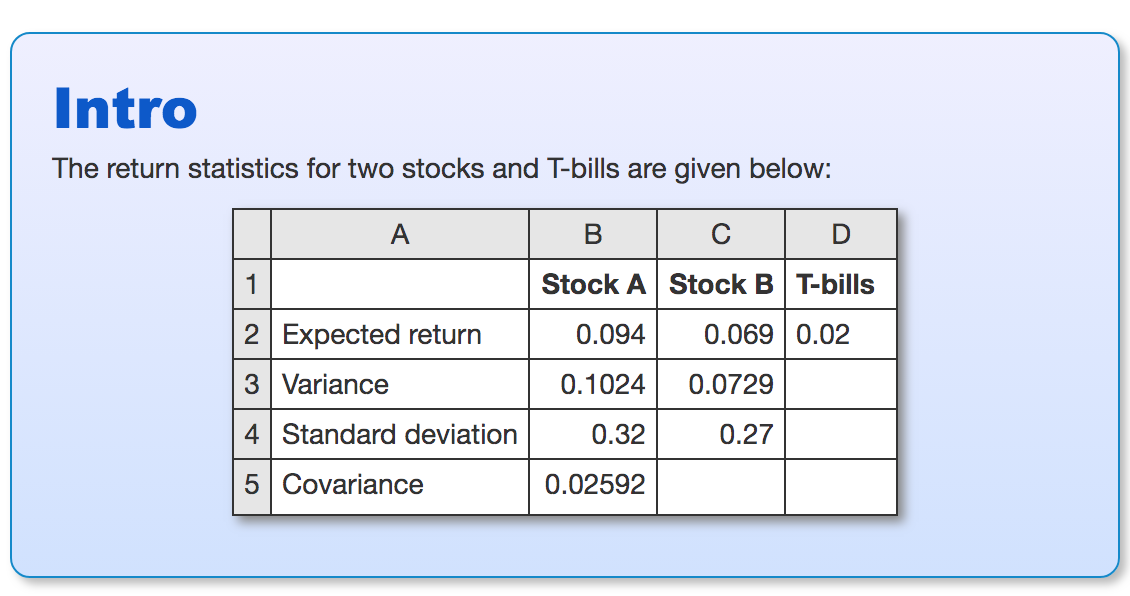

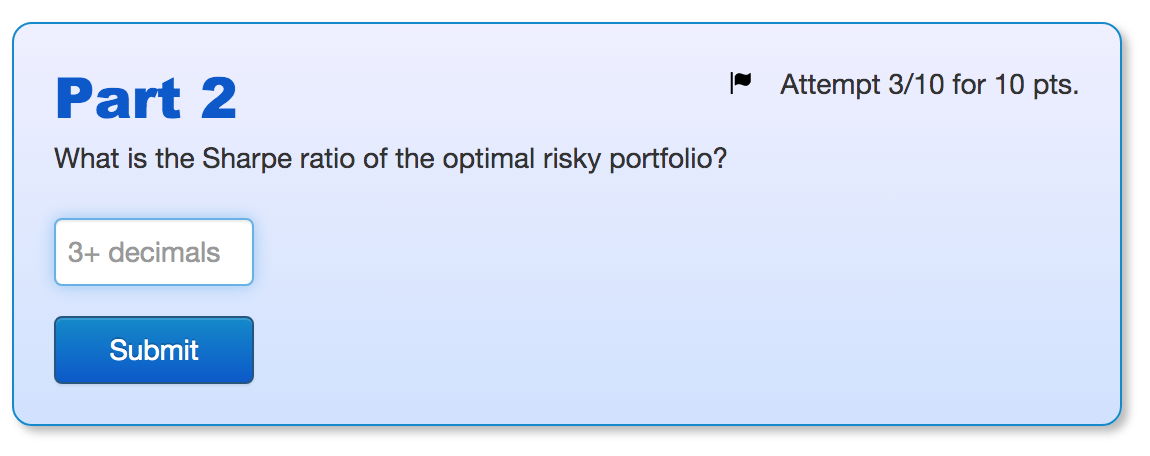

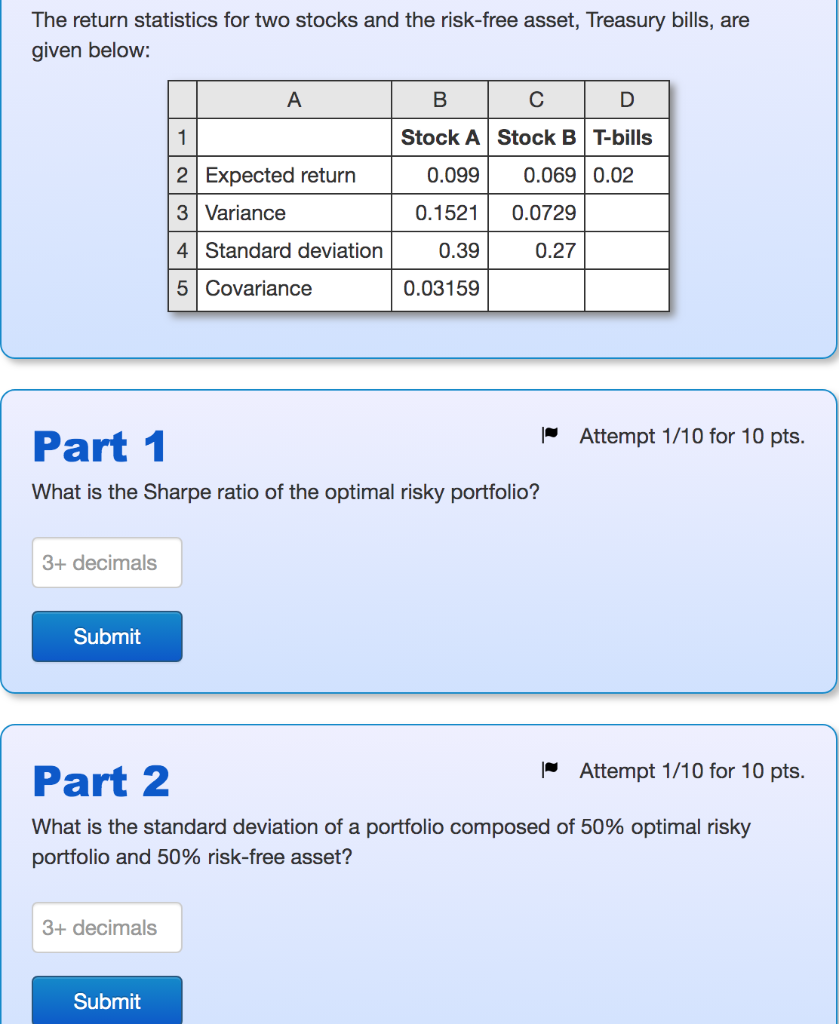

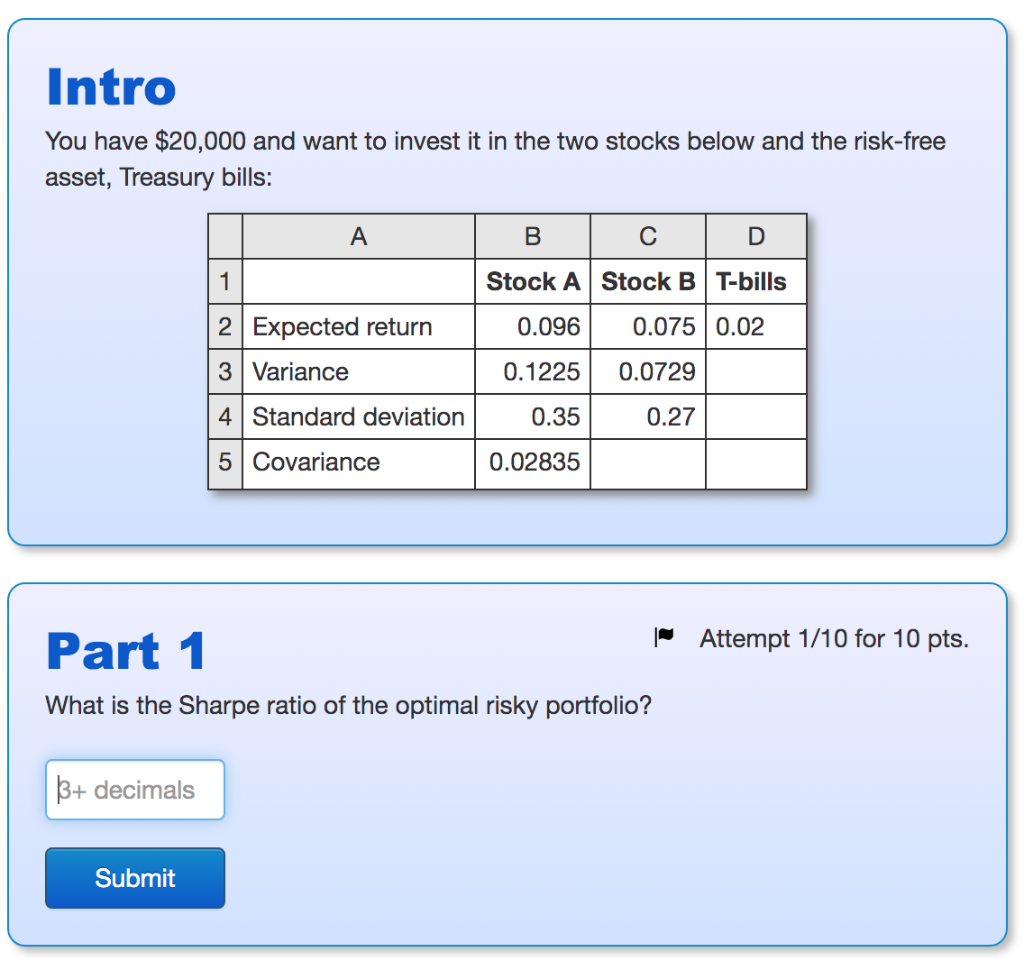

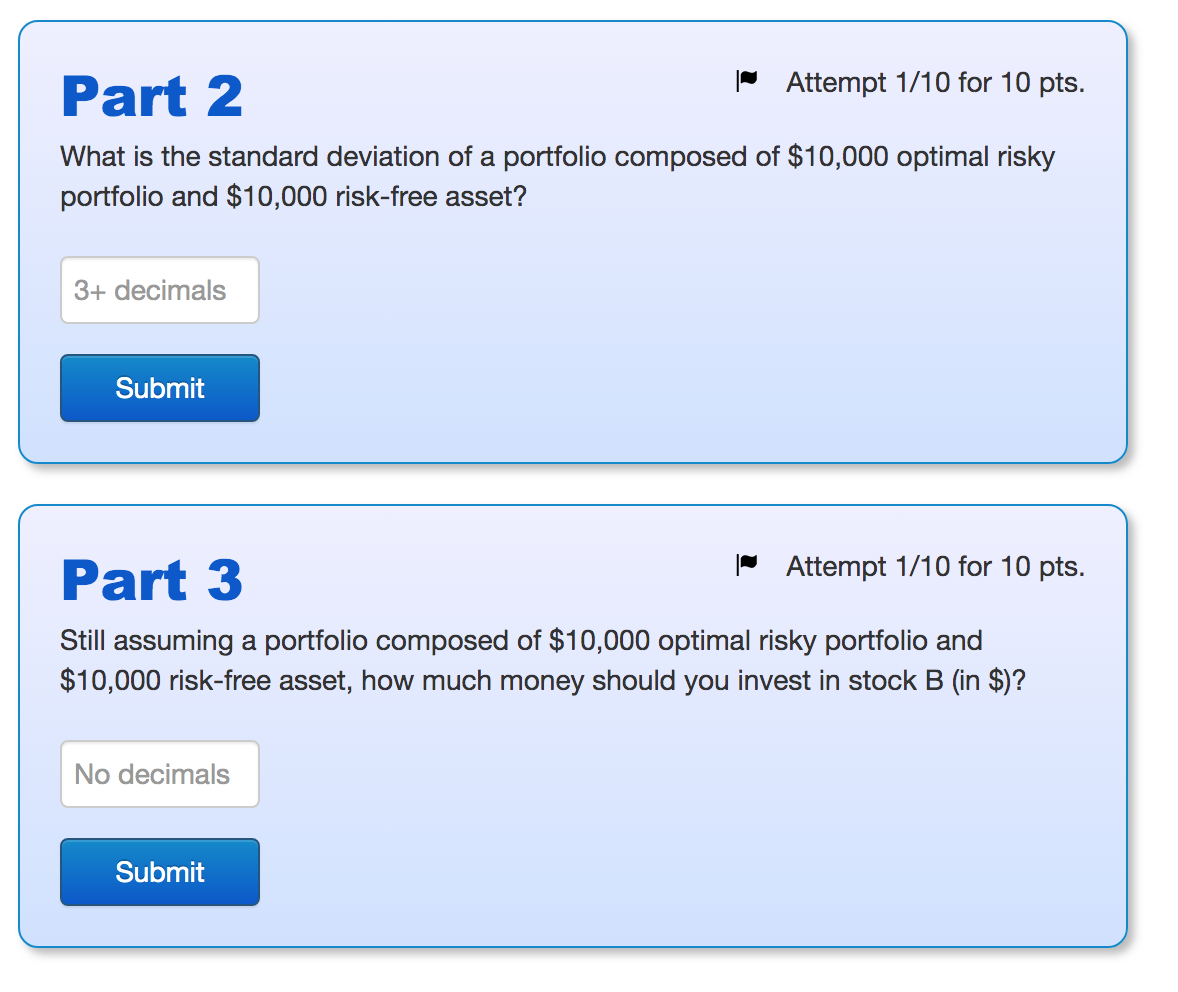

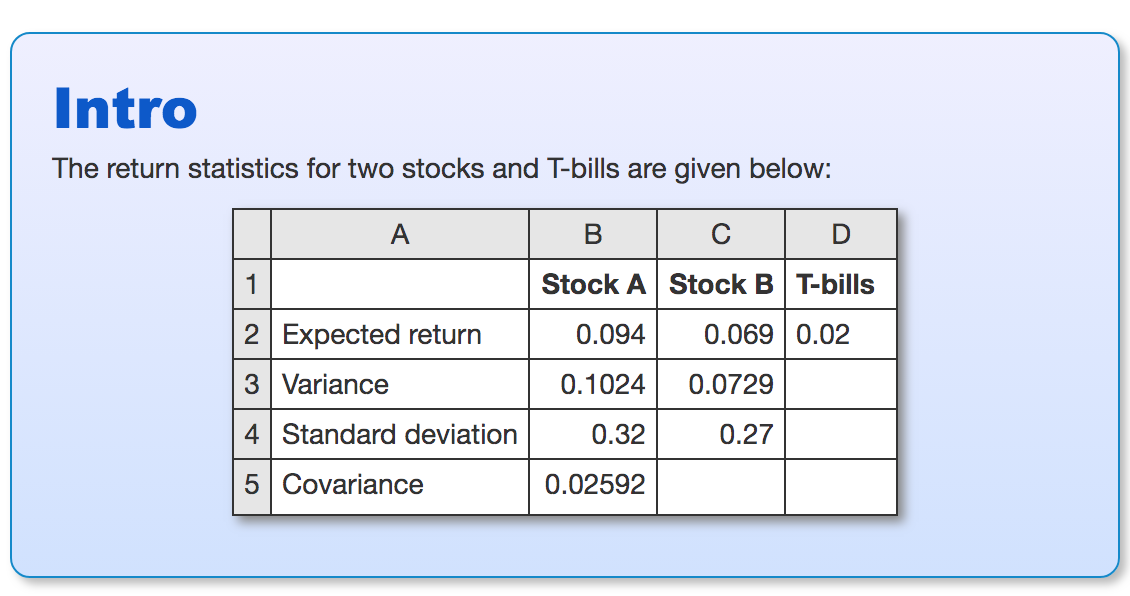

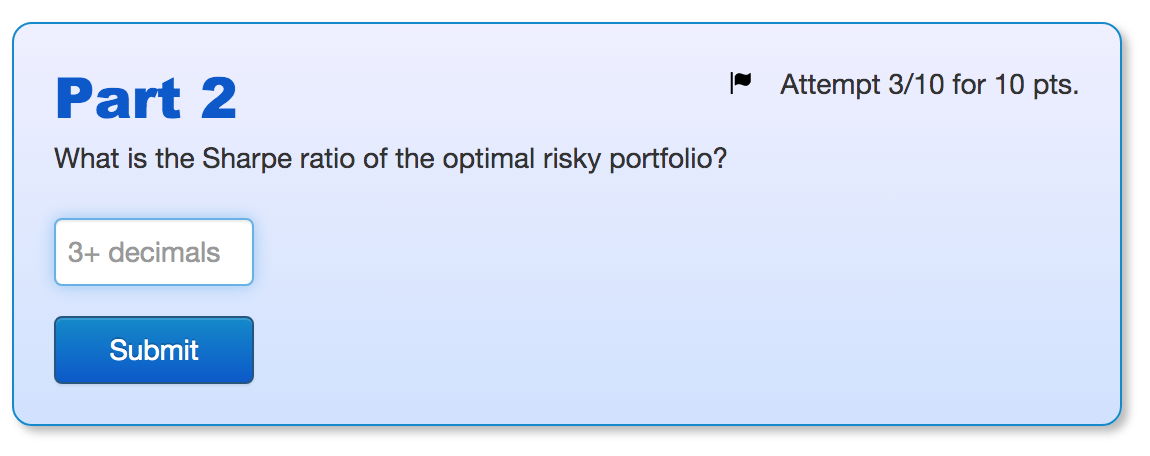

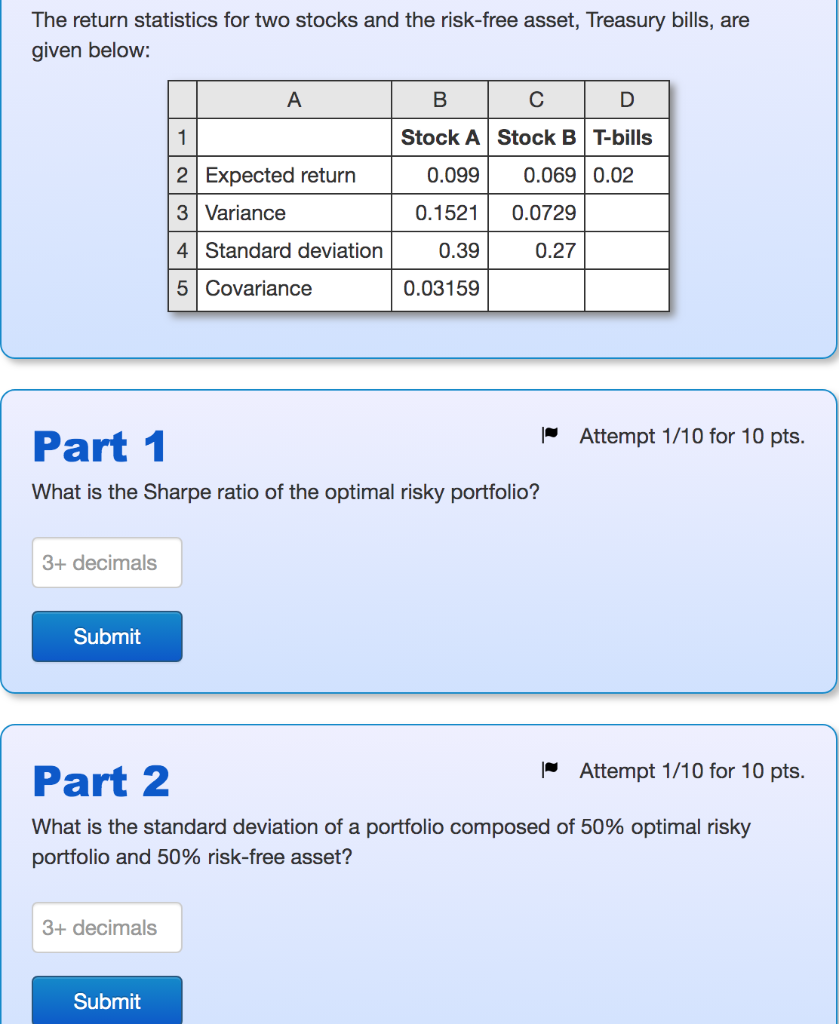

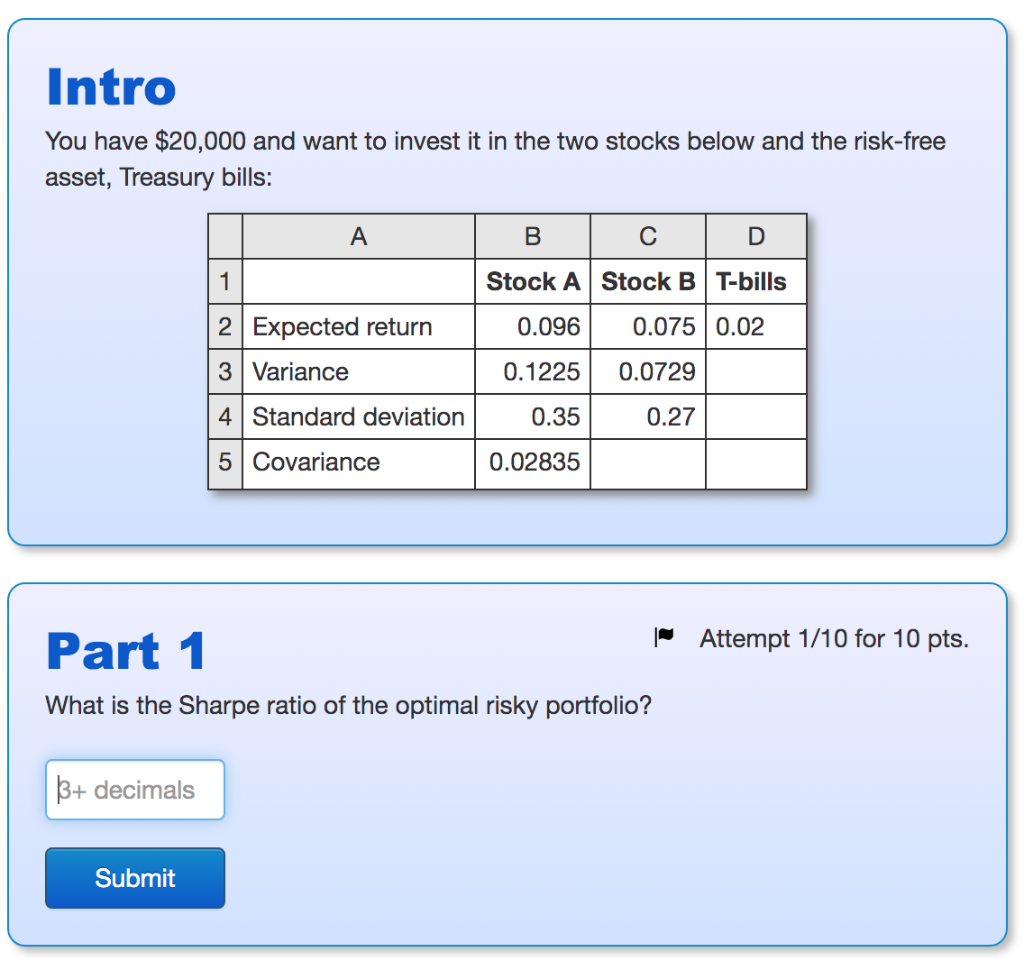

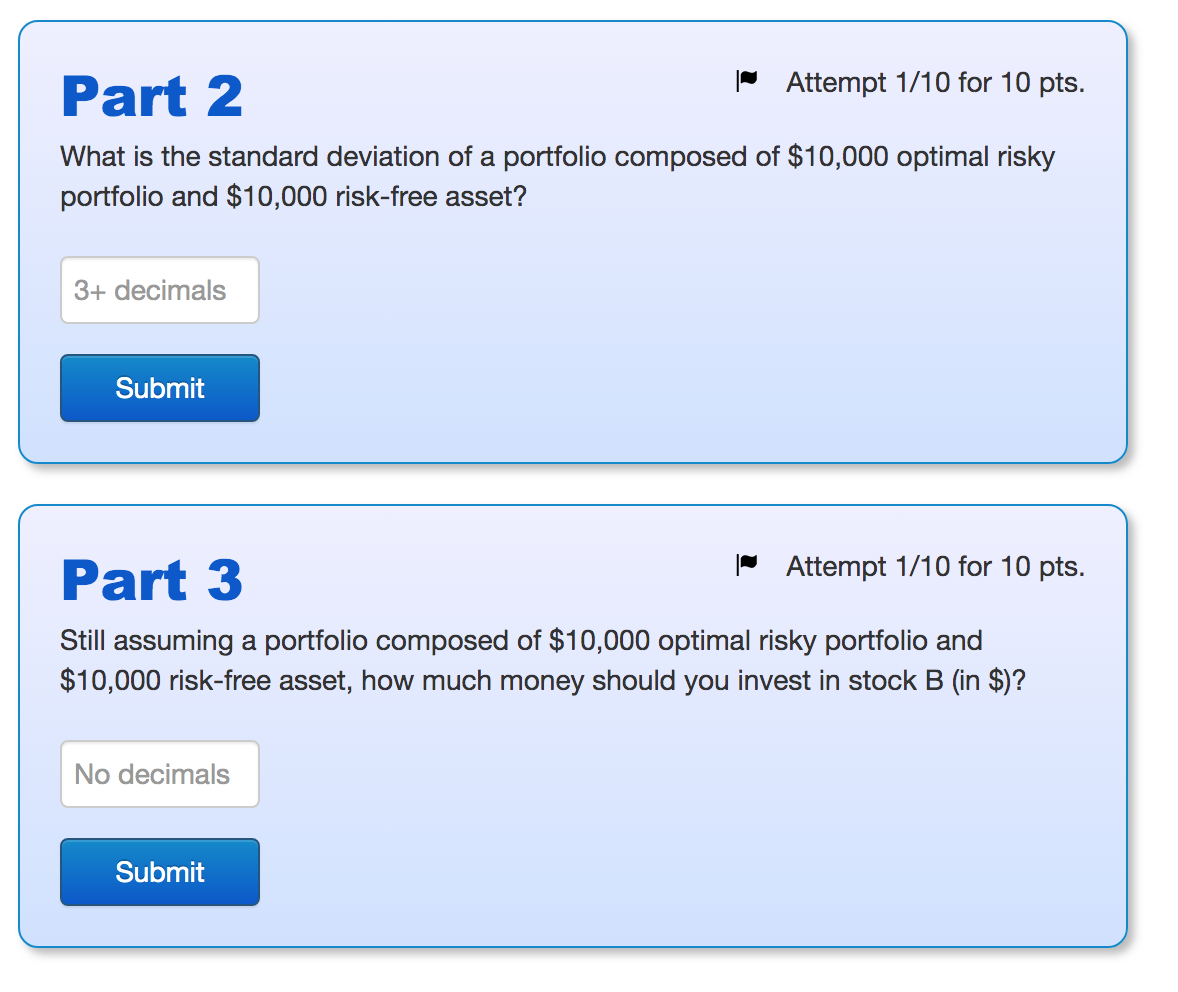

