Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attempts * Average / 2 5. Using regression analysis to forecast assets The AFN equation and the financial statement-forecasting approach both assume that assets

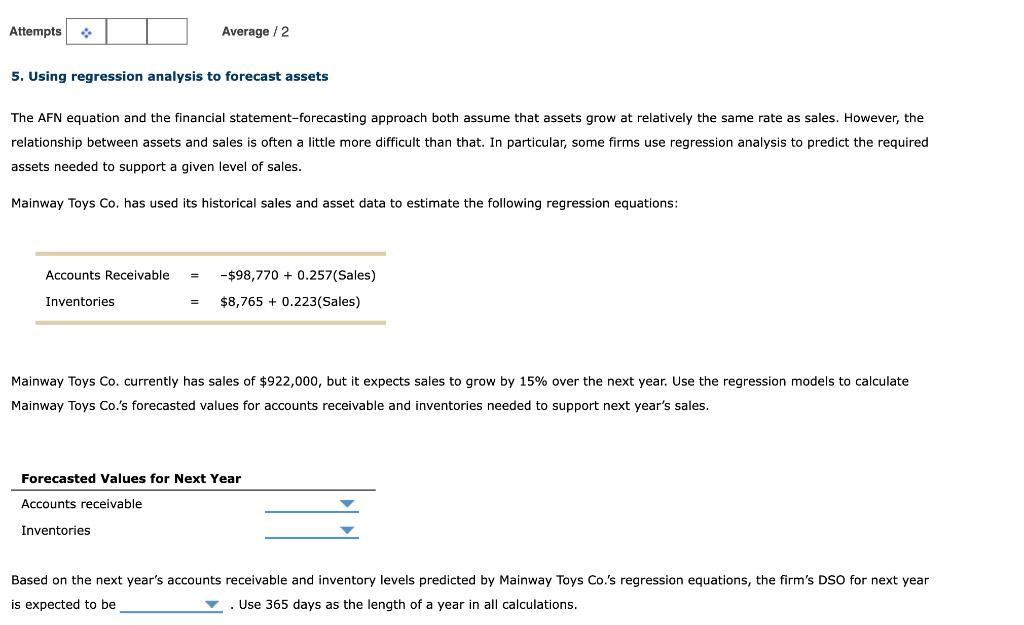

Attempts * Average / 2 5. Using regression analysis to forecast assets The AFN equation and the financial statement-forecasting approach both assume that assets grow at relatively the same rate as sales. However, the relationship between assets and sales is often a little more difficult than that. In particular, some firms use regression analysis to predict the required assets needed to support a given level of sales. Mainway Toys Co. has used its historical sales and asset data to estimate the following regression equations: Accounts Receivable = -$98,770+ 0.257(Sales) Inventories = $8,765 +0.223(Sales) Mainway Toys Co. currently has sales of $922,000, but it expects sales to grow by 15% over the next year. Use the regression models to calculate Mainway Toys Co.'s forecasted values for accounts receivable and inventories needed to support next year's sales. Forecasted Values for Next Year Accounts receivable Inventories Based on the next year's accounts receivable and inventory levels predicted by Mainway Toys Co.'s regression equations, the firm's DSO for next year is expected to be . Use 365 days as the length of a year in all calculations.

Step by Step Solution

★★★★★

3.37 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Forecasted values are computed as follows Sales next year will be as shown b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started