Answered step by step

Verified Expert Solution

Question

1 Approved Answer

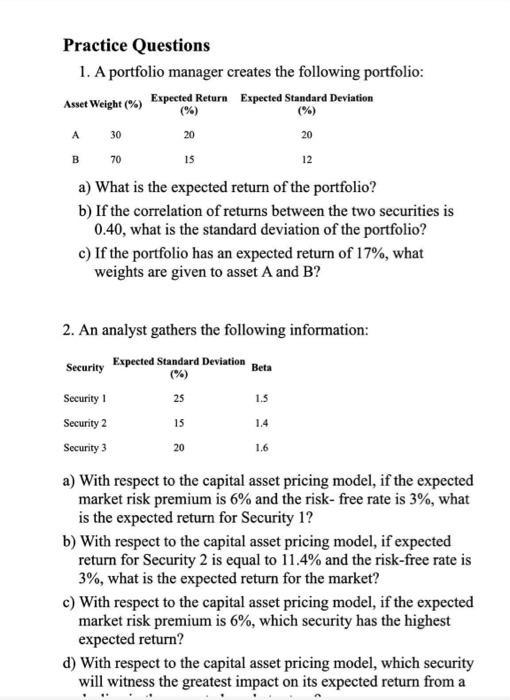

Practice Questions 1. A portfolio manager creates the following portfolio: Asset Weight (%) Expected Return Expected Standard Deviation (%) (%) 20 12 a) What

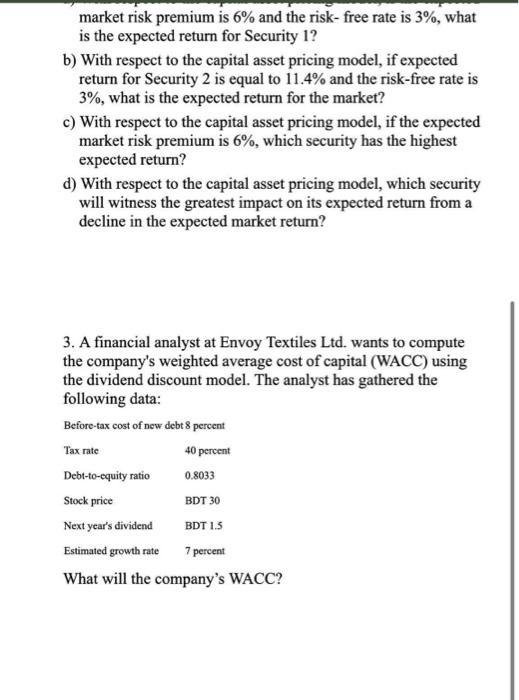

Practice Questions 1. A portfolio manager creates the following portfolio: Asset Weight (%) Expected Return Expected Standard Deviation (%) (%) 20 12 a) What is the expected return of the portfolio? b) If the correlation of returns between the two securities is 0.40, what is the standard deviation of the portfolio? A B 30 70 20 Security Security 1 Security 2 Security 3 15 c) If the portfolio has an expected return of 17%, what weights are given to asset A and B? 2. An analyst gathers the following information: Expected Standard Deviation (%) 25 15 20 Beta 1.5 1.4 1.6 a) With respect to the capital asset pricing model, if the expected market risk premium is 6% and the risk-free rate is 3%, what is the expected return for Security 1? b) with respect to the capital asset pricing model, if expected return for Security 2 is equal to 11.4% and the risk-free rate is 3%, what is the expected return for the market? c) With respect to the capital asset pricing model, if the expected market risk premium is 6%, which security has the highest expected return? d) With respect to the capital asset pricing model, which security will witness the greatest impact on its expected return from a market risk premium is 6% and the risk- free rate is 3%, what is the expected return for Security 1? b) With respect to the capital asset pricing model, if expected return for Security 2 is equal to 11.4% and the risk-free rate is 3%, what is the expected return for the market? c) With respect to the capital asset pricing model, if the expected market risk premium is 6%, which security has the highest expected return? d) With respect to the capital asset pricing model, which security will witness the greatest impact on its expected return from a decline in the expected market return? 3. A financial analyst at Envoy Textiles Ltd. wants to compute the company's weighted average cost of capital (WACC) using the dividend discount model. The analyst has gathered the following data: Before-tax cost of new debt 8 percent Tax rate 40 percent Debt-to-equity ratio 0.8033 Stock price BDT 30 Next year's dividend BDT 1.5 Estimated growth rate 7 percent What will the company's WACC?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a Expected return of Portfolio Asset weight x expected return 030x 20 070 x 15 165 Expected return o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started