Attempt 3/10 for 10 pts. Part 2 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit The return statistics for two stocks and the risk-free asset, Treasury bills, are given below: C A B D Stock A Stock BT-bills 1 0.069 0.02 2 Expected return 0.099 3 Variance 0.1521 0.0729 4 Standard deviation 0.39 0.27 5 Covariance 0.03159 PAttempt 1/10 for 10 pts. Part 1 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 2 What is the standard deviation of a portfolio composed of 50% optimal risky portfolio and 50% risk-free asset? 3+ decimals Submit Intro You have $20,000 and want to invest it in the two stocks below and the risk-free asset, Treasury bills: C A B Stock A Stock B T-bills 1 2 Expected return 0.096 0.075 0.02 3 Variance 0.1225 0.0729 4 Standard deviation 0.35 0.27 0.02835 5 Covariance Attempt 1/10 for 10 pts. Part 1 What is the Sharpe ratio of the optimal risky portfolio? B+decimals Submit Attempt 1/10 for 10 pts. Part 2 What is the standard deviation of a portfolio composed of $10,000 optimal risky portfolio and $10,000 risk-free asset? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 3 Still assuming a portfolio composed of $10,000 optimal risky portfolio and $10,000 risk-free asset, how much money should you invest in stock B (in $)? No decimals Submit Attempt 3/10 for 10 pts. Part 2 