Answered step by step

Verified Expert Solution

Question

1 Approved Answer

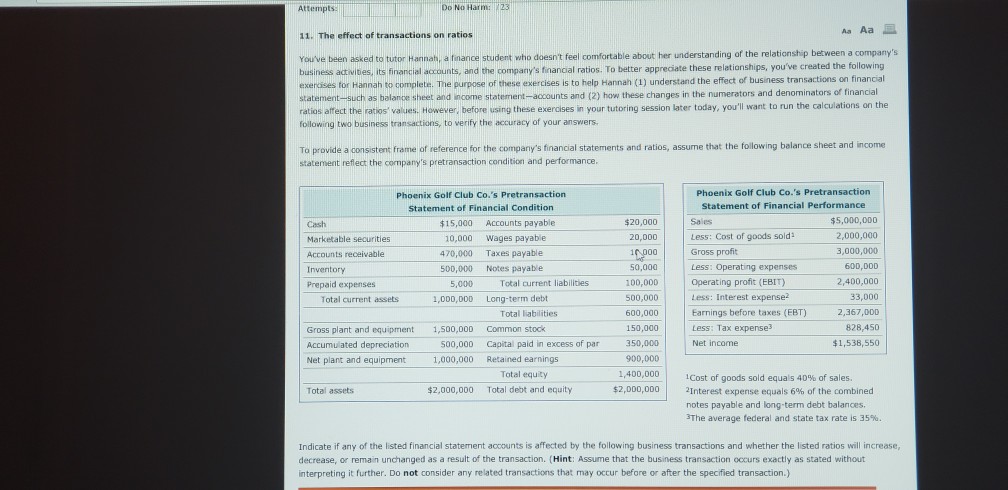

Attempts Do No Harm Aa Aa 11. The effect of transactions on ratios You've been asked to tutor Hannah, a finance student who doesn't feel

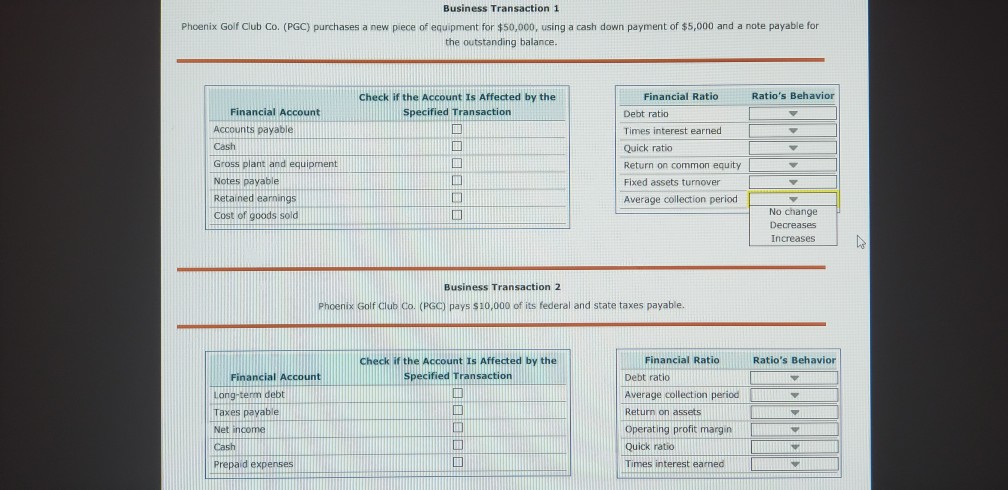

Attempts Do No Harm Aa Aa 11. The effect of transactions on ratios You've been asked to tutor Hannah, a finance student who doesn't feel comfortable about her understanding of the relationship between a company's business adtviies, its financial accounts, and the company's financial ratios. To better appreciate these relationships, you've created the following exendises tor Hannah to complete. The purpose of these exercises statement -such as balance sheet and income statement accounts and (2) how these changes in the numerators and denominators of financia ratios affect the ratos' values. However, before using these exercises in your tutoring session later today, you'll want to run the calculations on the following two business transactions, to verify the accuracy of your answers is to help Hannah (1) understand the effect of business transactions on financial To provide a consistent frame of reference for the company's financial statements and ratios, assume that the following balance sheet and in statement reflect the company's pretransaction condition and performance. Phoenix Golf Club Co.'s Pretransaction Statement of Financial Condition Phoenix Golf Club Co.'s Pretransaction Statement of Financial Performance $5,000,000 2,000,000 3,000,000 60D,DOD 2,400,000 33,000 Earnings before taxes (EBT) 2,367,000 828,450 $1,538,550 $15,000 Accounts payable $20,000 Saies 20,000 Less: Cost of goods sold 10,000 470,000 500,000 5,000 1,000,000 Wages payable Taxes payable Notes payable Marketable securities 000 Gross profit Accounts receivable 50,000 100,000 500,000 600,000 150,000 350,000 900,000 1,400,000 $2,000,000 Total current liabilities Long-term debt Less: Operating expenses Operating profit (EBIT) ess: Inte est expense? Prepaid expenses Total current assets Total liabilities Less: Tax expense3 1,500,000 500,000 1,000,000 Gross plant and equipment Common stodk Capital paid in excess of par Retained earnings Net income Net plant and equipment Total equity Total debt and equity cost of goods sold equals 40% of sales. 2|nterest expense equals 6% of the combined notes payable and long-term debt balances 3The average federal and state tax rate is 35%. Total assets $2,000,000 | Indicate if any of the listed financial statement accounts is affected by the following business transactions and whether the listed ratios will increase, decrease, or remain unchanged as a result of the transaction. (Hint: Assume that the business transaction occurs exactly as stated without interpreting it further. Do not consider any related transactions that may occur befare or after the specified transaction.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started