whats your position on July 16 if MSFT closes at $220 that day? What if closes at $235? At $260?

a. If on March 26 you bought a July 16 MSFT 240 call option at the last trade price, and MSFT closes at $230 on July 16, where would you stand? What if MSFT closes at $260 on May 15? b. Compare the last trade prices of an April 1 and July 16 250 put option. What explains the difference? c. If you bought one share of MSFT on March 26 at its closing price and also bought one July 16 240 put option, whats your position on July 16 if MSFT closes at $220 that day? What if closes at $235? At $260?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started