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit The return statistics for two stocks and the risk-free asset, Treasury bills, are given below: C A B D Stock A Stock BT-bills 1 0.069 0.02 2 Expected return 0.099 3 Variance 0.1521 0.0729 4 Standard deviation 0.39 0.27 5 Covariance 0.03159 PAttempt 1/10 for 10 pts. Part 1 What is the Sharpe ratio of the optimal risky portfolio? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 2 What is the standard deviation of a portfolio composed of 50% optimal risky portfolio and 50% risk-free asset? 3+ decimals Submit Intro You have $20,000 and want to invest it in the two stocks below and the risk-free asset, Treasury bills: C A B Stock A Stock B T-bills 1 2 Expected return 0.096 0.075 0.02 3 Variance 0.1225 0.0729 4 Standard deviation 0.35 0.27 0.02835 5 Covariance Attempt 1/10 for 10 pts. Part 1 What is the Sharpe ratio of the optimal risky portfolio? B+decimals Submit Attempt 1/10 for 10 pts. Part 2 What is the standard deviation of a portfolio composed of $10,000 optimal risky portfolio and $10,000 risk-free asset? 3+ decimals Submit Attempt 1/10 for 10 pts. Part 3 Still assuming a portfolio composed of $10,000 optimal risky portfolio and $10,000 risk-free asset, how much money should you invest in stock B (in $)? No decimals Submit